GBP/USD: Virus Variant Concerns And The American Shopper May Push Cable Below 1.40

Call off the reopening? Prime Minister Boris Johnson has come short of suggesting a reversal in policy but he has expressed concerns about the rapid spread of the Indian variant in the UK. To mitigate this strain, the government wants to accelerate the administration of second vaccine doses while continuing with the next opening on May 17. That is far from certain.

Photo by Colin Watts on Unsplash

Various health officials have called on the government to reconsider its roadmap and take a more cautious approach. If these voices grow louder – and if COVID-19 cases rise – sterling could suffer. Investors have already priced a rapid, vaccine-led recovery, and any bump in the road would hurt it.

Cable’s recent recovery came from dollar weakness. Markets swung back to positive territory, gaining some of the ground lost in response to rising US inflation figures. Overheating of the world’s largest economy may force the Federal Reserve to taper down its bond-buying scheme and raise interest rates sooner rather than later. Nothing has changed.

The upswing in markets and consequent drop in the dollar seem like a much-needed correction rather than a change of course. Thursday’s releases continued supporting the narrative of a steaming hot economy – producer prices rose by more than estimated in April, while weekly jobless claims showed a new pandemic low of 473,000 as of last week. A more significant test is due on Friday.

Have Americans continued storming the stores? Retail Sales statistics for April are forecast to show a moderate increase after March’s 9.8% leap. Only a drop in expenditure could further pressure the dollar, and that seems highly unlikely.

The last word of the week belongs to the preliminary Consumer Sentiment figures from the University of Michigan. Economists expect a moderate increase, extending the recovery. Any surprise in the headline or the inflation components could boost the greenback.

Overall, there is room for cable to resume its decline after the recent bounce.

GBP/USD Technical Analysis

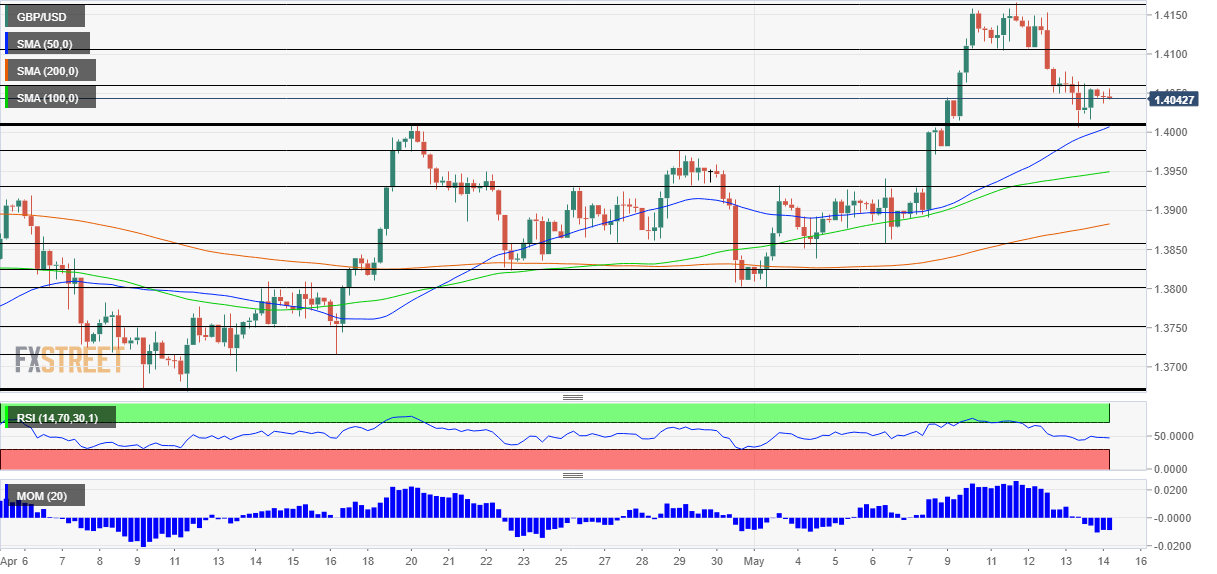

(Click on image to enlarge)

Make or break at 1.40? Pound/dollar’s first brush with that line after the big breakout resulted in a bounce. Nevertheless, momentum on the four-hour chart has turned to the downside, raising the chances of a downfall. On the other hand, cable still holds above the 50, 100 and 200 Simple Moving Averages (SMAs).

Below 1.40, the next line to watch is 1.3975, which capped GBP/USD in late April. It is followed by 1.3930 and 1.3855.

Some resistance is at the daily high of 1.4070, followed by 1.41005 and 1.4160.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more