USD/JPY Eyes July Low With US Yields Under Pressure Ahead Of NFP Report

Japanese Yen Talking Points

USD/JPY appears to be on track to test the July low (109.06) following the Federal Reserve interest rate decision as longer-dated US Treasury yields come back under pressure.

USD/JPY Eyes July Low with US Yields Under Pressure Ahead of NFP Report

USD/JPY extends the series of lower highs and lows from the previous week as the US ISM Manufacturing survey unexpectedly downticks in July, and the exchange rate may face a further decline over the coming days as the 10-Year Treasury yield approaches the July low (1.13%).

The update to the US Manufacturing survey may keep the Federal Open Market Committee (FOMC) on the sideline as the index narrows to 59.5 from 60.6 in June to mark the lowest reading since the start of the year. Indications of a weaker-than-expected recovery may continue to drag on US yields as it encourages the Fed to retain the current course for monetary policy.

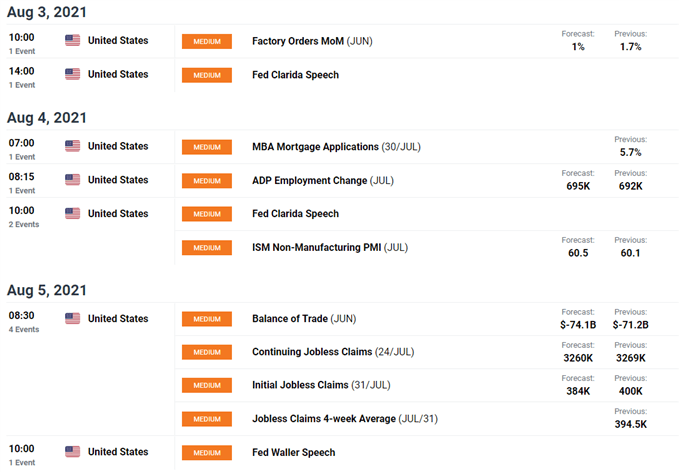

As a result, the slew of US event risks may influence USD/JPY ahead of the Non-Farm Payrolls (NFP) report as a number of Fed officials are scheduled to speak over the coming days. More of the same from the central bank may keep US yields under pressure as Governor Lael Brainard, a permanent voting-member on the Federal Open Market Committee (FOMC), insists that “employment has some distance to go” while speaking at the Annual Meeting of the Aspen Economic Strategy Group.

In turn, lackluster data prints coming out of the US economy may drag on USD/JPY as the FOMC remains reluctant to switch gears, but a further decline in the exchange rate may fuel the recent shift in retail sentiment like the behavior seen earlier this year.

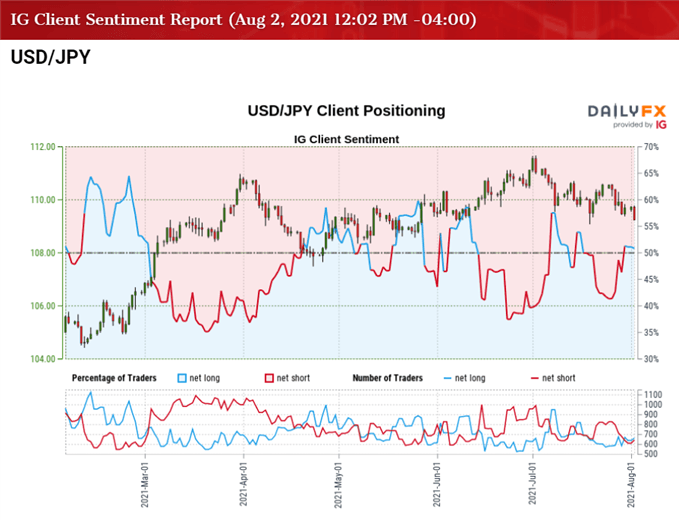

The IG Client Sentiment report shows 50.75% of traders are currently net-long USD/JPY, with the ratio of traders long to short standing at 1.03 to 1. The number of traders net-long is 6.48% higher than yesterday and 16.67% higher from last week, while the number of traders net-short is 7.36% higher than yesterday and 12.28% lower from last week.

The rise in net-long interest has fueled the shift in retail sentiment as 45.73% of traders were net-long USD/JPY last week, while the decline in net-short position could be a function of profit-taking behavior as the exchange rate extends the series of lower highs and lows from last week.

With that said, a further decline in USD/JPY may fuel the shift in retail sentiment like the behavior seen earlier this year, and the exchange rate appears to be on track to test the July low (109.06) as US yields come under pressure.

USD/JPY Rate Daily Chart

Source: Trading View

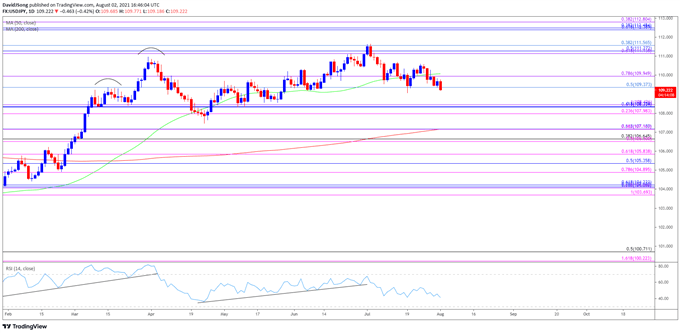

- USD/JPY approached pre-pandemic levels as a ‘golden cross’ materialized in March, with a bull flag formation unfolding during the same period as the exchange rate traded to a fresh yearly high (110.97).

- The Relative Strength Index (RSI) showed a similar dynamic as the indicator climbed above 70 for the first time since February 2020, but the pullback from overbought territory has undermined the upward trend from this year, which briefly pushed USD/JPY below the 50-Day SMA (110.07) for the first time since January.

- Nevertheless, USD/JPY reversed ahead of the March low (106.37) to largely negate the threat of a head-and shoulders formation, with the exchange rate climbing back above the moving average to trade to a fresh yearly high (111.12) in June.

- A similar scenario took shape in July as USD/JPY traded to a fresh yearly high (111.66), but the lack of momentum to hold above the 109.40 (50% retracement) to 110.00 (78.6% expansion) region may push the exchange rate towards the Fibonacci overlap around 108.00 (23.6% expansion) to 108.40 (100% expansion), with the next area of interest coming in around 107.20 (61.8% retracement).

Disclosure: See the full disclosure for DailyFX here.