Magna International (MG), a Canadian company specializing in automotive equipment, and a subcontractor for many manufacturers, swung a profit in its second quarter. However, the company reduced its 2021 forecast due to an expected reduction in global light vehicle production caused by an ongoing shortage of semiconductor chips.

Total revenue for Q2 2021 came in at $9 billion, an increase of 110% from a revenue of $4.3 billion reported in Q2 2020. The rise in sales came as global light vehicle production rose 58%, largely driven by increases in North America and Europe.

Meanwhile, the Canadian auto parts maker reported a profit of $424 million ($1.40 per diluted share) in Q2 2021, compared to a net loss of $647 million (-$2.17 per diluted share) in Q2 2020. (See Magna International stock charts on TipRanks)

On an adjusted basis, Magna earned $426 million ($1.40 per diluted share) for its most recent quarter compared with a loss of $511 million (-$1.71 per diluted share) in the prior-year period.

Analysts on average expected Magna to bring in $1.38 per share in adjusted earnings on $9.29 billion in revenue.

Magna CFO Vince Galifi said, “The short-term industry production disruptions have led us to reduce our outlook. Nevertheless, we have maintained our expectations for free cash flow in 2021. In addition, we anticipate that the coming years will see some recovery of lost industry production, which should be a positive for our sales, earnings and free cash flow.”

Magna expects that 14.4 million North American light vehicles will be built in 2021, down 7.7% from its previous forecast of 15.6 million. European production is expected to decline 2.2% to 18.1 million units while Chinese production is expected to remain stable at 24.7 million.

As a result, the company has reduced its net income forecast by $200 million, to between $2 billion and $2.2 billion.

On July 26, Wells Fargo analyst Colin Langan reiterated a Hold rating on MG while lowering its price target to $88.00 (C$110.09). This implies 4.8% upside potential.

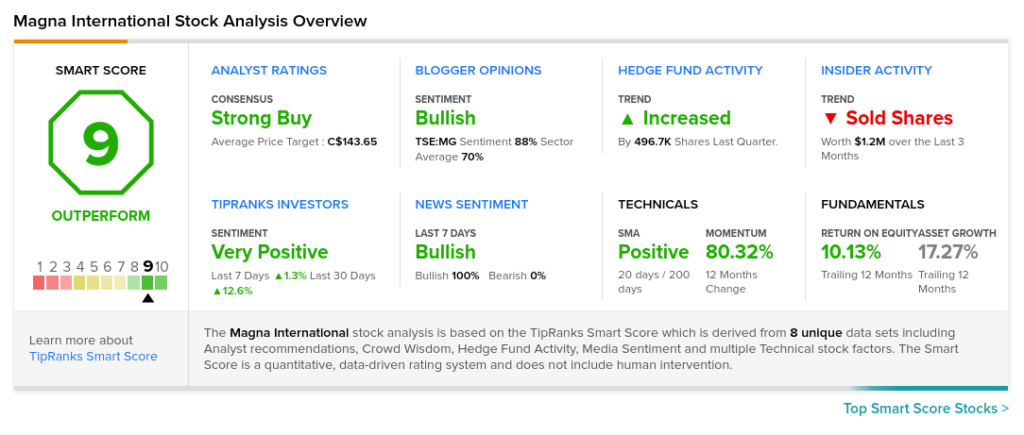

Overall, MG scores a Strong Buy consensus rating among analysts based on six Buys and one Hold. The average Magna International price target of C$143.65 implies 36.3% upside potential to current levels.

TipRanks’ Smart Score

Magna scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the overall market.

Related News:

Waste Connections Revenue Rises 17.5% in Q2

Canadian Pacific Q2 Revenue Rises 15%, Misses Estimates

Copper Mountain Shares Pop 7% After Strong Q2