Short EUR/MXN: Q2 Top Trading Opportunities

The first quarter of 2021 has proven stale compared to the end of 2020 for risk-on assets, despite the continuation of a reflation trade from traditional stores of value to growth and cyclical assets.

For most emerging market currencies the unwinding of USD shorts has meant rapid devaluation towards the end of the first quarter, with pairs like USD/MXN bouncing back above 4-month highs. But, despite recent moves making EM currencies look expensive, there is still plenty of potential in the second quarter of the year.

That’s why I’m short EUR/MXN in the second quarter, given the Euro’s resilience against EM currencies in the last 6 months, despite risk-on appetite bringing them back from March 2020 lows. From the Mexican side, I expect a pickup in inflation to halt the easing cycle from Mexico’s Central Bank (Banxico). And that’s when the Peso will start to be appealing again as a carry trade, attracting foreign flows which typical leads to domestic currency appreciation.

From the European side, the Euro looks overstretched and I expect the common currency to drift lower as the bloc’s recovery is likely to be subdued. Not only is Europe trying to bounce back from the COVID-19 economic crisis, it is also struggling to administer vaccines, creating internal and external disputes which will also weigh on sentiment in the short-term. Lackluster inflation is a struggle in the Eurozone and I expect this time to be no different, so the Euro is likely to be held back compared to the other G10 currencies. This makes it an appropriate funding currency for a carry trade.

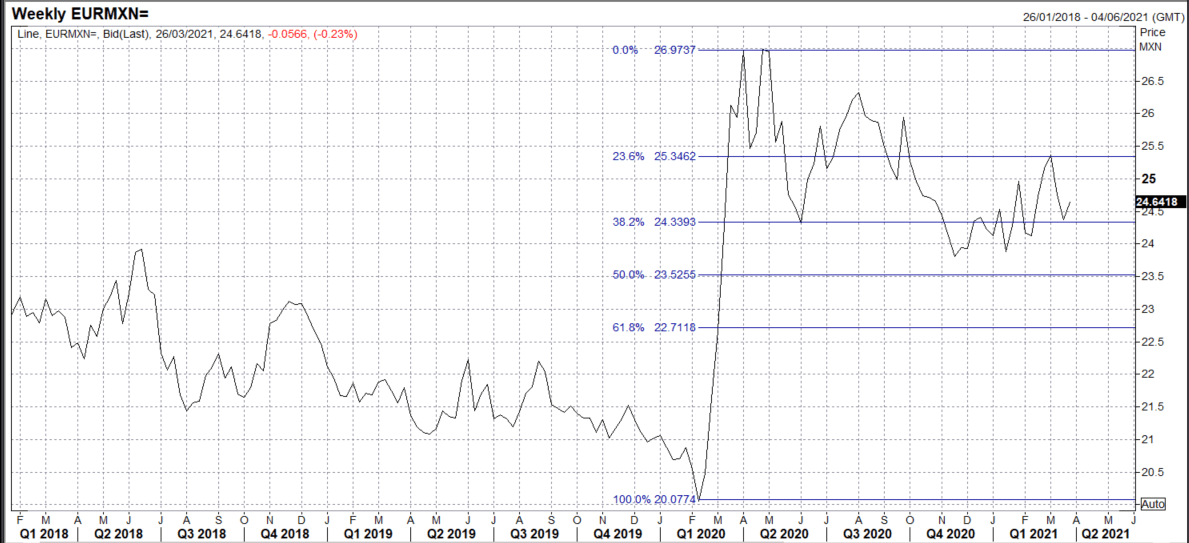

Looking at the weekly chart below, EUR/MXN has only managed to complete about 40% of the retracement from the COVID-19 induced highs. This leaves room for the pair to trend lower towards the second half of the year. Fibonacci levels are key to measure the performance against other benchmarks. The rejection to push above the 23.6% level (25.3462) as investors flocked to safe havens on rising bond yields shows good resilience from sellers to bring the pair lower.

The aim for the short EUR/MXN trade would be to see the pair continue its retracement from the COVID-19 highs with target price set anywhere between the 50% (23.5255) and 61.8% (22.7118) Fibonacci levels as the pair catches up to the likes of USD/MXN.

Weekly EUR/MXN Chart

Disclosure: See the full disclosure for DailyFX here.