Black Gold Beats Silver

An oil derrick at dusk. Image via Laredo Petroleum.

Oil Versus Precious Metals Versus Crypto

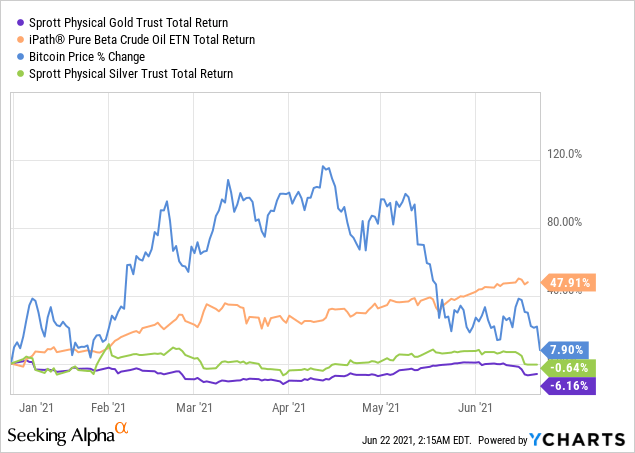

Three ways investors have tried to play the reflation trade this year have been industrial commodities, precious metals, and crypto. Last week's Fed meeting and the possibility of rate hikes in 2023 put a dent in all three sectors, and then news of another China crackdown made crypto a sea of red on Monday. At the same time, the failure of Iran talks boosted oil. Year-to-date, here's what the comparison looks like, using the iPath Pure Beta Crude Oil ETN (OIL) as a proxy for oil and the Sprott Physical Gold Trust (PHYS) and Physical Silver Trust (PSLV) and proxies for gold and silver.

Oil's been the best performer by far, followed by Bitcoin posting a 7.9% return, PSLV down fractionally, and PHYS down a little more than 6%. It's interesting to consider why oil has crushed precious metals and crypto. Maybe it's because, while all could plausibly benefit from higher inflation, oil benefits from a rebound in the real economy as well. People who didn't get a chance to travel due to COVID lockdowns last summer don't need Bitcoin or silver to drive or fly now, but they do need oil (unless they're driving electric vehicles, about which, more below).

The Reflation Trade In Our Top Names

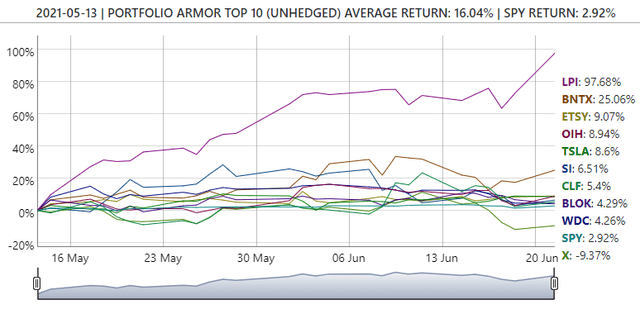

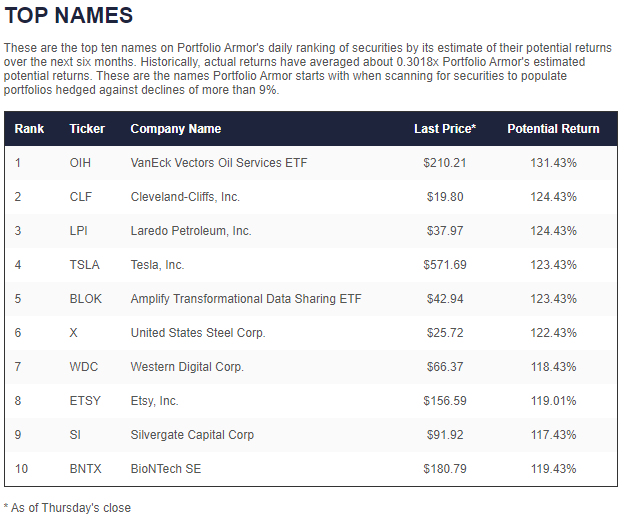

Every day the market's open, our system gauges underlying price action and options market sentiment to pick the securities it estimates will perform best over the next six months. This year, it's picked up industrial commodity names as well as crypto and precious metal names: sometimes ETFs or ETNs tracking the underlying commodities, and sometimes miners or similarly adjacent names. An example of this was our top ten names from May 13th.

