Galapagos (GLPG) is far from a household name in the US, yet it remains a productive company that warrants further review. GLPG burst onto the scene in 2015 when it signed a collaboration agreement with biotech heavyweight Gilead Sciences (GILD) to develop Filgotinib for a host of inflammatory disease states. GILD’s foray into the inflammatory disease market comes as part of its efforts to expand its product offerings beyond its core infectious disease franchises.

Filgotinib has posted impressive results throughout its journey from a candidate to an approved product. The promise of the product enticed GILD to pay over $1.5 billion to purchase an equity stake in GLPG, in addition to a $3.95 billion upfront payment to gain access to GLPG’s suite of promising molecules. The agreement stipulated a ten-year standstill period, preventing GILD from acquiring the company. Events looked promising, yet the story was about to take a strange turn thanks to the FDA.

Filgotinib received approval in the EU in the 100mg and 200mg dose forms, yet the US FDA saw issues with the sperm formation in the 200mg dose, with further studies required for approval. This came as a massive blow to the GILD/GLPG partnership as the 200mg dose’s potency is a crucial differentiating factor versus AbbVie’s rival product. The FDA’s reluctance, coupled with a recent executive shuffle at GILD, emboldened management to return the product to GLPG.

Turning to this week’s news, the next promising molecule in GLPG’s arsenal is Ziritaxestat, which was designed to treat Idiopathic Pulmonary Fibrosis. The market for a novel treatment for IPF is vast, with blockbuster status (north of $1 billion in annual sales) if efficacy and safety are proven.

That said, the results could not have been worse, with the trial discontinued early due to side effects, including a higher-than-expected mortality rate. The drug is being dropped from all future studies in a stunning setback.

GLPG Could be a Takeover Target

GLPG has now morphed from a stock market darling to a near pariah as its market cap is now less than the cash on its balance sheet. GLPG traded as high as $279 per share but has fallen to its current perch in the $80s, as optimism for its clinical pipeline diminished. That said, GLPG could be viewed as a takeover target.

At the time of writing, it seems reasonable to conclude that GILD will not be acquiring the company even with the ten-year lock-up agreement in place. The priorities for GILD have pivoted towards oncology, spearheaded by a new CEO. The desire to defend what has proven to be a dreadful partnership is not present, removing an obstacle towards acquisition.

The current management team was reluctant to part with the company as the founder is still the CEO. Most likely, they believed there was real potential with the pipeline that was not reflected in the share price, yet subsequent trials have proven that their optimism was misguided. GLPG is now tasked with transforming itself from a cutting-edge developmental company to a product-based company that will be judged on product sales, not promising science. The new paradigm is often too burdensome on research-based entities, hence the desire to sell the company ramps up.

An acquirer will need to have marketing expertise in Europe as well as an existing salesforce that can be leveraged to maximize the potential of Filgotinib. Novartis (NVS) and Sanofi (SNY) are the two best candidates, with growing and critical Immunology assets. With interest rates incredibly low in Europe, coupled with Galapagos’ cash-heavy balance sheet, an accretive deal for the European behemoths is available if both parties are willing to come to the table and negotiate. The GLPG story bears watching in 2021.

Wall Street’s Take

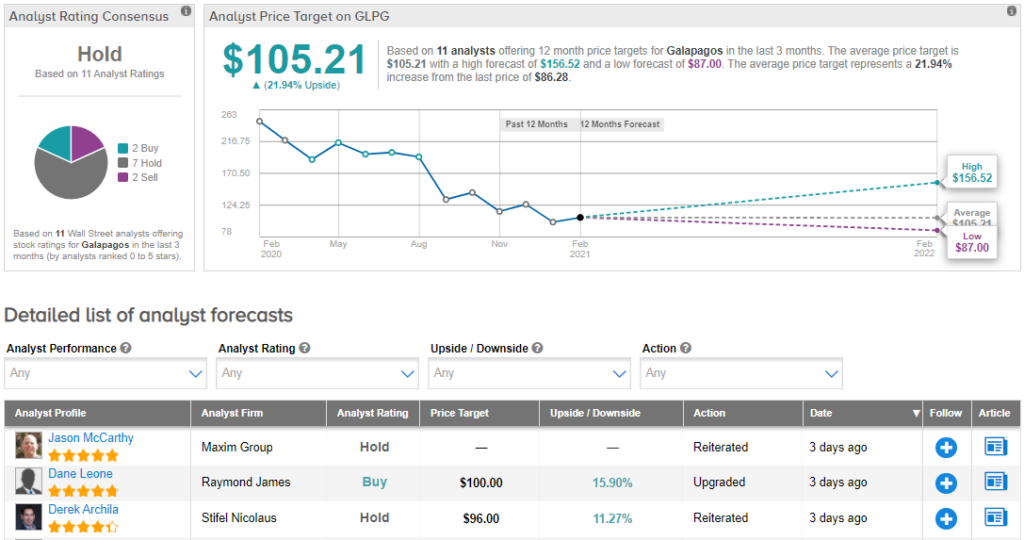

Meanwhile, consensus among analysts is a cautious Hold based on 7 Hold, 2 Buy and 2 Sell recommendations. The average analyst price target of $105.21 implies upside potential of around 22% from current levels over the next 12 months. (See Galapagos stock analysis on TipRanks)

Disclosure: On the date of publication, Alexander Poulos did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.