Downside Risks Ahead! Will Gold Dodge Bullets Or Get Shot?

The Fed’s taper talk, vaccines, Treasuries… the rifles are being fired at gold from every direction this week. Will it escape unharmed?

A Fog of Confusion

With investors’ manic mood swings whipsawing the U.S. yield curve in-and-out of hysteria, gold suffered another dose of reality on Jul. 21. And with inflation surging and the U.S. 10-Year Treasury yield still extremely oversold, the yellow metal could be dodging even more bullets in the coming weeks.

Case in point: while over-positioning, the U.S. Federal Reserve’s (Fed) hawkish shift, unprecedented reverse repos (another $886.206 billion sold on Jul. 21), and the Delta variant have rocked investors’ boats, the reality on the ground is much different. To explain, with Canadian National Railway (CN) SVP James Cairns telling analysts on Jul. 20 that “during Q2 we saw the more balanced demand recovery that we expected,” the U.S. 10-Year Treasury yield is still underestimating the strength of the U.S. economic recovery.

For context, CN is a leading North American transportation and logistics company that transports more than C$250 billion worth of goods annually across a rail network of approximately 20,000 route-miles spanning Canada and mid-America.

Please see below:

Source: CN/The Motley Fool

Moreover, another excerpt from the conference call read:

“Labor and fringe benefit expense was up 28% versus last year. This was mostly driven by increased wages due to a 9% higher average headcount and higher incentive compensation. Fuel expense was up 86% driven by a 76% increase in price and a 14% higher workload, partially offset by another solid fuel efficiency improvement of 2%.”

On top of that, with CEO Jean-Jacques Ruest noting that “there is rail inflation [and that] eventually you will see it in the all-inclusive rail index of AAR because there is a bit of a lag in that index,” how is the company responding to the inflationary pressures?

Source: CN/The Motley Fool

Singing a similar tune, Stellantis NV CEO Carlos Tavares said on Jul. 21 that rising raw material costs and a shortage of semiconductors could uplift inflation well into next year. For context, Stellantis NV is a European automaker that was created following the merger of PSA Group and Fiat Chrysler in 2021.

Please see below:

Source: Bloomberg

Likewise, Daimler AG Chairman Ola Kallenius said the following during the automaker’s Q2 earnings call on Jul. 21:

“On the raw material, you're right. The headwinds we now see moving forward are stronger than what we assumed so far. We said, I think, at the beginning of the year, we could probably have on the full year 0.5% in terms of cost headwind. I mean, now you could hear us, I mean, saying 1% in the second half. And actually, I mean, we can see that all in all, in cars and vans, as well as in trucks and buses.”

He added:

Source: Daimler/Seeking Alpha

Inflation and Commodities – Do We Still Fight for Lumber?

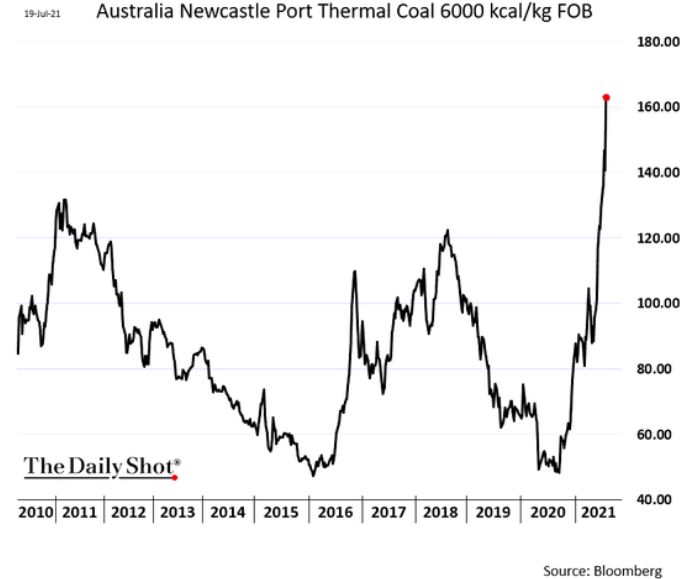

Furthermore, while I’ve been warning for months that inflationary pressures will likely force the Fed’s hand in September, cost-push inflation remains alive and well. For example, while crude suffered a freak-out on Jul. 19 and lumber has fallen off a cliff, steel remains in the clouds and coal isn’t far behind.

