ArcelorMittal SA (MT), a global steel manufacturer and mining company announced that its subsidiary, ArcelorMittal North America Holding, sold all of its remaining 38.2 million shares of Cleveland Cliffs, Inc. (CLF). Shares of MT closed down 1.2% at $28.42 on June 18. (See MT stock chart)

ArcelorMittal has been gradually selling its stake in CLF, and with the latest sale, the total cash proceeds from the sale stand at $1.9 billion.

The company has been returning all of the cash proceeds from the sale to shareholders through share buyback programs.

To date, the company has completed two share buybacks of a total of 17,847,057 million shares worth $570 million. The average per-share price for the previous two repurchases was €26.2683.

Following the latest CLF share sale, the company announced a third new share buyback program of $750 million to be completed by December 31.

The shares acquired by the company through these programs will be used either to meet MT’s obligations under debt obligations exchangeable into equity securities, or to reduce its share capital.

ArcelorMittal continues to hold non-voting preferred stock redeemable at Cleveland-Cliffs’ option for approximately 58 million common shares, or cash equivalent to the value of such common shares.

Last month, KeyBanc analyst Philip Gibbs reiterated a Buy rating on the stock and lifted the price target to $37 (30.2% upside potential) from $33.

Gibbs believes that MT is poised to benefit from international steel spreads, increasing iron ore pricing expectations, and favorable joint venture results with Essar India and AMNS Calvert.

Gibbs has increased the FY2021 earnings expectations to $9.50 per share (from $6.25 per share), and also expects investors to earn 10 – 11% capital returns in 2022.

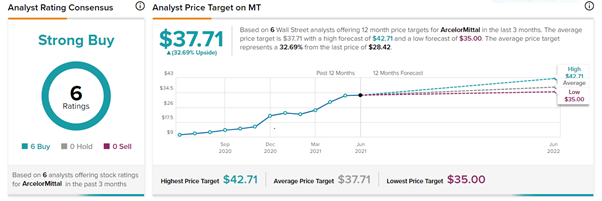

With 6 unanimous Buys, ArcelorMittal has a Strong Buy consensus rating. The MT stock average analyst price target of $37.71 implies 32.7% upside potential to current levels. Shares have gained 169.6% over the past year.

Related News:

U.S. Steel Provides Upbeat Q2 Guidance; Shares Plunge on Worries of Increased Metal Supply

Fisker and Magna Ink Long-Term Manufacturing Deal; Fisker Shares Jump

Ford Raises Q2 EBIT Estimates, Claims Vehicle Orders are Expanding

Top Dividend Stocks For 2021