Screen capture via Portfolio Armor on 5/13/2021.

This top names cohort came to mind because it's the most recent one to include Laredo Petroleum (LPI), and LPI had a big day on Monday, spiking more than 14%. Regular readers may recall we first mentioned that oil E&P in February (Trouble In Texas). This particular top ten didn't have precious metals exposure but it had exposure to industrial commodities via LPI, the VanEck Vectors Oil Services ETF (OIH), the iron miner Cleveland-Cliffs (CLF), and US Steel (X). It also had crypto exposure via the Amplify Transformational Data Sharing ETF (BLOK) and Silvergate Capital (SI). The inclusion of Tesla (TSLA) in this cohort added exposure to electric vehicles. As of Monday's close, LPI had nearly doubled since May 13th.

LPI has more than tripled since it first hit our top ten names this year on January 21st. If you bought the stock since we mentioned it, and you haven't hedged it yet, this may be a good time to do so.

Locking In Laredo Gains

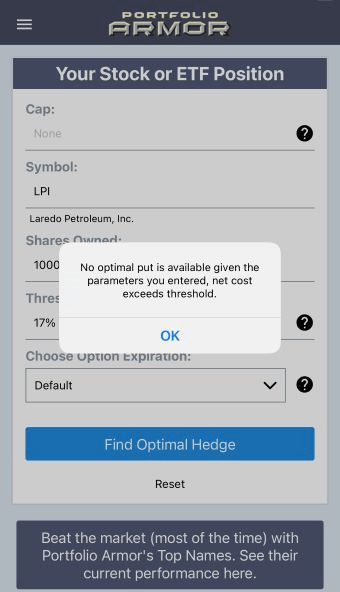

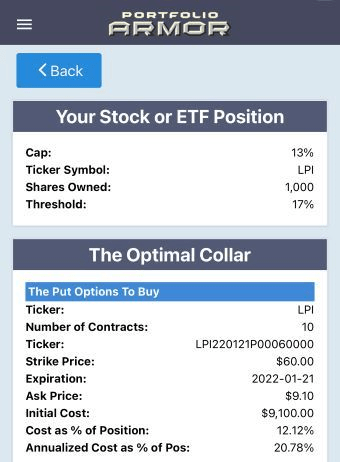

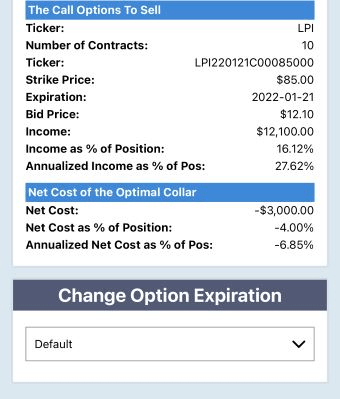

Let's say you owned 1,000 shares of LPI on Monday and wanted to protect against a greater-than-17% drop over the next several months.

Uncapped Upside: Unavailable

This and the subsequent screen captures are via the Portfolio Armor iPhone app.

Laredo was too expensive to hedge against a >17% decline with puts because the puts themselves would cost >17% of position value.

Capped Upside, Negative Cost

If you were willing to cap your upside at 13%, this was the optimal collar to hedge LPI against a >17% decline over the same time frame.

Here the net cost was negative, so you would have collected $3,000, or 4% of position value when opening this hedge. That's assuming, to be conservative, that you bought the puts and sold the calls at the worst ends of their respective spreads. So your maximum upside here would be the 13% cap minus that negative hedging cost of 4%: 13 - (-4%) = 13% + 4% = 17%, assuming you bought the puts at the ask and sold the calls at the bid.

We used the default time to expiration here, which went out to January, but you can experiment with different times to expiration if you want more upside. Given your gains so far though, limiting downside risk might be a better focus.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more