- GBP/USD bulls seeking a test of the daily highs but awaits NFP.

- Bears will be keen on a deeper correction on a positive NFP print.

Following the Bank of England event earlier today, GBP/USD has held onto a modest gain.

Cable rose as high as $1.3949 after the BoE decision but was unable to break the resistance needed for an upside continuation in the daily time frame.

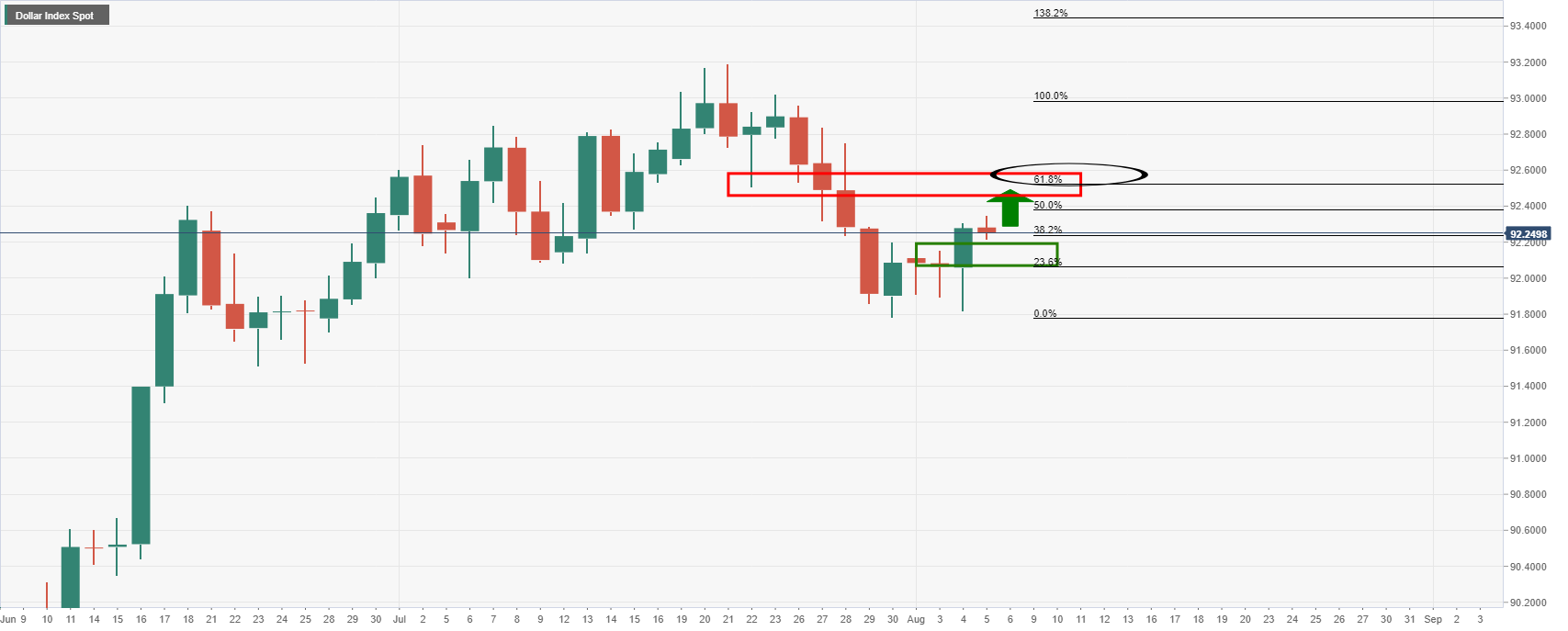

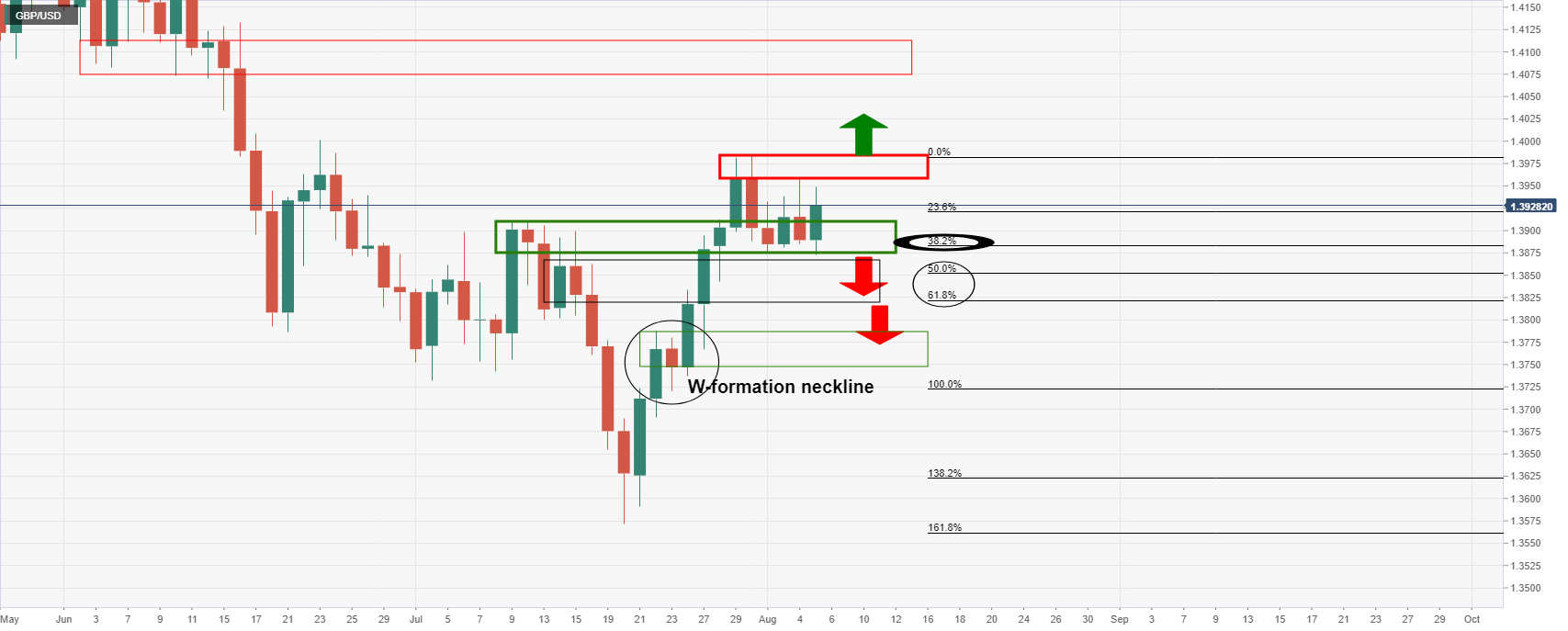

The following illustrates the market structure of both the DXY and GBP/USD.

The current trajectory in the US dollar is higher for prospects of a deeper correction into the 61.8% Fibonacci retracement level next to prior lows in the 92.50 area.

This will be depending on the outcome of Friday's Nonfarm Payrolls event. In respect of this, there is potential for a disappointment in contrast to the current hawkish narrative from the Federal Reserve.

In such an instance this would be expected to weigh heavily on the greenback and potentially send it over the cliff into the abyss to test the 90.50/40s area:

As for cable, it is on the brink of an upside breakout on the daily chart.

The price has consolidated following a slight breach of the 38.2% Fibonacci retracement level and sits in a structure that acts as support that was once resistant mid-July.

Given that, there are upside risks in this period of distribution as bulls might be attracted to buy back into uptrend at a discount following the end of month squaring/profit-taking and the probable reduction in the overall net long sterling positioning.

With that being said, there could be more distribution to come, especially on overwhelming Nonfarm Payrolls that supports the greenback.

Therefore, the downside will come into play and the W formation neckline could be a theme for weeks ahead in the 1.3780s.

Meanwhile, it is worth noting the prospects of a reverse head and shoulders:

The reverse head & shoulders is a bullish pattern on a break of neckline resistance.

With that being said, the W-formation could be brewing and any move to the upside could be in jeopardy.

M & W formations are reversion structures that have a high completion rate with price usually drawn back into the neckline of the pattern.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.