- USD/CAD booked the first weekly loss in four, well off multi-month highs.

- Impressive recovery in WTI prices knocked off USD/CAD amid record-high equities.

- USD/CAD eyes deeper correction after closing the week below the key 200-DMA barrier.

- All eyes are on the FOMC decision in the big week ahead.

USD/CAD witnessed high volatility last week, enjoying good two-way price-action amid a fresh record rally in the US equities and a V-shaped recovery in oil prices. The currency pair failed to preserve early gains and closed the week in the red, snapping three straight weekly advances. The corrective pullback from five-month highs is likely to extend into a fresh week, as the pair failed to resist above the critical 200-Daily Moving Average (DMA) at 1.2614 on a weekly closing basis.

USD/CAD: In the rear

Although it was a relatively quiet week data-wise, volatility remained high around USD/CAD in the first half of the week. The bulls extended their control and sent the price to the highest levels since February at 1.2807. The rally was mainly driven by the relentless rise in the US dollar and slumping WTI prices, as fears over the global economic recovery heightened amid the Delta covid variant flareups on both sides of the Atlantic. A risk-off market profile remained in full swing on Monday, with the Wall Street indices hitting monthly lows and lifting the safe-haven demand for the greenback.

Turnaround Tuesday rescued the CAD bulls amid an improvement in the market mood, which weighed on the US dollar’s strength. Oil prices last also took advantage of the risk rebound and staged a V-shaped recovery from two-month lows of $65.11. Further, expectations that oil supply will remain tight through the year also underpinned WTI’s bullish reversal. The US stimulus optimism and strong corporate earnings reports and the European Central Bank’s (ECB) dovish monetary policy stance helped uplift the overall market sentiment in the latter part of the week.

On Thursday, weaker-than-expected US Jobless Claims exerted additional downward pressure on the greenback, keeping a check on USD/CAD recovery attempts from corrective decline to four-day lows of 1.2525 reached on Wednesday. The Initial Jobless Claims increased last week to 419,000, the most in two months, from 368,000 the previous week while missing estimates of +350,000. Disappointing Existing Home Sales data also added to the dour mood around the American dollar.

Friday’s mixed US Markit Preliminary PMI reports and a rebound in Canadian Retail Sales once again capped the rebound in the CAD pair. Retailer spending bounced back in June with sales jumping by 4.4% as restrictions eased amid falling virus count. However, record in Wall Street indices helped put a floor under the pair.

USD/CAD: Week ahead

The week ahead is a busy one from the word go, with the first-tier events due for release from both the North American economies. The US Federal Reserve (Fed) monetary policy decision is likely to stand out among other relevant macro data.

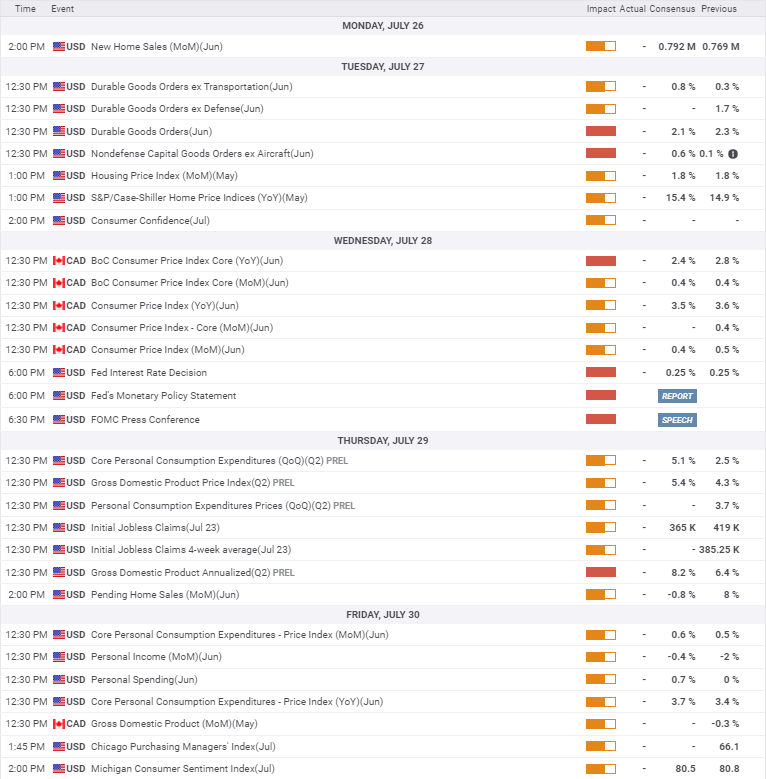

Monday’s sees the US New Homes Sales for June at 0.792M vs. 0.769M previous. The US Durable Goods Orders and CB Consumer Confidence data will be closely eyed on Tuesday. The US Durable Goods Orders are seen rising 2.1% in June vs. the previous increase of 2.3%. Also, of note for CAD traders will be the US weekly crude supplies report from the API and EIA on Tuesday and Wednesday.

Wednesday is also a big day, as the FOMC will announce its policy decision. Although the world’s powerful central bank is likely to leave its monetary policy settings unchanged, any hints on the taper timing will be eagerly awaited, especially after Fed Chair Jerome Powell came out dovish at his Congressional testimony earlier this month. The recent uptrend could resume if the Fed signals a clear hawkish shift, with rolling back of bond purchases later this year. US stocks will feel the heat of a potential taper and could see a fresh sell-off, reviving the greenback’s haven demand. Ahead of the Fed decision, the Canadian Consumer Price Index (CPI) for June will drop-in, with the Bank of Canada (BOC) annualized Core CPI seen easing to 2.4% in the reported month when compared to May’s 2.8%.

Traders will brace for a raft of key US economic releases on Thursday, including the US Q2 advance GDP report, Jobless Claims and Pending Home Sales. The US economy is likely to grow by 8.2% in Q2 vs. a 6.4% expansion reported in the previous quarter. Friday’s US Personal Consumption Expenditures - Price Index, the Fed’s preferred inflation gauge, UoM Consumer Sentiment and Canadian monthly GDP will hog the limelight, as a data-intensive week will draw to an end.

USD/CAD: Technical outlook

USD/CAD’s daily chart shows that the near-term technical outlook still appears constructive, despite the sharp pullback from multi-month tops. Although another downswing cannot be ruled out before the pair resumes the uptrend.

This view comes on the back of USD/CAD’s weekly closing below the critical 200-DMA at 1.2614. Therefore, recapturing the latter is critical to reviving the upbeat momentum towards 1.2675, which is 23.6% Fibonacci Retracement level of the rally from June 23 lows of 1.2252 to the five-month highs of 1.2807.

A daily closing above that barrier would offer the much-needed boost to the bulls, driving the prices back towards the multi-month highs. The 14-day Relative Strength Index (RSI) trades flatlined but well above the midline, suggesting that there is room for additional upside.

Meanwhile, the corrective mode will remain intact so long the rates hold below the 200-DMA. Immediate support awaits at 1.2525, the convergence of the previous week’s low and 50.0% Fibonacci Retracement level of the same advance.

A firm break below the latter could expose the upward-pointing 21-DMA at 1.2487, below which the critical 61.8% Fibonacci level at 1.2462 could come into play. A sharp sell-off will be triggered if the 61.8% Fibo caves in, opening floors for a test of the horizontal 100-DMA at 1.2372.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.