Silver & Gold Going Higher Thanks To Imminent USD Decline?

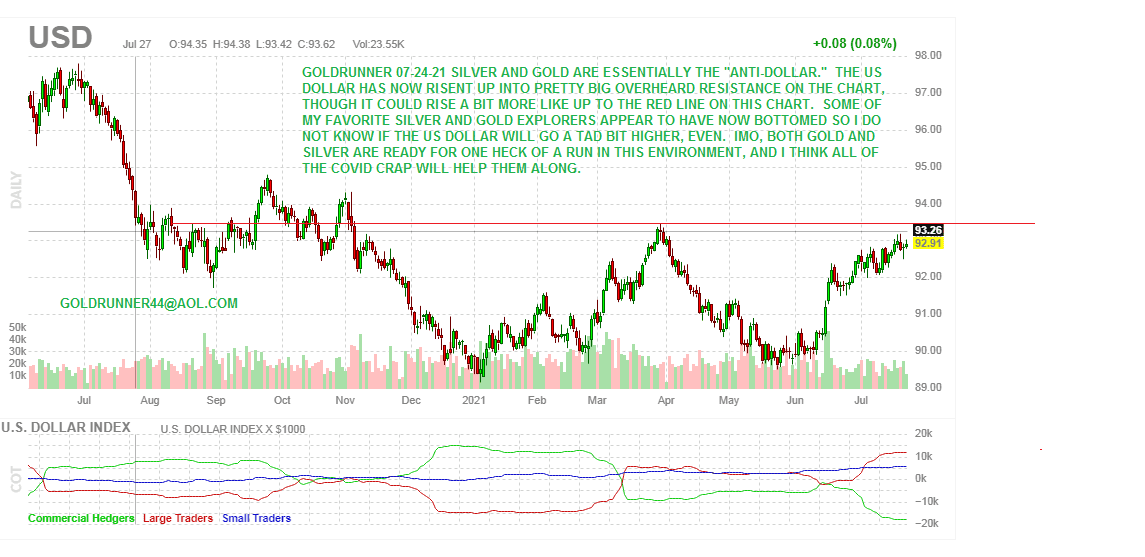

We appear to be at the point where the USD will soon start to move lower causing Precious Metals pricing across the board to start moving up aggressively.

USD - In A Terminal Run?

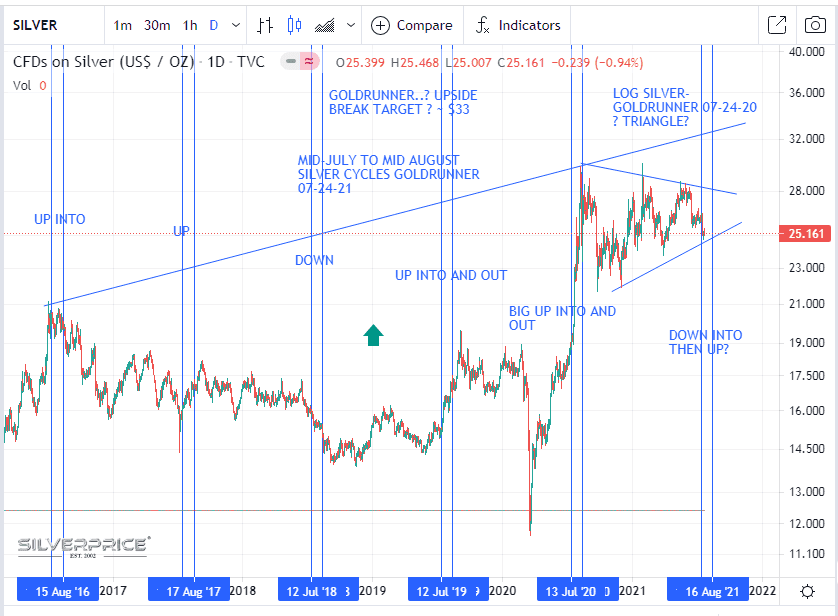

Silver - Ready To Run?

As can be seen in the chart below from Goldrunner, Silver is currently mired in a large triangle correction which should bottom soon and then take off to a much higher price matching the USD's terminal run on the chart above.

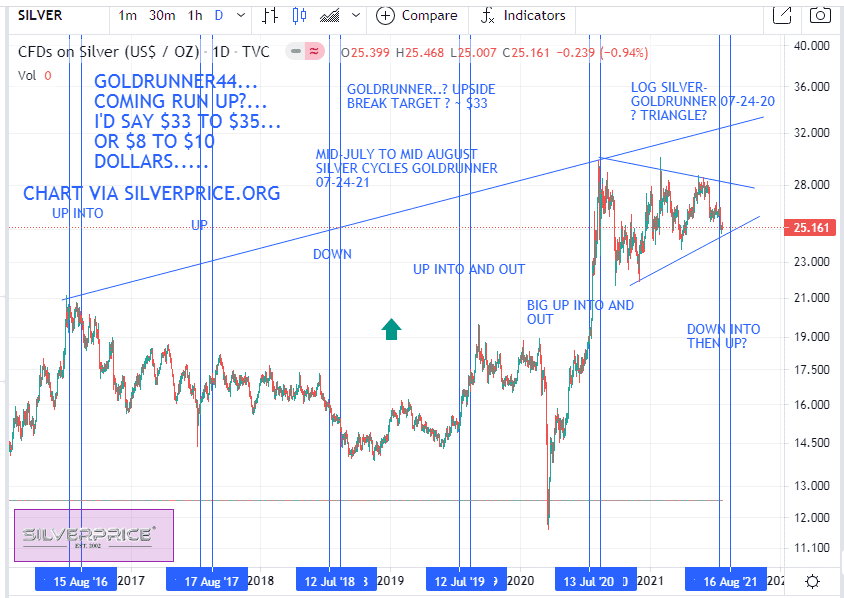

$33 - $35 Silver Potential?

As mentioned above, with the USD now appearing to be topping, Silver should move up aggressively out of the triangle by as much as $8 to $10 per troy ounce to $33 to $35/ozt. according to Goldrunner which, as mentioned in last week's article, should also cause the Silver (and other precious metals) mining stocks to surge thereafter.

Gold To Follow?

If, and when, the expected decline in the USD occurs, Gold will likely run up to its old highs, and then higher in the weeks and months ahead. I'll include a gold chart projecting that possibility in my follow-up article next week.

The Bottom Line

"Everything real", i.e. Silver and Gold (and Platinum), is getting ready to run up substantially based on the USD topping and then dropping in "price".

Disclosure: The contents of this article are sourced from a private conversation with a friend who operates under the pseudonym "Goldrunner", and are paraphrased in this article ...

more