Relatively protected from the fallout of the COVID-19 pandemic’s brief but palpable economic recession, Alphabet, Inc. (GOOGL) has seen seriously strong year-over-year gains in stock price. Expected to release earnings after market close on Tuesday July 27, the multinational technology conglomerate is anticipated to report another quarter of high revenues, due in part to its search, advertising, and cloud computing services. (See GOOGL stock charts on TipRanks)

Reporting bullishly on the stock is Justin Post of Bank of America, who wrote that Alphabet can be seen as a good 2021 recovery stock with more value to gain. He added that while the company’s quarter-over-quarter comparison may be difficult to beat, CEO Sundar Pichai has made efforts to keep shareholders pleased.

Post reiterated a Buy rating on the stock, and provided a price target of $2,755 per share. This target suggests a possible 12-month upside of 9.14%.

The five-star analyst boldly stated that GOOGL is his “top FAANG pick,” due to its exposure to “the accelerating digital ad shift & travel/local recovery.” He sees the company benefitting in the long-run from its cloud services and self-driving vehicle businesses.

Of slight concern, noted Post, are Alphabet’s expenses on its balance sheet, from both operating and hiring costs as well as its $593 million fine by French regulators over uncooperative behavior with news publishers. Despite these factors, GOOGL has not been as active with pursuing mergers and acquisitions, so more capital returns are expected.

He sees significant upside from ramping up Youtube ad revenues, as well as from the platform’s increased viewership. Youtube provides future monetization opportunities in ecommerce, such as through partnerships with Square (SQ) and Shopify (SHOP).

GOOGL has recently experienced positive activity elsewhere across its far-reaching business. Its wearable operating software is merging with Samsung, while it is integrating a shopping platform with Shopify merchants and payment options. Additionally, the company plans to open its first physical storefront in summer 2021 in New York City.

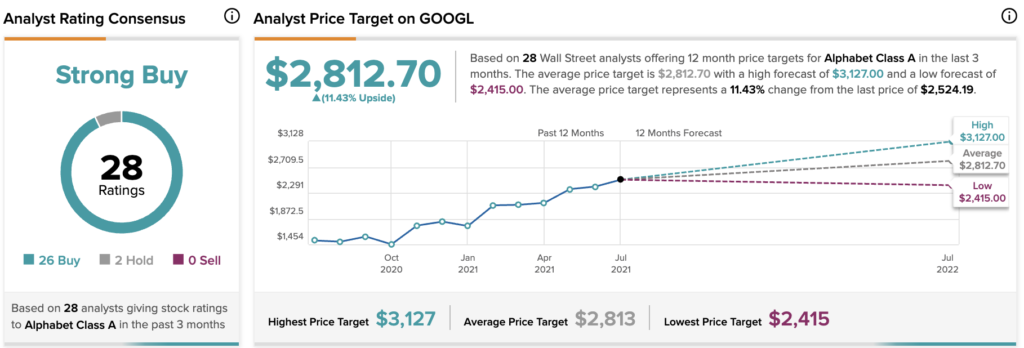

On TipRanks, GOOGL has an analyst rating consensus of Strong Buy, based on 26 Buy and 2 Hold ratings. The average Alphabet price target is $2,812.70, reflecting a potential 12-month upside of 11.43%. GOOGL closed trading Tuesday at a price of $2,524.19.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.