The WallStreetBets crowd has rushed into the Canadian cannabis sector sending stocks, such as Sundial Growers (SNDL), soaring. The stock went from trading for pennies to one with a market cap hitting $3.6 billion.

The big issue for investors that don’t cash out on these gains is that Sundial isn’t poised to benefit from the potential legalization of pot in the US, which is a big part of the basis for this crowed buying these cannabis stocks. The company is in a much better position now after raising a large amount of cash, but the stock’s move doesn’t help change the weak financial prospects of the business.

Stunning Rally

Back in early November, Sundial traded at only $0.14. The stock and the company were an afterthought in the industry after reporting Q3 revenues of only C$12.9 million.

In the quarter, Sundial saw revenues collapse 36% from Q2 levels as the cannabis company shifts out of the wholesale business to focus on branded cannabis products. The Canadian cannabis sector has a long history of companies shifting from product segments to only rush straight into another competitive segment without any margin power in an oversupplied market.

Due to the WallSteetBets insanity, the stock almost reached the $4 level today, before giving back some of the gains it made over the past few days. With a current market cap of $3.6 billion, the valuation doesn’t match with a company struggling to generate $10 million in quarterly revenues.

Better Financial Position

Sundial is definitely in a better position after this stock rally, since the company has raised $175 million in the last month. On February 2, the company raised $74.5 million selling 74.5 million shares plus warrants at $1. Only a few days earlier, Sundial raised $100 million selling 133 million shares plus warrants at around $0.75 per unit.

Investors should note that Sundial rushed out both offerings at $1 or less while the stock sits at $2.38 now. The management team clearly thought the lower stock prices warranted a good price to sell shares.

The additional cash could help the prospects of the company where analysts were only targeting 2021 sales of $66 million. Unfortunately though, Sundial is still generating EBITDA losses due to 20% grow margins and the sector is littered with companies trying to alter the product mix to limited success.

Takeaway

The key investor takeaway is that the recent stock move in Sundial isn’t justified by any changes in the prospects of their cannabis business as the company is locked out of the U.S. market. Sundial has raised a lot of cash to improve the balance sheet, but the company still hasn’t proven any ability to actually sell cannabis, whether wholesale or branded, at solid profits.

The WallStreetBets crowd could clearly push the stock higher in the next few days or weeks, but Sundial has no business prospects supporting the stock above $1. Investors should cash out before the stock falls like GameStop previously.

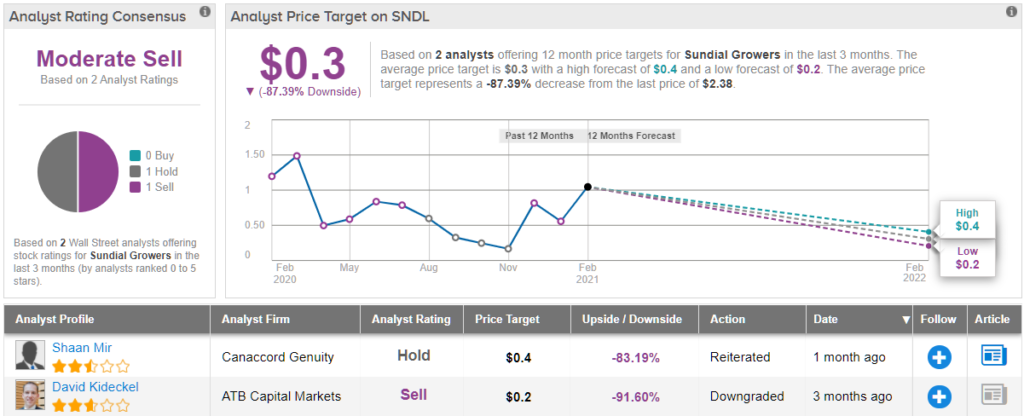

The view from the Street is hardly any rosier. Not only does the stock show a Moderate Sell consensus with not a single Buy rating over the past three months, but the current consensus price target indicates ~87% downside risk. (See SNDL stock analysis on TipRanks)

Disclosure: No position.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.