- July Net Employment Change could bring recovery to 95% of lockdown losses.

- Unemployment Rate forecast to drop to pandemic low.

- Canada’s employment report takes back seat to US Nonfarm Payrolls.

- USD/CAD likely to reflect changes and discrepancies in the US payrolls report.

The July employment report may bring the Canadian economy to nearly full replacement of its pandemic losses. Even if it does, markets and the USD/CAD will pay far more attention to the US Nonfarm Payrolls result, issued at the same time, 8:30 am EDT on Friday.

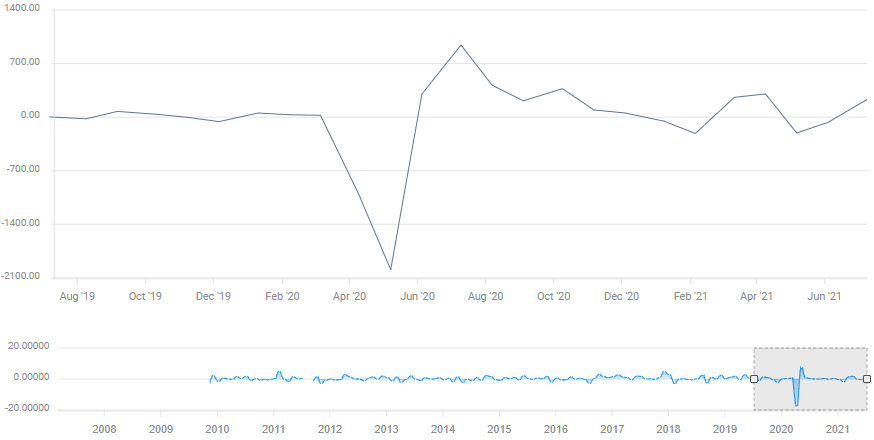

Canada’s Net Employment Change is expected to add 177,500 new positions, which would bring its labor economy to a 94.5% recovery of the lockdown job destruction of last March and April.

Net Employment Change

Average Hourly Wages rose 0.9% (Y/Y) in June and the participation rate was 62.5%.Canada’s unemployment rate is projected to drop to 7.4% from 7.8% in June.

Through June, the Canadian economy had rehired 2.648 million, 88.6%, of the 2.989 million workers fired at the outset of the pandemic.

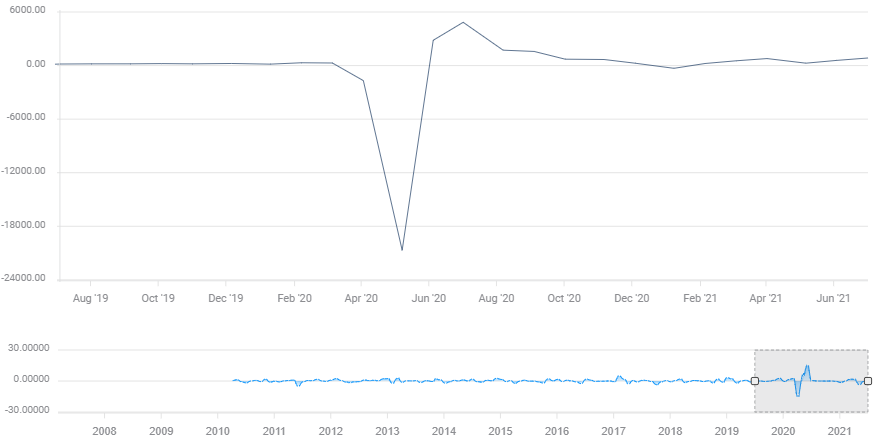

In contrast the US record is far weaker. Through June just 15.06 million workers have been reemployed, 67.3%, of the 22.36 million fired from Nonfarm Payrolls in the first quarter of 2020. The US unemployment rate is considerably lower at 5.9% in June with 5.7% and 800,000 new hires expected in July.

Nonfarm Payrolls

Canadian economy

Canada’s resource based economy has benefited from the strong rebound in commodity prices and crude oil this year, which provides about 11% of GDP.

Employment reflects this strong economic base.

The Bloomberg Commodity Index (BCOM) has gained 22.2% this year and 58.2% from the lockdown low last April.

BCOM

Bloomberg/MarketWatch

West Texas intermediate (WTI) the North American crude pricing standard is up 47.5% since January 4, and that includes its 4.7% fall on Monday and Tuesday this week.

WTI

Canada has also profited from the strong rebound in US growth. Because of the intricate and multifarious economic ties spanning the border, Canada is in the unusual position of participating directly in US economic expansion and profiting from the largess of Congress and the monetary accommodation of the Federal Reserve. Canada is the source of many of the raw materials for US factories and the manufacturing sector of both countries in effect straddles the border.

The $120 billion a month of Treasury and mortgage-backed securities purchases by the Fed is one reason the Bank of Canada has been able to cut its own bond program in half from C$4 billion to C$2 billion.

USD/CAD and Net Employment Change

The Canadian dollar had maintained a 15-month ascendancy over its US counterpart, from its low in the March and April 2020 Covid panic to its six-year high this June.

Beginning in last summer's general retreat of the dollar’s pandemic panic-driven supremacy, Canadian strength continued to rise with the steady support provided by the rising prices of the commodity complex.

The level of the USD/CAD has been more closely tied to the fortunes of WTI and to the US Nonfarm Payroll report, than to the monthly reverberations of Statistics Canada’s Net Employment Change data.

The recent reversal of in the pair had much to do with the speculation on a change in Federal Reserve monetary policy abetted an unusually long period without a profit-taking challenge to the prevailing trend.

The dominance of American payrolls over the reaction of the USD/CAD will continue. The USD/CAD should rise or fall depending on the quality of the data from the US labor economy.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.