WTI/Brent - Longterm Target Over $100

What has happened in the crude oil market since last November is just unbelievable! Incredible performance! From there, the prices of our two benchmark crude oils, Brent and WTI, have continuously increased. When we take a couple of steps back, we see that this trend started in May 2020. There were a couple of corrections, but honestly, who cares about them? Neither Brent nor WTI as it appears. Accordingly, the prices rose like crazy. Indeed, in the end, the current levels are laughable in comparison to what awaits us in the future. Looking back on the past week, we can see it was very positive for both crude oils.

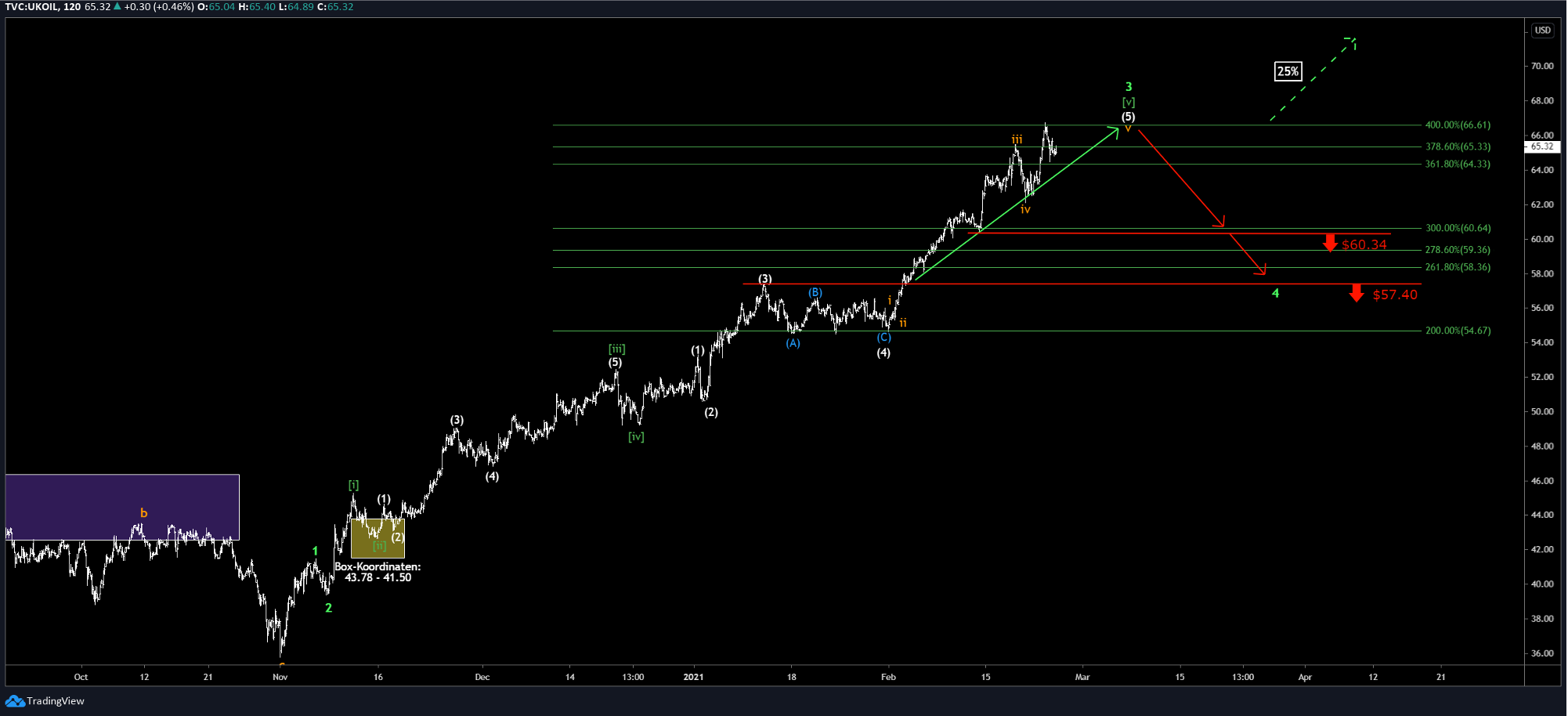

WTI 2hour Chart

(Click on image to enlarge)

Brent 2hour Chart

(Click on image to enlarge)

After a relaxed start to the last week, the prices peaked in a sudden movement, but then went back down. This was necessary from a health perspective. Of course, we loved to see how disciplined and motivated the oils rose over the last weeks, but little breaks are essential, too. Before burning out, the bears now should take over and dominate the refineries. Although the oils surprisingly peaked again this week, we primarily expect that the Brent and WTI prices drop below $60.34 and $57.27, respectively. These are the first thresholds that we need to cross. The price should stretch down to $57.40 for Brent and $53.93 for WTI. We do not think that the oils can be contained for much longer than that, as we are expecting quotations of way above $100 in the coming years. Such an increase does not come out of the blue but needs certain conditions to build on. Hence, the oils are likely eager to finish wave 4 and attack new heights. Fueled with that much enthusiasm, there is always the possibility for a preliminary comeback. We have calculated alternative scenarios for both crudes, which are triggered at $66.61 (Brent) and $63.89 (WTI). Although we are pretty close to those levels, we still give them only a probability of 25%, as the prices need to consolidate above those thresholds.

WTI 4day Chart

(Click on image to enlarge)

Brent 4day Chart

(Click on image to enlarge)

The steadily decreasing supply of oil, due to depleting reserves will push the prices higher in the future.

In the imminent course, we expect the crude prices to drop. Brent prices should fall below $60.34 first and continue to drop under $57.40. WTI, on the other hand, should be traded under $57.27 in the first instance and then fall all the way down to around $53.93.