RBS adversary Tomlinson eyes windfall from sale of care home developer

Lawrence Tomlinson's LNT Group has hired Goldman Sachs to sell a stake in its biggest division, Sky News learns.

Tuesday 23 February 2021 19:49, UK

A businessman who led a campaign against Royal Bank of Scotland (RBS) over its treatment of small business customers is plotting a deal that could generate a windfall worth hundreds of millions of pounds.

Sky News has learnt that Lawrence Tomlinson, the owner of LNT Group, has appointed Goldman Sachs to find external investors for a division which builds care homes across the country.

City sources suggested on Tuesday evening that a transaction could value LNT Care Developments at several hundred million pounds, although the accuracy of this figure could not be independently verified.

A deal at that level would see significant investment injected into accelerating the expansion of LNT Care Developments' operations, as well as crystallising a big potential payday for the entrepreneur.

Mr Tomlinson became one of the most prominent figures in British business for a period after the 2008 financial crisis, when RBS - now renamed NatWest Group - had to be bailed out by taxpayers.

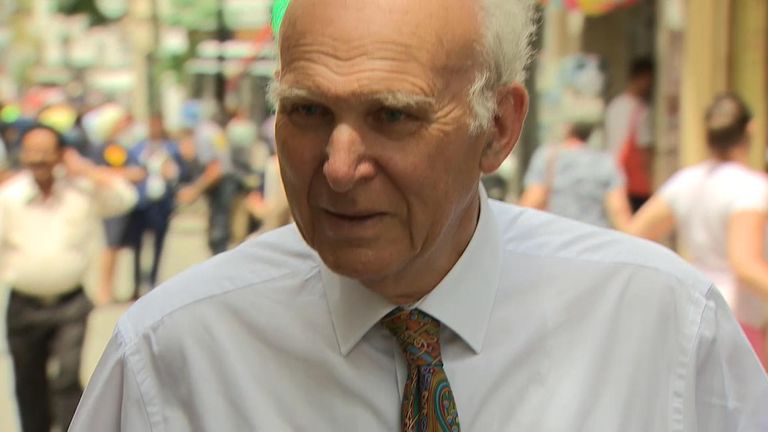

An adviser to Sir Vince Cable during the Liberal Democrat MP's spell as business secretary, Mr Tomlinson published a report in 2013 alleging that RBS's Global Restructuring Group (GRG) had forced otherwise-viable businesses into bankruptcy.

Mr Tomlinson's businesses had themselves been clients of the state-backed lender.

A number of further inquiries into GRG largely exonerated the bank of the most serious allegations, but contributed to the reputational crises which beset RBS for much of the first decade since its rescue.

In last year's Sunday Times Rich List, Mr Tomlinson was estimated to have a fortune worth £130m, placing him joint-923rd on the list of wealthiest Britons.

LNT Care Developments is the largest division of Mr Tomlinson's group.

Insiders said it had yet to be decided whether the owner would sell a minority or controlling stake in the subsidiary.

Goldman's mandate does not include selling a stake in LNT Group's other operations, which include a software provider to the social care sector and a minority stake in Ideal Carehomes, which has a separate management team.

In a statement, Mr Tomlinson's company said: "LNT Care Developments is seeking investment in order to substantially ramp up its production over the next five years to meet demand in the post-COVID world.

"Our goal is to build over 30 well-designed and future-proofed care homes in the UK each year by 2025.

"We believe modern purpose-built care homes are a key social mission for our company as everyone deserves care facilities which are environmentally sustainable.

The company added that LNT Care Developments had built more than 100 care homes since 2009.

Goldman declined to comment.