- Financial markets are optimistic but cautious amid progress in the battle against covid.

- Inflation imbalances between Australia and the United States skew the scale in the USD favor.

- AUD/USD gains bearish traction, needs to break 0.7645 to confirm another leg south.

The AUD/USD pair changes hands at around 0.7690, mute for a third consecutive week. The pair has been ranging since mid-April, bottoming at 0.7645 on June 4 and topping at 0.7890 on May 10. Beyond the hiccups caused by the Nonfarm Payroll report on Friday and the following reversal on Monday, the pair has remained lifeless.

Somehow, AUD/USD replicates the behaviour of Wall Street, which consolidates near record highs but is unable to enter into a directional trend, both indicating that financial markets are all about sentiment.

What’s driving investors’ mood

Global growth´s signs indicate that the world has begun turning the corner on the pandemic setback. The process toward normalcy is underway mainly in the developed world. However, it will take at least another semester until the world leaves the worst of covid behind. Financial markets are in wait-and-see mode, optimistic but cautious.

So far, risk appetite has offset demand for the American dollar, despite the US economy is among those improving the most. Australia is not far behind, as the Q1 Gross Domestic Product was up 1.8%, officially above pre-pandemic levels. The imbalance between the two economies comes from inflation. In Australia, the Consumer Price Index rose 1.1% in the first quarter of the year, from 0.9% in the previous one, way below the Reserve Bank of Australia desired 2-3%. In the US, inflation skyrocketed to 5% YoY in May, although there is a general sense that such a jump is temporal, in line with what Federal Reserve officials have said in the last couple of months.

However, inflationary pressures, employment recovery, and how they could affect central banks’ decision is the main theme. The RBA will update policy guidance at the 6 July Board meeting, while the Federal Reserve is set to meet in the next week.

Macroeconomic indicators giving positive signals

Australian macroeconomic figures were mixed. The AIG Performance of Services Index printed at 61.2 in May, while NAB’s Business Conditions improved to 37 in the same month from 32 in April. Also, June Consumer Inflation Expectations soared to 4.4% from 3.5%, while New Home Sales were up 15.2% in May. On a down note, Westpac Consumer Confidence contracted further in June, printing at -5.2%, while NAB’s Business Confidence resulted in 20 in May, down from 23 in the previous month.

China published multiple figures, most of them missing the market’s expectations. The trade balance posted a surplus of $45.54 billion in May, while inflation shrank 0.2% MoM in May.

The US published the April Goods Trade Balance, which posted a deficit of $68.9 billion, better than anticipated. Initial Jobless Claims for the week ended June 4 came in at 376K, improving from the previous 428K but above expectations. The country also released the preliminary estimate of the June Michigan Consumer Sentiment Index, which improved by more than anticipated, hitting 86.4.

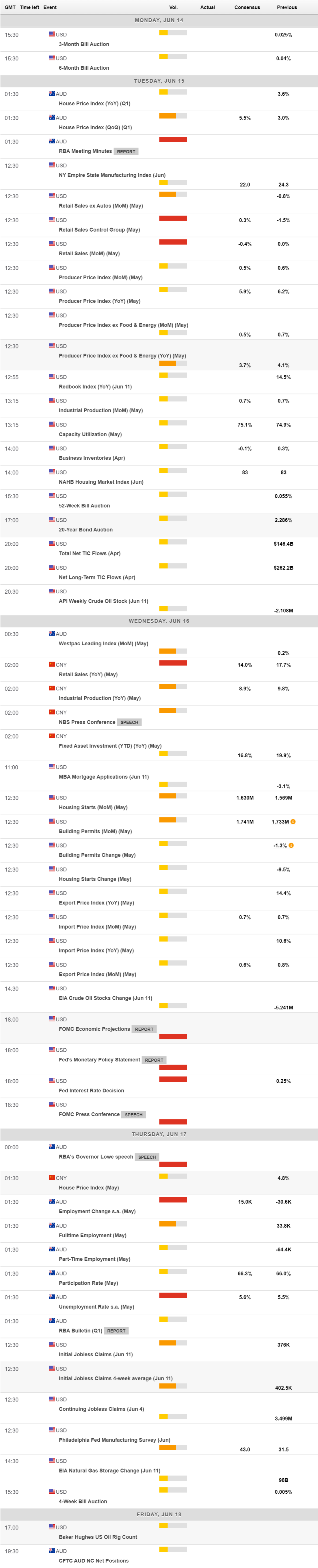

The upcoming week will stage a US Federal Reserve monetary policy meeting on Wednesday. The central bank is widely anticipated to maintain its current policy unchanged, despite the sharp rise in consumer prices. Fed officers have repeated ad exhaustion that heating inflation would likely be transitory amid resurgent demand and supply chain lags. Things may change if inflation remains overheated for a couple more months. The US will also publish May Retail Sales.

The Reserve Bank of Australia will publish the Minutes of its latest meeting on Tuesday and the May Westpac Leading Index on Wednesday. Later into the week, the country will unveil May employment figures.

AUD/USD technical outlook

The AUD/USD pair is still neutral in its weekly chart, seesawing around a directionless 20 SMA while above the longer ones, which also stand aimless. The Momentum indicator heads nowhere around its midline, while the RSI grinds lower, currently at 54.

The daily chart shows that price is retreating from converging 20 and 100 SMAs. Technical indicators have turned south from around their midlines, heading lower below them, although without enough momentum to suggest another leg lower.

The immediate support level is 0.7645, followed by 0.7600 and 0.7531, the latter being the yearly low. Relevant resistances come at 0.7770 and 0.7820, with a break above the latter favoring a bullish extension toward 0.7900.

AUD/USD sentiment poll

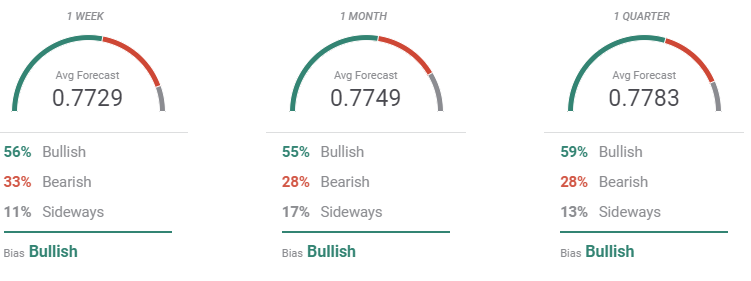

According to the FXStreet Forecast Poll, AUD/USD is seen holding above the 0.7700 level on average. Those betting for higher targets account for over 55% of the polled experts in the three time-frame under study. Bulls are the most in the quarterly perspective.

In the Overview chart, the pair is neutral in the weekly outlook, with the moving average flat. The monthly one heads north, while the quarterly one lacks directional strength. However, there is a clear accumulation of possible targets around 0.8000 with some fresh bears beating for lower lows in the 0.7200 price zone.

Related Forecasts:

USD/JPY Weekly Forecast: Fed timing is everything

EUR/USD Weekly Forecast: Eyes turn to Fed amid heating inflation

GBP/USD Weekly Forecast: Sterling's time to shine? UK data, Fed may put fuel to fire

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.