Join Our Telegram channel to stay up to date on breaking news coverage

MicroStrategy has modified its compensation terms for non-employee directors as they would now receive their board fees in Bitcoin instead of cash.

Non-Employee Board Of Directors To Receive Salary In BTC

The company’s CEO and founder Michael Saylor made this announcement via Twitter. MicroStrategy also filed a form with the U.S. Securities and Exchange Commission (SEC). It stated that this approval signifies the firm’s commitment to Bitcoin and its ability to serve as a store of value.

In its SEC filing, the software company also noted that the board fees payable to directors will be unchanged and will continue to be nominally denominated in U.S. dollars under the new agreement.

“At the time of payment, the fees will be converted from USD into bitcoin by the payment processor and then deposited into the digital wallet of the applicable non-employee director.” the filing reads.

MicroStrategy’s Bitcoin Portfolio

The Nasdaq-listed company has invested over $5 billion into Bitcoin, making it one of the public companies with the largest Bitcoin holdings.

MicroStrategy also has a solid Bitcoin portfolio as it is one of the first companies that started adding Bitcoin in its treasury months back.

It made its first $250 million investment in August 2020 and has gone on to use its cash on its balance sheet to acquire more of the world’s oldest digital currency.

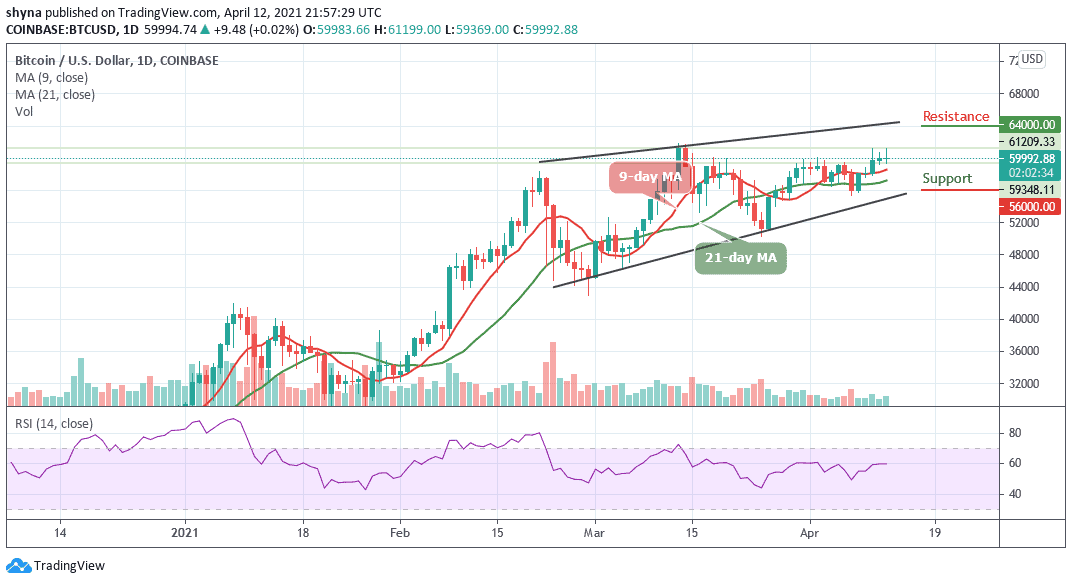

The company recently disclosed that it had purchased approximately 253 Bitcoins for $15 million in cash, at an average price of approximately $59,339 per Bitcoin, including fees and expenses.

So far, MicroStrategy reportedly holds 0.436% out of the 21 million Bitcoin in circulation, and this is worth $5.4 billion. Companies like electric car manufacturer Tesla Inc. and payment firm Square also have a large Bitcoin portfolio.

Tesla holds approximately 48,000 Bitcoin. After Tesla announced a $1.5 billion investment in Bitcoin in February, MicroStrategy’s CEO said 2021 is the year of institutional investment in cryptocurrency.

Saylor, who has long been an advocate of digital currencies, especially Bitcoin, made this statement in an interview with Ran Neuner, former host of CNBC’s Crypto Trader.

Saylor’s statement came on the back of a historic rise for Bitcoin, which hit all-time highs on Tuesday of over $48,000 per coin after Tesla announced a $1.5 billion investment in the currency.

With fiat currencies depreciating, Saylor said that the simple, most value-creating thing companies could do is convert cash from analog money into a digital asset like Bitcoin. According to him, many companies would soon follow suit.

Join Our Telegram channel to stay up to date on breaking news coverage