USD/CAD Analysis: Bulls Looking At 1.28, WTI Falls And USD Bids

On Tuesday, the USD/CAD analysis still seems positive even after a bull run for three consecutive days. The pair continues to rise moderately, maintaining the buying momentum from the end of last week.

Yesterday, the pair showed the best dynamics of strengthening over the past few months, updating local highs from February 5. However, the upward dynamics of the USD/CAD contributed to a decrease in demand for risky assets and a collapse in the oil market due to a deterioration in demand prospects amid the spread of a new strain of coronavirus.

Investors are watching with alarm the worsening pandemic situation in several countries. In the UK, the number of cases per day exceeded 50k, but Boris Johnson, nevertheless, announced the complete abolition of quarantine restrictions, including the mandatory wearing of a mask.

Today in the US, statistics from the construction sector will be released. Analysts predict the growth of indicators, which may provide additional support to the Greenback. In addition, tomorrow will be published the June housing price index in Canada.

USD/CAD technical analysis: Indicators pointing at further gains

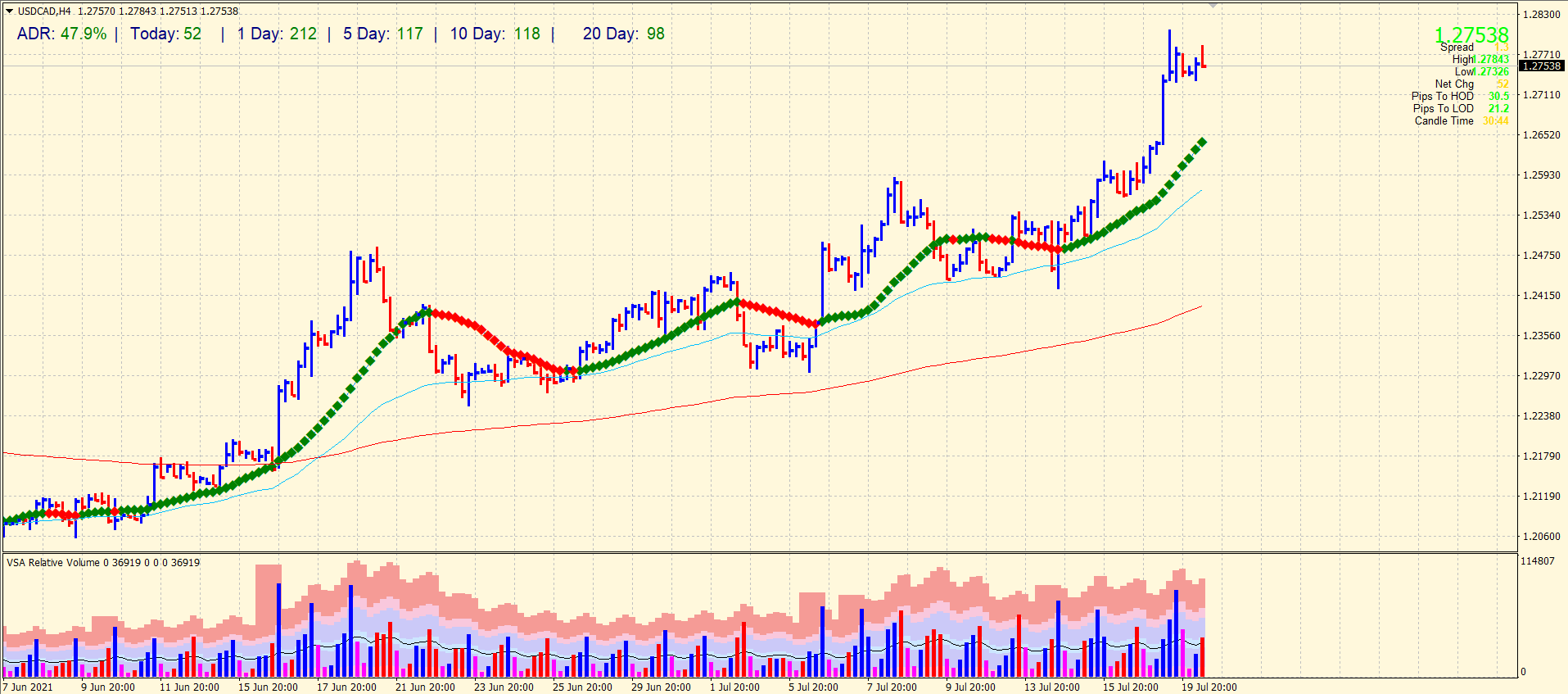

According to the daily chart, the key moving averages are in a phase of active rise with a simultaneous expansion of the price range.

The MACD histogram is growing in the positive zone. The indicator keeps a strong buy signal. Stochastic is flat in the area of highest values.

USD/CAD 4-hour chart analysis

For buyers, an important resistance is at 1.2800. If it breaks out, we can look for long positions with a target of 1.2900.

If a bullish failure and a rebound from the resistance at 1.2800 occurs, it is necessary to wait for the price to consolidate below 1.2750. After that, we can look for short opportunities with a target of 1.2650.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more