- EUR/USD has been tumbling from the highs as the US bond rout boosts the dollar.

- End-of-month flows and speculation about intervention may turn the mood around.

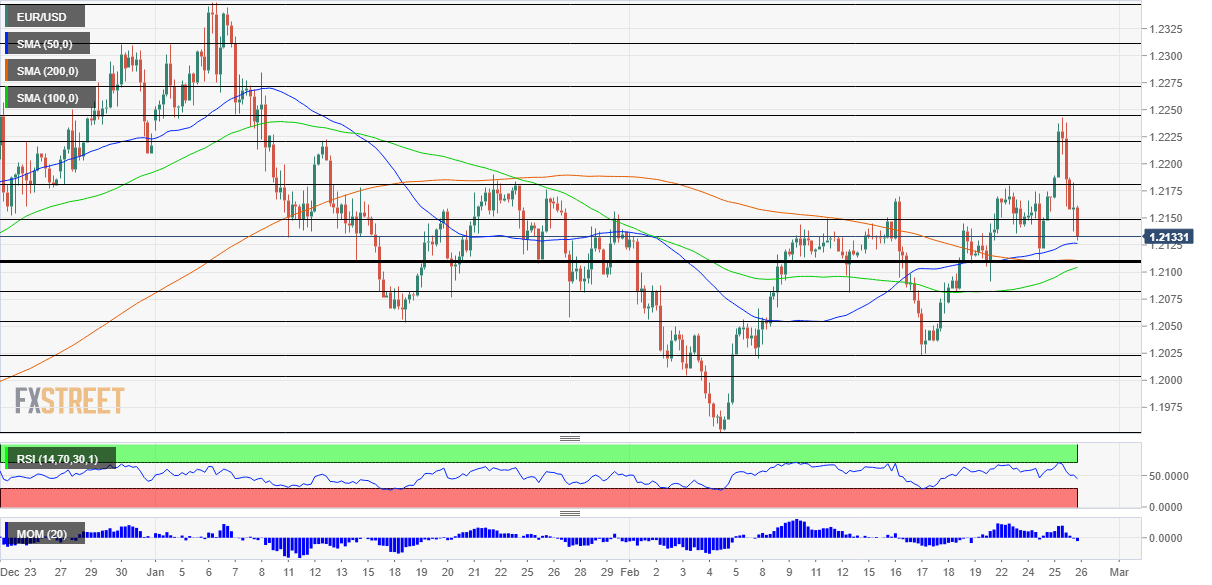

- Friday's four-hour chart is showing the pair is approaching a critical confluence level.

The frog has jumped out of the boiling water – markets were able to absorb gradually rising US bond yields, until Thursday's leap in returns. Higher Treasury yields – the ten-year benchmark hit a high of 1.61% – and the risk-off mood have been favoring the safe-haven US dollar, sending EUR/USD down over 100 pips.

Will the sell-off in bonds continue and push the pair even lower? Not so fast. Here are four reasons for a bounce.

Investors have been repricing growth prospects following the deployment of vaccines and stimulus. Immunization continues at full speed in the US and is set to pick up in Europe, especially as Johnson and Johnson's single-shot vaccine is set for final FDA approval on Friday.

1) Stimulus snag: However, on the stimulus front, President Joe Biden's proposed $1.9 trillion stimulus plan hit a snag. Elizabeth MacDonough, the Senate parliamentarian, disqualified the hike in the minimum wage from the bill. While House Speaker Nancy Pelosi is set to push the legislation forward, it is in a bind in the upper chamber. Prospects of a delay in further aid to the economy soothe concerns about the economy overheating.

2) No inflation (for now) Another factor that could contribute to calm in markets is the publication of the Core Personal Consumption Expenditure (Core PCE) figure – the Federal Reserve's preferred gauge of inflation. It will likely show that price rises remain tame, a drop from 1.5% to 1.4% yearly.

3) Flows: The third factor that may play in favor of bonds – thus against higher yields and the dollar – is end-of-month flows. Money managers are set to adjust their portfolios in order to tidy up their reports, and that may balance the recent moves.

Jerome Powell, Chairman of the Federal Reserve, pledged to keep supporting the economy – leaving rates low and bond-buying high – in two public appearances. His colleagues, including hawk Esther George, repeated the same message and dismissed inflation. That worked on Tuesday and Wednesday but failed on Thursday.

4) Powell to the rescue (again) The fourth factor that may calm markets is the scheduling of another public appearance from Powell next week. Will he commit to do more? The European Central Bank and the Bank of Japan have already called out higher returns in their jurisdictions while the Reserve Bank of Australia took one step further and bought bonds in markets.

Powell may hint that the current $120 billion/month pace is not a ceiling and that would help. At the moment, the sell-off in bonds and stocks may be seen as a correction rather than a change of course.

All in all, there is room for recovery.

EUR/USD Technical Analysis

Euro/dollar is trading above the 50, 100 and 200 Simple Moving Averages – but only just. These 200 SMA is at 1.2110, which previously provided support while the 100 SMA is rising toward this line – which is now a critical confluence point. Break or bounce? Fundamentals are pointing to recovery but momentum has turned negative and may encourage bears.

Support below 1.2110 awaits at 1.2080, 1.2055, 1.2025 and 1.20.

Some short-term resistance awaits at 1.2150, a peak recorded earlier in February. It is followed by 1.2183, the daily high, and by 1.2220 and 1.2145.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.