- EUR/USD looks to add to Tuesday’s gains above 1.2100.

- German/EMU final February Services PMI remain depressed.

- ECB-speak, US ADP report and ISM Non-Manufacturing next on tap.

The European currency manages to leave behind the recent weakness and pushes EUR/USD back to the proximity of the 1.2100 neighbourhood on Wednesday.

EUR/USD retakes 1.2100 on ECB

EUR/USD advances further and clinch the area just above 1.2100 the figure on Wednesday, extending the bounce off Tuesday’s lows in the 1.1990 zone.

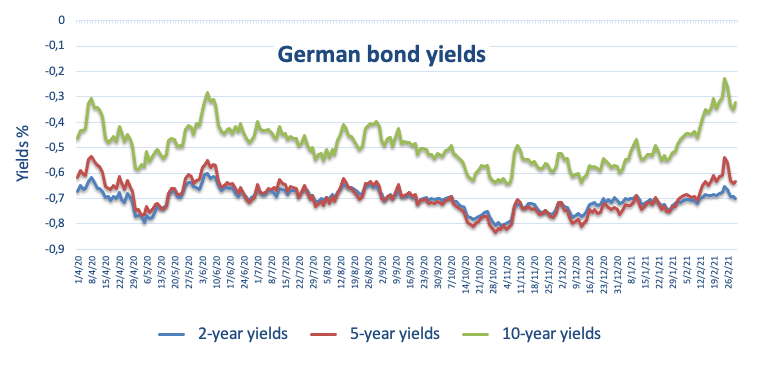

The rebound in the pair comes in tandem with rising European yields, all after the ECB said there is no need to implement a drastic action to curb bond yields in the Old Continent.

Looking at the macro scenario, the vaccine/reflation trade keeps dominating the investors’ sentiment along with prospects of a solid bounce in the economic activity in the region in HS 2021.

Earlier in the euro docket, final Services PMIs in Germany and Euroland showed mixed results although both remain still in the contraction territory (<50). Additionally, EMU’s Producer Prices rose 1.4% MoM in January, while ECB’s Board members F.Panetta, L. De Guindos and I.Schnabel are all due to speak later in the session.

Across the pond, the ADP report and the ISM Non-Manufacturing will be in the limelight along with speeches by FOMC’s Harker, Bostic and Evans.

What to look for around EUR

EUR/USD bounces off recent sub-1.2000 lows and trades back in the 1.2100 neighbourhood. The underlying bullish sentiment in the euro remains under pressure for the time being amidst investors’ adjustment to potential US inflation and the subsequent increase in yields and the demand for the dollar. Looking at the medium/longer-run, the outlook for the pair remains constructive on the back of prospects of extra fiscal stimulus in the US, real interest rates favouring Europe vs. the US and hopes of a solid economic rebound in the next months.

Key events in Euroland this week: EMU’s Retail Sales, Unemployment Rate (Thursday).

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention, always amidst the current (and future) context of subdued inflation. Potential political effervescence around the EU Recovery Fund. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is gaining 0.10% at 1.2102 and a breakout of 1.2139 (50-day SMA) would target 1.2243 (weekly high Dec.17) en route to 1.2349 (2021 high Jan.6). On the flip side, the next up barrier comes in at 1.1991 (weekly low Mar.2) followed by 1.1976 (50% Fibo of the November-January rally) and finally 1.1952 (2021 low Feb.5).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.