Where Are We In The Market?

Where are we? At the edge of a cliff, or the foot of a mountain?

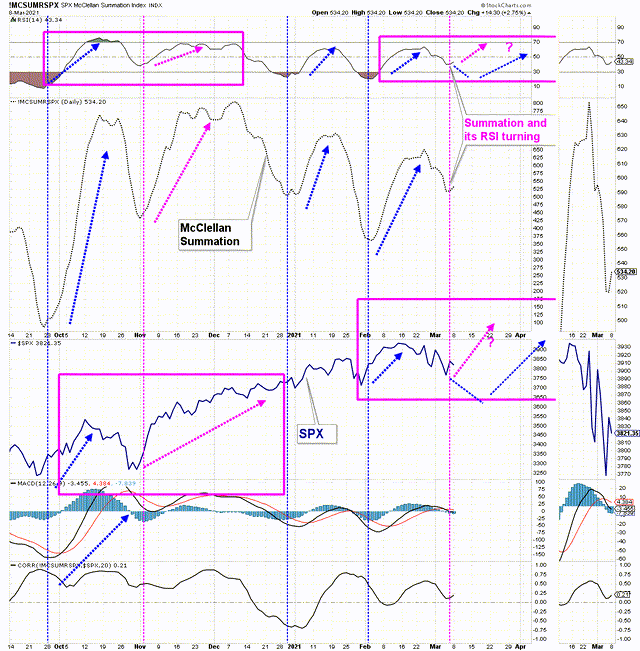

In the weekend summary, we pointed out that the McClellan summation index RSI was poised to turn back up while still above 30 as it did at the start of the November recovery, and that is what it did on Monday. This increases the odds that we are at the foot of a mountain (chart below).

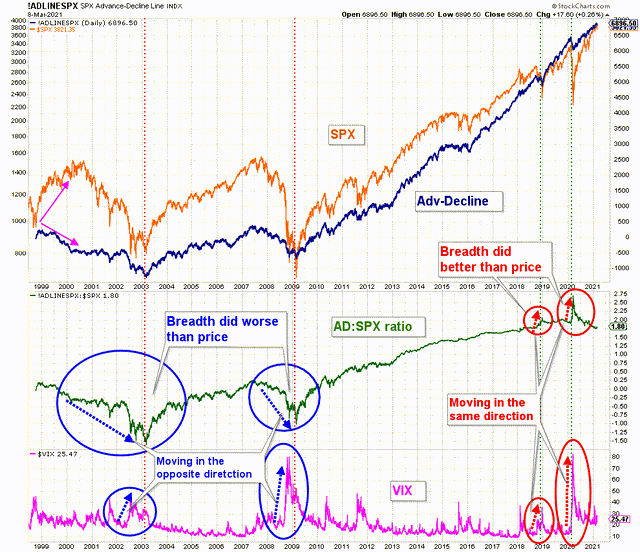

Serious trend-changing moves (cliffs) are accompanied by relative weakness in the breadth of the market compared to the price; AD:SPX has a negative slope, while the VIX has a positive slope (blue arrows on chart below). Normal pullbacks within a bull market (mountain), are characterized by positive slopes in both the VIX and the AD:SPX lines (red arrows on the chart below).

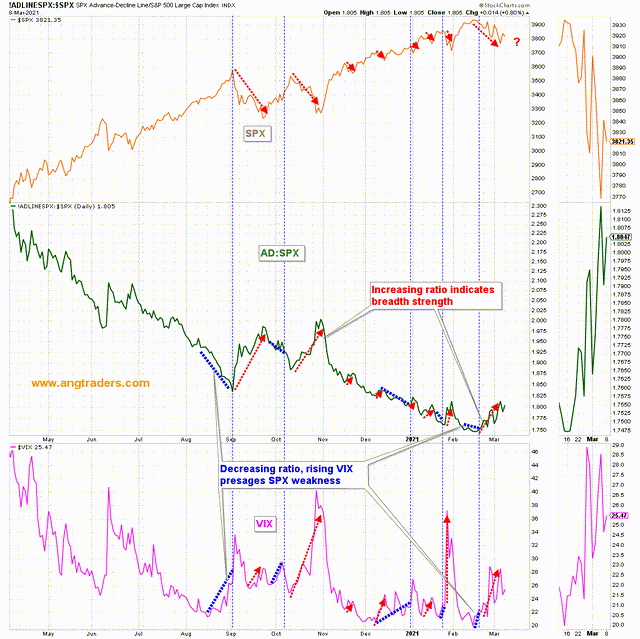

At a more granular-scale, a similar association is found; when the AD:SPX slope is negative and the VIX slope is positive, it means that increased volatility is being accompanied by weaker breadth which warns of impending trouble in the price (blue markings below). However, when both slopes are positive, it means that despite the price weakness and increased volatility, the underlying breadth of the market is strong (red markings below). This is more evidence that we are at the foot of the mountain, not at the edge of a cliff.

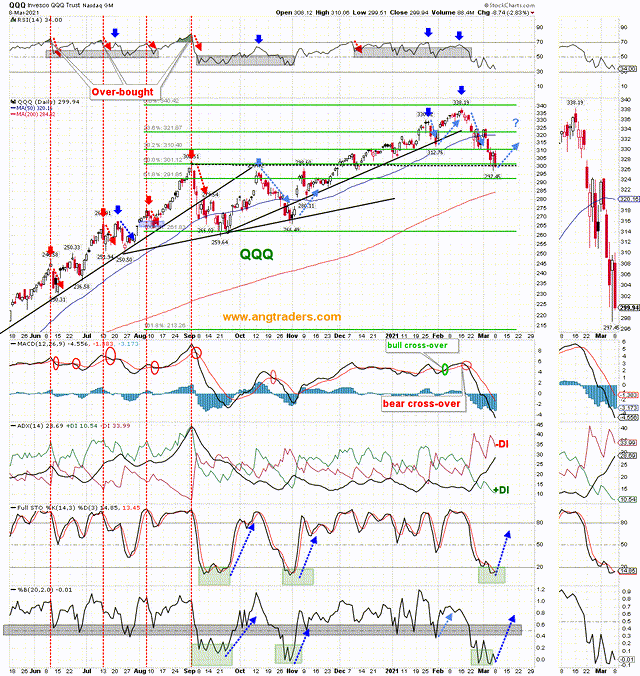

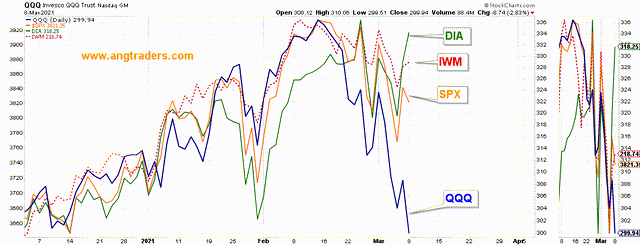

The QQQ tracks the market that has suffered the most in this pullback, dropping 12%. Considering that it has risen 106% since last March, we would be a little spoiled to think a 12% correction spells the end. The QQQ is sitting on strong support and is unlikely to slip too much further (chart below).

And as the chart below illustrates, QQQ is the worst of the litter. The Dow 30 (DIA) is close to a new high.

Last, but not least, let's not forget the gorilla in the room...$1.9T that is about to fertilize the economy and the stock market (with more to come in the form of infrastructure spending).

Where are we? ....about to start a steep climb.

Excellent analysis.

Thanks for reading and saying you liked it.