In one way or another, the pandemic has impacted everyone’s lives across the globe. It has also affected almost every company’s trajectory.

Deutsche Bank analyst Sidney Ho set out to find how the pandemic has affected Apple (AAPL), and particularly its flagship product – the iPhone.

A recent dbDIG survey indicates that since the pandemic’s onset, the iPhone’s share of the US installed base and length of smartphone ownership has “remained relatively consistent.”

The iPhone’s cut of the market share remains just below 50%, whilst over the past 2 years, roughly 75% of smartphone users have purchased a new phone.

“The launch of 5G smartphones does not seem to have significantly changed the length of smartphone ownership (both iPhone and other),” Ho said, “Although we do expect the refresh cycle to accelerate when 5G infrastructure is more built out.”

When looking to make a smartphone purchase, 57% of iPhone users intend to get the latest model, just below the 59% who planned to do so in Dec 2019. Storage wise, less are inclined to get 512 GB models – the highest amount available – although 64 GB appears insufficient to most. Since Dec 2019, consumers buying 64GB models have dropped from 18% to 8%, while in the same period, those purchasing 128 GB models grew from 12% to 24%.

Elsewhere in the Apple ecosystem, the talk of an Apple Car does not seem to be drawing much enthusiasm; only 33% of those surveyed expressed an interest in an Apple auto offering, while considering the tech giant’s lack of experience with car design, 68% said they were unlikely to purchase a first-generation model.

dbDIG has also been gathering geolocation data, which shows that Apple’s U.S. store traffic is on the rise.

“While store traffic bottomed out in the spring of 2020,” Ho noted, “It has improved since and is now at about 40-50% of the volume seen pre-pandemic.”

Given all of the above, Ho stays with the bulls. The 5-star analyst rates Apple shares a Buy along with a $160 price target. Should Ho’s thesis play out, investors are looking at upside of ~30% over the next 12 months. (To watch Ho’s track record, click here)

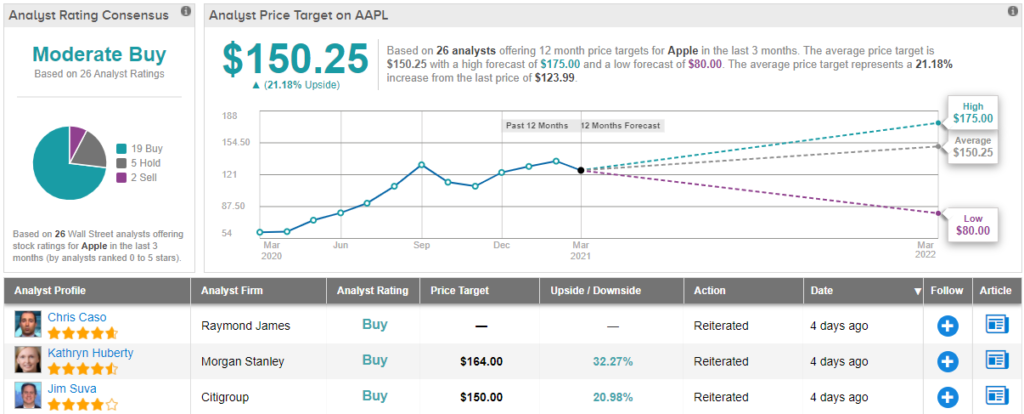

All in all, most on the Street are backing Apple’s continued success; Based on 19 Buys vs. 5 Holds and 2 Sells, the analyst consensus rates the stock a Moderate Buy. The 12-month forecast is for gains of 21%, given the average price target currently stands at $150.25. (See AAPL stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.