USD/CAD Price Looking To Break 1.26 Before Canadian CPI, Fed

- The USD/CAD edged lower on Wednesday after facing rejection at a very important 200-day SMA.

- The environment is in favor of bulls and supports chances of a break to the upside.

- The positive outlook needs negation for sustained weakness below 1.2500.

The USD/CAD price faced a significant rejection at the very important level of 200-day SMA on Wednesday. The pair has continued its struggle to achieve acceptance or build on the momentum beyond the 1.2600 marks. The USD/CAD pair faced a sharp decline to fresh daily lows near 1.2560 regions. The update reversed the part of yesterday’s positive move now.

The commodity-linked Loonie got underpinned by the stable and modest increase in crude oil prices. This shift has become one of the key factors that deal as a USD/CAD pair headwind. However, at least for the present day, the renewed buying interest and US Dollar demand can limit any meaningful pullback for the major.

The safe-haven Greenback is continuously getting benefits amid a prevalent risk-off environment at financial markets. It was further supported by the goodish pickup in the US Treasury bond yields. Furthermore, the traders in financial markets are unwilling or hesitant to place any aggressive bets against the Canadian CPI report and the monetary policy decision by the FOMC.

USD/CAD technical analysis: Key levels to watch

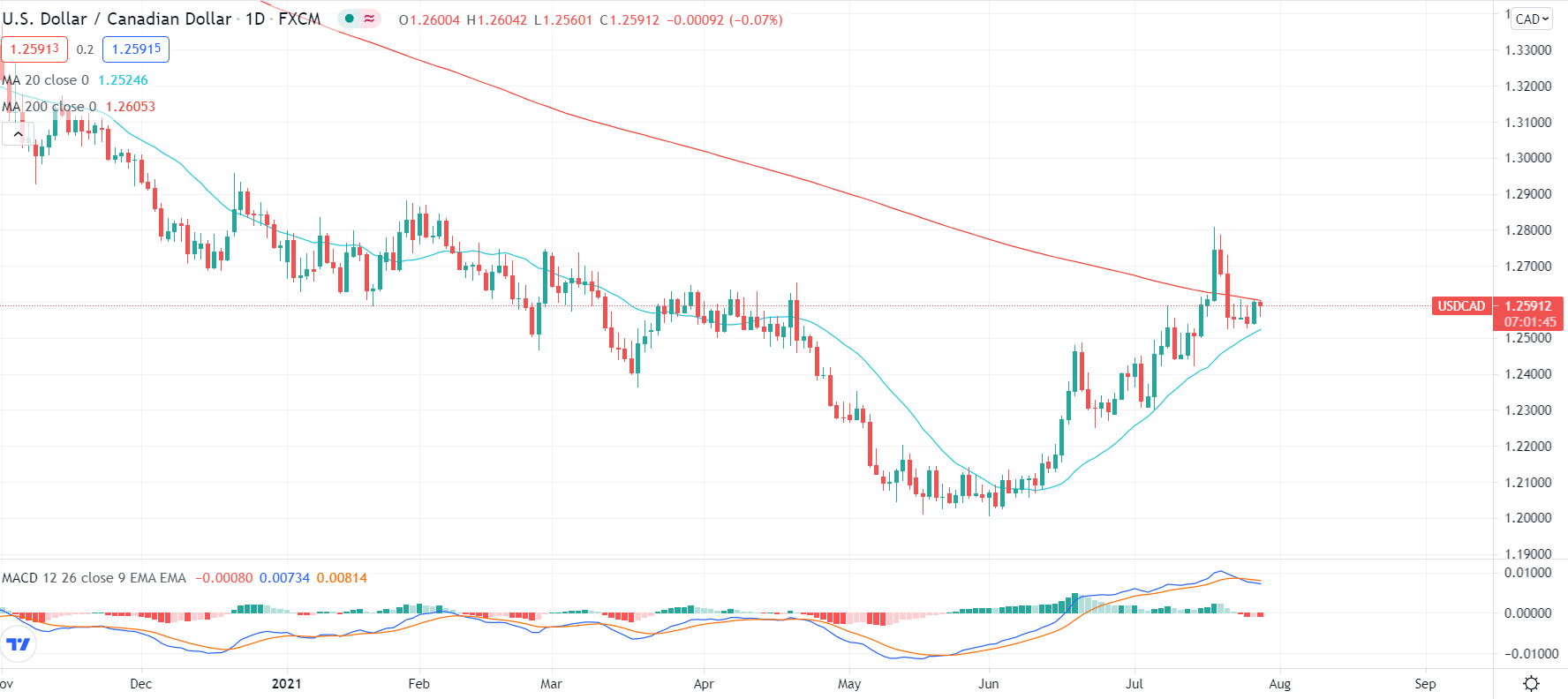

Overseeing the technical aspect of the situation, the USD/CAD pair is in oscillation in a variable range for a week or more. The upper margin of the trading trend coincides with the daily 200-SMA. It should act as the critical point for traders working short-term in the financial market. The additional gains will be set up by sustained strength these days.

USD/CAD daily price chart

The technical indicators on the daily chart are holding comfortably in the bullish territory. These technical indicators have been corrected from the higher level recently but still show stability. These indicators support the chances of rising in several dip-buying scenarios at the lower levels. Any subsequent reduction or decline could be considered as a buying opportunity for traders.

On the other hand, several follow-throughs buying above the 1.2600 mark will be considered a fresh trigger for the bulls. It can potentially lift the USD/CAD pair towards the 1.2665-70 intermediate hurdle. There is a chance of extension in momentum up to the 1.2700 marks. It could be possible before bulls eventually push the pair to the resistance zone of the 1.2770-75 mark.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more