Please see below:

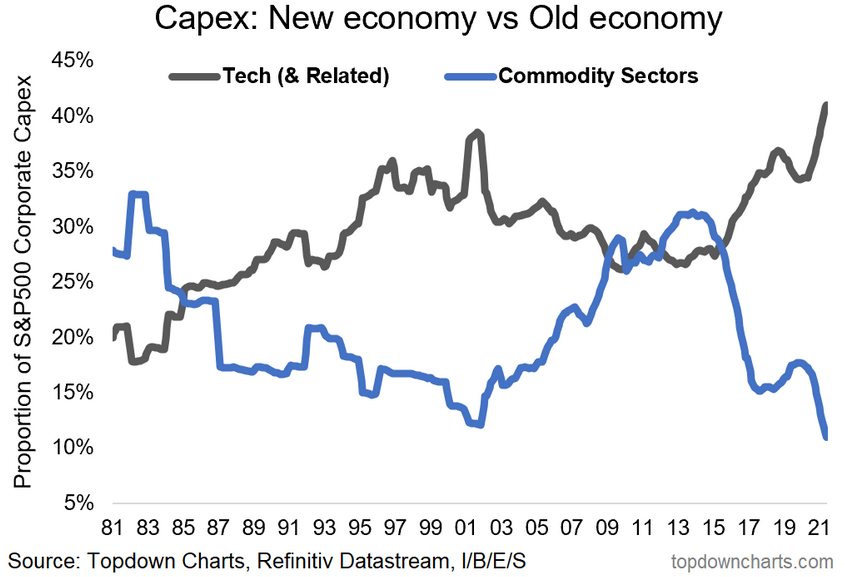

In addition, with commodity producers still skittish over the wreckage that occurred during the global financial crisis (GFC), the group has been extremely cautious this time around. And with a lack of capital investments severely constraining production, the supply/demand equilibrium remains completely out of whack.

Please see below:

To explain, the black line above tracks capital investments made by technology-related firms in the S&P 500, while the blue line above tracks capital investments made by commodity producers in the S&P 500. If you analyze the right side of the chart, you can see that commodity cap-ex is at a 40-year low. On the flip side, technology-related firms are expanding at a pace that exceeds the dot-com bubble. As a result, not only could a Big Tech tirade upend the PMs, but realigning U.S. interest rates with the economic realities could be just as damaging.

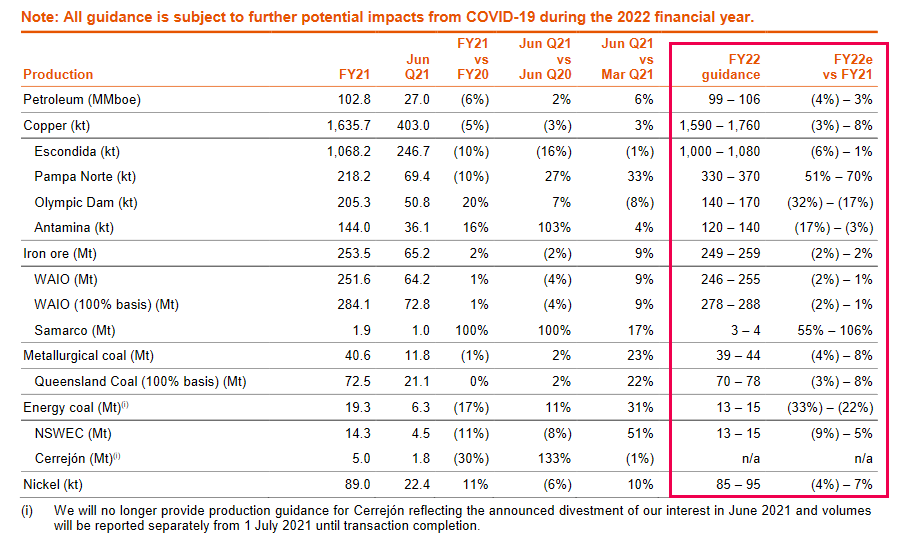

To that point, BHP Group, the world’s largest mining company, released its full-year operational review on Jul. 20. For context, CEO Mike Henry said back in March that “there’s really no point in chasing production. The industry has a good track record of being quite a pro-cyclist, and it has ended in tears quite often.”

