Canadian Airline Stocks – Which Rebound Play Is Best In 2021?

You'd be hard-pressed to find an industry harder hit by the COVID-19 pandemic than Canadian airline companies.

For one, travel came to a complete standstill as borders were closed and international travel was halted. To add to this, travel is often booked well in advance. So not only was the forward outlook for Canadian airline stocks crushed, but it also had to dish out some hefty refunds to customers who couldn't go on the trips that had planned.

In fact, some required government bailouts in order to pay refunds.

But now that the economy is opening back up, the question many investors are asking is are these Canadian stocks worth the gamble, or have they been materially impacted by the pandemic?

In this piece, I'll go over 3 Canadian airline stocks, and discuss whether or not they're worth investing your hard-earned money in today.

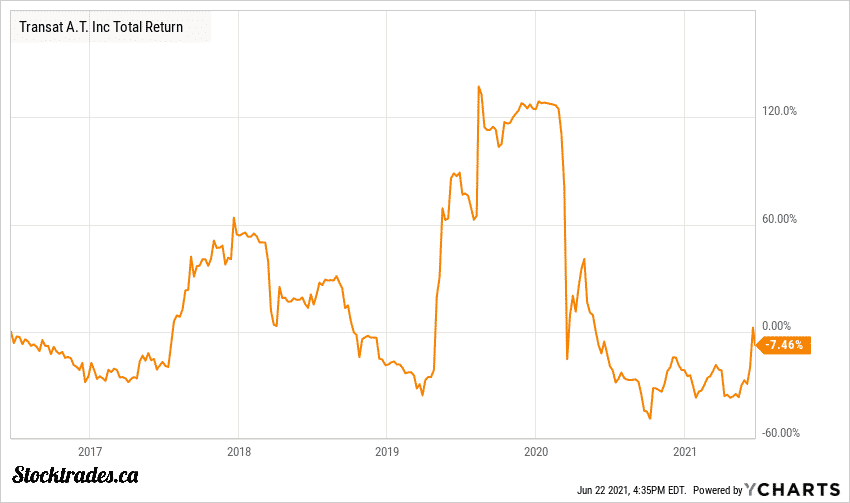

Transat (TSE: TRZ)

Transat (TSE: TRZ) has been a popular company in the media over the last 6 months. Why? Well, it has gone through a series of failed acquisition attempts by both Air Canada (TSE: AC) and surprisingly telecom company Quebecor (TSE: QBR.B).

In April of 2021, Air Canada and Transat agreed to terminate the proposed acquisition and just recently Quebecor CEO Pierre Karl Peladeau ended talks with Transat on a potential acquisition as well.

So, as it stands, Transat is going to be kicking around for a while unless another offer comes in. So, what exactly does the company do?

Transat specializes in the marketing and distribution of holiday travel. It not only offers vacation packages but hotel stays and general air travel under the Air Transat brand.

The pandemic hit the company extremely hard, and the fact it owned a hotel division seemed to be a double whammy. In fact, so much so that on May 20, 2021, the company discontinued its hotel division due to a lack of liquidity.

Through the first 6 months of 2021, Transat has operating revenue of $49.48M, a far cry from the $1.26B it had through the first 6 months of 2020. This should show you why the company needed a $700M government bailout in late April to continue its operations.

The company's balance sheet continues to deteriorate as debt stacks up and capital depletes. It's safe to say that Transat needs the economy to reopen, and it needs it to reopen fast.

But, there is light at the end of the tunnel as travel restrictions are being eased and somewhat of a "booking boom" should be on the horizon.

However, I wasn't too much of a fan of Transat even pre-COVID. I believe there are much more operationally efficient airline companies here in Canada. Two of which I'm going to go over next.

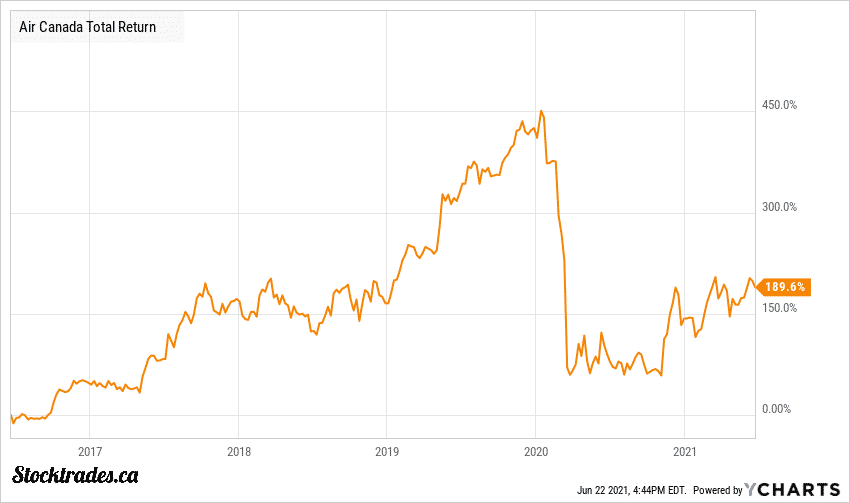

Air Canada (TSE: AC)

If you're looking for popular Canadian airline stocks, look no further than Air Canada (TSE: AC). In fact, this was one of the most popular airline stocks in the world at one point due to the rumored economic recovery.

