BHP Billiton Group continues to expect a strong second half of FY21. The Australian mining company announced its 1H FY21 results on Feb. 16. The company continues to expect strong demand of around 1 billion tons of steel from China in FY21, for a third consecutive year.

BHP Group (BHP) had a capex of $3.6 billion in 1H FY21 and expects its capex in FY21 to be $7.3 billion due to a stronger Australian dollar. It expects its capex in FY22 to be $8.5 billion.

BHP reported an operational profit of $9.8 billion, up by 17% year-on-year. The company reported basic earnings per share (EPS) of $0.76 in 1H FY21, a 20% decline year-on-year. Its underlying profit of $6 billion was up 16% year-on-year, but fell short of analysts’ estimates of $6.4 billion.

BHP CEO Mike Henry said, “BHP has delivered a strong set of results for the first half of the 2021 financial year. Our continued delivery of reliable operational performance during the half supported record production at Western Australia Iron Ore and record concentrator throughput at Escondida. Our operations generated robust cash flows, return on capital employed increased to 24 per cent and our balance sheet remains strong with net debt at the bottom of our target range.”

The company declared a record interim dividend of $1.01 per share, up from $0.65 in the same period last year. BHP has returned over $30 billion to its shareholders in the past three years and has a return on capital employed (ROCE) of 24%. ROCE is a financial ratio that helps investors assess a company’s profitability with respect to the capital used. (See BHP Group stock analysis on TipRanks)

Earlier this month, Credit Suisse analyst Carsten Riek downgraded the stock from a Buy to a Hold with a price target of 2,100p. Riek prefers BHP’s competitor, Rio Tinto, as the analyst is more positive on iron ore. Riek added that while BHP’s portfolio has more organic optionality, the valuation premium between Rio Tinto and BHP has widened to a great extent, making it difficult to argue in favor of BHP.

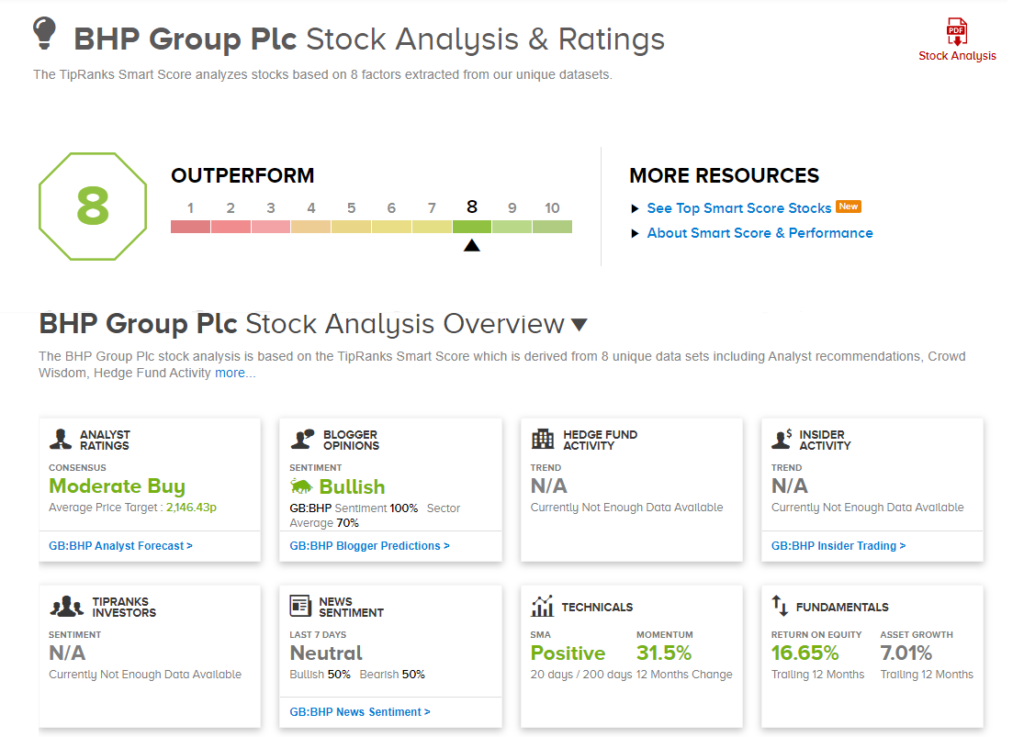

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 7 analysts recommending a Buy, 6 analysts suggesting a Hold, and 1 analyst recommending a Sell. The average analyst price target of 2,146.43p implies a 4.3% downside potential from current levels.

According to the TipRanks Smart Score system, BHP scores an 8 out of 10, indicating that the stock is likely to outperform the market.

Related News:

Siemens Healthineers’ $16.4B Takeover Of Varian To Win EU Clearance – Report

Google Clinches Content Licensing Deal With Australia’s Seven West

Microsoft Showed Interest In Pinterest Takeover – Report