And with that, while BHP had 18 major projects in motion a decade ago, only two are in development now: the Mad Dog Phase 2 project in the Gulf of Mexico (24% stake) and its Jansen Potash project in Saskatchewan, Canada. Thus, please have a look at BHP’s forward guidance:

(Click on image to enlarge)

Source: BHP

To explain, if you analyze the red box above, you can see that BHP’s “FY22 guidance” includes lower-to-roughly-flat production. If you turn to the first column from the right, you can see that petroleum, copper, iron ore, coal and nickel could experience negative year-over-year (YoY) production growth (on the low-end) to low/mid-single digits production growth (on the high-end).

The bottom line? While cost-push inflation has been the main driver of the inflationary surge and the bond market is all-in on the Fed’s “transitory” narrative, fresh commodities supply is not coming to the Fed’s rescue.

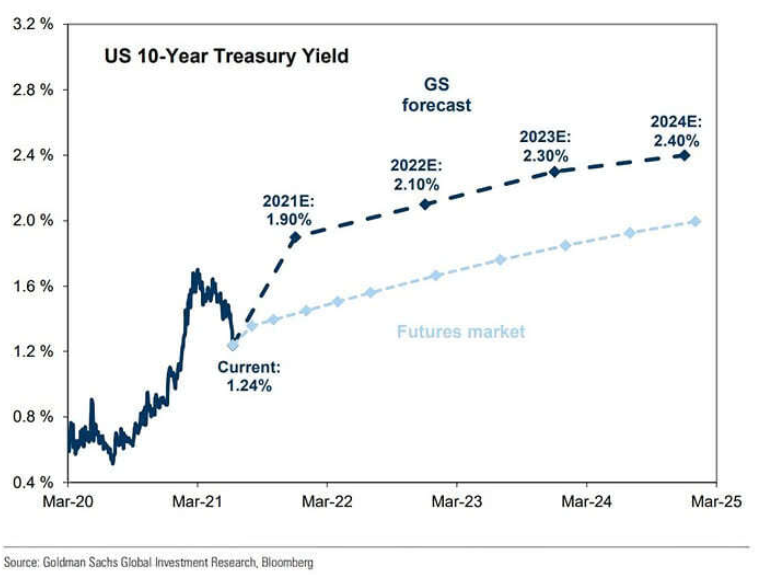

10-Year Treasury: Goldman Sachs Doubles Down

Finally, while the U.S. 10-Year Treasury yield continues to weigh the Fed’s likely taper (which would slow economic growth and reduce inflation) with the effects of the supply chain disruptions that continue underwriting the inflationary surge, Goldman Sachs has doubled down on its year-end forecast.

Please see below:

Despite the recent malaise, the U.S. investment bank expects the U.S. 10-Year Treasury yield to end the year at 1.90% (the dark blue line above). Moreover, with the futures market implying a year-end target of roughly 1.40% (the light blue line above), Goldman Sachs still sees upside risk to the consensus expectation.

In conclusion, the PMs remain in no man’s land, as the front-end and the back-end of the U.S. yield curve have the potential to push them over a cliff. Regarding the former, with the Fed likely to announce its taper timeline in September, rising short-term interest rates reduce the PMs’ relative appeal. Regarding the latter, if the vaccines prove effective and reduce the impact of the Delta variant (which data shows that they already have), long-term interest rates are massively underestimating the inflationary pressures and the prospective strength of the U.S. economy. Thus, any way you slice it, the medium-term outlook for the PMs remains profoundly bearish (the long-term outlook is bullish, though).

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more