The yields on government bonds fell for the second straight day as sentiments improved on further easing of crude oil prices and US Treasury yields. “All positive things across the globe, whether it is fall in US Treasury yields, easing oil prices is reflecting in the yields on bonds since Monday. Along with this, GST compensation given by central government to the states also helped bond yields to fall,” said Mahendra Kumar Jajoo, chief investment officer, Fixed Income, Mirae Asset Investment Managers (India).

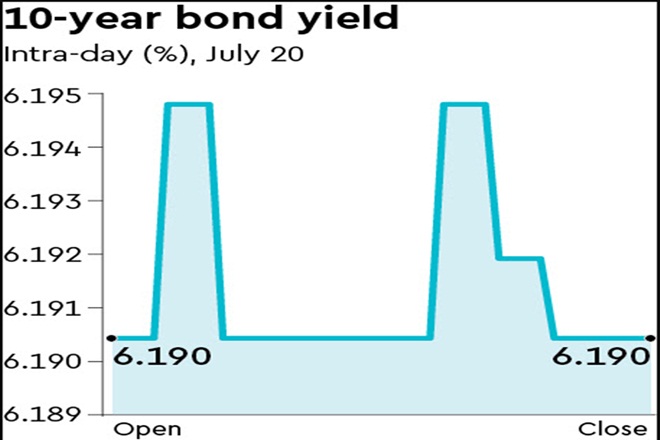

On Tuesday, the yields on bonds ended almost 2-3 basis points down. The 5.63%-2026 and 6.64%-2035, which is the most traded in the market as of now, ended at 5.6350% and 6.7477%, respectively. The new benchmark 10-year bonds ended at 6.1190%, which is nearly 1 basis points lower compared to its previous close on Monday.

A dealer with a state-owned bank said that the thin trading activity in the benchmark 10-year gilts will increase once the Friday’s weekly bond auction take place as it is expected that it will get a good response from investors. “Post-Friday’s weekly bond auction, you can see the new benchmark 10-year yields can come closer to 6.05%, because the positive things are improving sentiments of traders in the market,” Jajoo said.

The central bank in Friday’s weekly bond auction has announced that it would sell Rs 14,000 crore worth of 6.10%-2031 bonds.

This will be the second auction in this segment after it was firstly auctioned on July 9, where the Reserve Bank of India raised Rs 14,000 crore after setting 6.10% yield on 10-year bond.

While, the Brent crude oil prices continued its fall on Tuesday and had now been trading below $70 a barrel due to increase in output of oil supply after settling internal dispute at Opec+ and concerns of rising Delta variant of Covid-19 is putting restrictions in some countries. By the end of trading hours on Tuesday, Brent crude oil was trading at $68.98 a barrel.

Adding to this, the bond yields also got a support due to fall in US Treasury yields, which hit almost five months low on Monday. The yield on 10-year benchmark bond fell just below 1.20%. The fall in US Treasury yields was witnessed due to heavy sell-off in the US stocks, with Dow Jones Industrial Average falling more than 800 points.