Air Canada is Canada's largest airline. Prior to the COVID-19 pandemic, this is an airline that was serving 50 million passengers per year. Not only does it operate regional flights here in Canada, but international and vacation destinations as well.

The pandemic rocked the company hard, as it saw revenue collapse from nearly $18B in 2019 to just $5.3B in 2020.

The company had been cash flow positive for 3 years running prior to the pandemic, but losses piled up in 2020, resulting in negative FCF of over $3.5B.

Air Canada was one of the most efficient airlines in the world prior to the pandemic, providing investors with industry-leading ROE, ROA, and ROIC numbers.

It's no surprise that up until the market crash in 2020, Air Canada had provided overall returns for investors in excess of 2,360% since mid-2011. In fact, it was one of the best performing stocks on the Toronto Stock Exchange.

In terms of airline bailouts, Air Canada got the premium package. Not only did the government open up the potential for nearly $5.4B in low interest loans, but it also took an equity stake in the company of $500M.

So, as the company shores up liquidity it is all but guaranteed to survive the pandemic and get back on track. But, there's no doubt this company's balance sheet has deteriorated, and investors must be aware that this is not the same Air Canada as before.

The company's retained earnings balance of $3.5B from 2019 has all but evaporated and now sits with a deficit of $500 million. Debt has ballooned, with just over $9.7B in long-term debt, with over $1.24B payable in the next year.

To put this into perspective, this is over $3B higher than 2019 levels.

An investment in Air Canada does have some promise today considering the inevitable boom in travel bookings and return to normalcy. This might result in a spike in share price as people buy up stock in preparation for continued momentum.

However, the company will likely take multiple years to stabilize its financial position, and this is key for investors to understand. An investment made today in Air Canada will require patience, and likely a 5-year timeline at minimum.

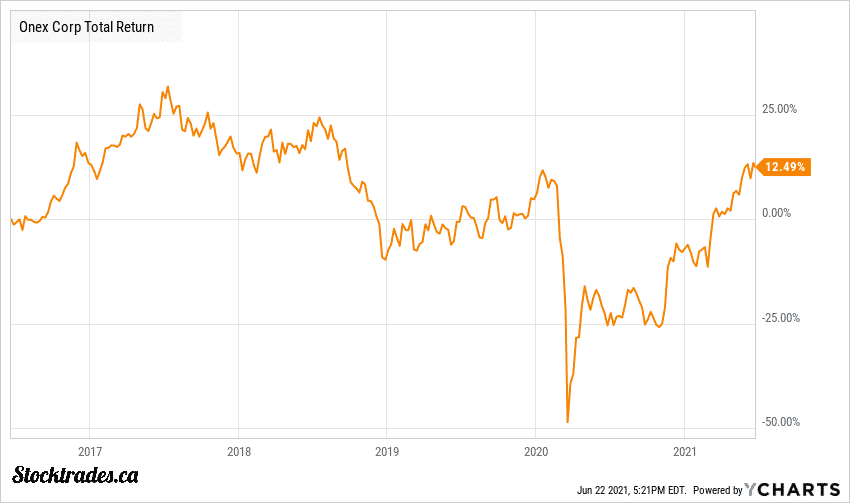

Onex (TSE: ONEX)

I will admit, Onex (TSE: ONEX) in terms of Canadian airline stocks is cheating a bit. The company is a large asset manager with $44 billion in assets and over 37 years of operations. But, it does still own one of the biggest airlines in the country, and that is Westjet.

The company also owns or has owned a stake in some other valuable businesses including Celestica, Purolator, Canadian Securities Institute, and Cineplex.

Onex's business model is likely to confuse some investors. Because it is an asset manager, when its investments go up in value, it gets to report that as an increase in overall earnings.

However, as we've all witnessed, investments are far from a straight line upwards. So, it's earnings can get quite sporadic. What you really need to look at in terms of growth from Onex is its book value per share. And speaking of which, it has grown by 3.76%, 36.26%, and 8.04% over the last 3 years, some fairly solid returns.

Onex's purchase of Westjet just one year prior to the COVID-19 pandemic was nothing more than bad luck, as it was viewed at the time as a solid acquisition. In fact, I was a shareholder of Westjet, and I viewed them as the best airline in the country.

The company is still trading below book value at 0.83 times, and although it may not be a pure-play in terms of airline companies, there is no question it will benefit from an economic reopening on not just its Westjet investment, but others as well.

Overall, Canadian airline stocks are likely to have rocky times ahead

If you're willing to take on a bit more risk, a pure-play Canadian airline stock could be for you. If I were to pick one right now, it would be Air Canada. I've never been a fan of Transat, and I really think the company could struggle coming out of the pandemic.

However, if you're looking for a bit of an "all in one" recovery play that has some airline exposure to it, Onex provides solid value.

Disclaimer: The writer of this article or employees of Stocktrades Ltd may have positions in securities listed below. Stocktrades Ltd may also be compensated via affiliate links in the post ...

more