Infosys - Pick Of The Day

Summary

- 100% technical buy signals.

- 13 new highs and up 10.95% in the last month.

- 91.35% gain in the last year.

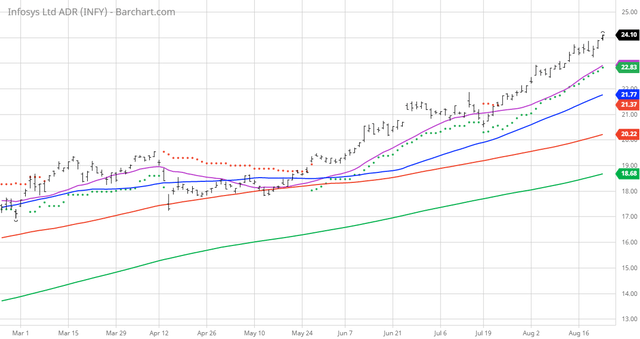

The Barchart Chart of the Day belongs to the digital services company Infosys (NYSE: INFY). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. That resulted in a watch list of 26 stocks. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 7/23 the stock gained 10.91%.

Infosys Limited, together with its subsidiaries, provides consulting, technology, outsourcing, and next-generation digital services in North America, Europe, India, and internationally. It provides application development and management, independent validation, product engineering and management, infrastructure management, enterprise application management, and support and integration services. The company's products and platforms include Finacle, a core banking solution; Edge suite of products; Infosys Nia, an artificial intelligence platform; Infosys McCamish - an insurance platform; Wingspan, a customizable learning platform; Stater mortgage servicing platform; Panaya automation suite; and Skava, an e-commerce suite. The company serves clients in the financial services and insurance, life sciences and healthcare, manufacturing, retail, consumer packaged goods and logistics, hi-tech, communications, telecom OEM, media, energy, utilities, resources, services, and other industries. It has collaboration agreements with Rolls-Royce, BP plc, Newmont Corporation, RXR Realty, Majesco Limited, and Centre for Accessibility Australia. The company was formerly known as Infosys Technologies Limited and changed its name to Infosys Limited in June 2011. Infosys Limited was incorporated in 1981 and is headquartered in Bengaluru, India.

Barchart technical indicators:

- 100% technical buy signals

- 88.69+ Weighted Alpha

- 91.35% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 10.95% in the last month

- Relative Strength Index 77.52%

- Technical support level at 23.66

- Recently traded at 24.10 with a 50 day moving average of 21.70

Fundamental factors:

- Market Cap $102.2 billion

- P/E 36.23

- Dividend yield 1.42%

- Revenue expected to grow 16.20% this year and another 10.40% next year

- Earnings estimated to increase 13.10% this year an additional 13.00% next year and continue to compound at an annual rate of 8.00% for the next 5 years

- Wall Street analysts issued 5 strong buy, 4 hold and 1 sell recommendation on the stock

- The individual investors following the stock on Motley Fool voted 1,092 to 35 that the stock will beat the market. The more experienced investors voted 171 to 4 for the same result

- 28,260 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more