The pandemic hasn’t been kind to the world economy. Almost every sector has had to face headwinds originating from strict restrictions, shutdowns, and stalled business.

However, these trials and tribulations also highlighted the strength of some of the core drivers of the global economy. Specifically, the e-commerce sector, which experienced an impressive boom and enjoyed steady growth during this phase of turmoil.

In particular, Amazon (AMZN), an e-commerce, digital services and cloud-computing giant, continued growing. I am bullish on the stock.

Despite a small dip in Q1 of last year, Amazon has seen its top and bottom lines grow rapidly. Revenue growth almost doubled from 20.5% in 2019 to 37.6% in 2020 (a pandemic year).

Accordingly, investors are on the lookout for what the future has in store once the economy reopens. (See AMZN stock charts on TipRanks)

In one camp, long-term growth investors note that Amazon’s disruptive business model isn’t going anywhere. On the other hand, when brick-and-mortar shopping returns, some investors expect a slowdown for Amazon.

Let’s dive into two recent moves Amazon has made to push investors toward the bullish end of the spectrum.

Amazon to Foray into Departmental Store Space

The Wall Street Journal has recently reported on Amazon’s plan to set up its brick-and-mortar outlet chain. These first locations are likely to be strategically placed in California and Ohio.

Additionally, these locations are seen by analysts as ways for Amazon to fully integrate its omnichannel model — something the company has tried to do for years.

Each store is expected to be around 30,000 square feet, smaller than big-box retailers, but in line with recent modernization moves of many department stores. Among the benefits of having these stores is the ability for Amazon to incorporate its delivery, return, and associated e-commerce services in them.

Stocks of several retail investors dipped with the news of Amazon’s plan to enter into the retail sphere. However, experts believe that Amazon’s foray into physical retail is unlikely to hit existing retail chains particularly hard — those with strong brands and customer loyalty, at least.

Amazon will likely be leveraging its private-label products in a bid to compete against physical retailers on brand.

Major Boost in Amazon Web Services

Amazon is one of the top cloud-computing service providers globally. The company has recently focused on expanding and boosting its cloud-computing offerings. Amazon Web Services, its cloud-computing division, has largely contributed to maintaining Amazon’s top-line growth.

This past week, AWS launched Amazon MemoryDB for Redis. MemoryDB allows users to store an entire dataset in-memory.

Users, therefore, do not require maintaining a durable database — or cache — for building high-performance applications. Amazon MemoryDB is designed to offer low latency, high throughput and durability at any scale.

This development in AWS will allow Amazon to garner popularity among its consumers. Analysts and investors expect this move to bolster Amazon’s cloud market share, increasing the company’s top-line growth.

Moreover, consumers do not need to pay upfront for this service. Rather, payments for utilized database capacity are what Amazon is after right now. Unsurprisingly, it has been reported that major customers such as Cimpress (CMPR), TransACT (TACT), Netflix (NFLX), Twilio (TWLO), and others have already showed interested in this new database.

Amazon comes with a 31% worldwide cloud market share, which is the highest in the world. However, the company faces major competition and challenges from rivals like Google (GOOGL), and Microsoft (MSFT). This move ought to be viewed positively by investors concerned about market-share leakage from here.

Wall Street’s Take

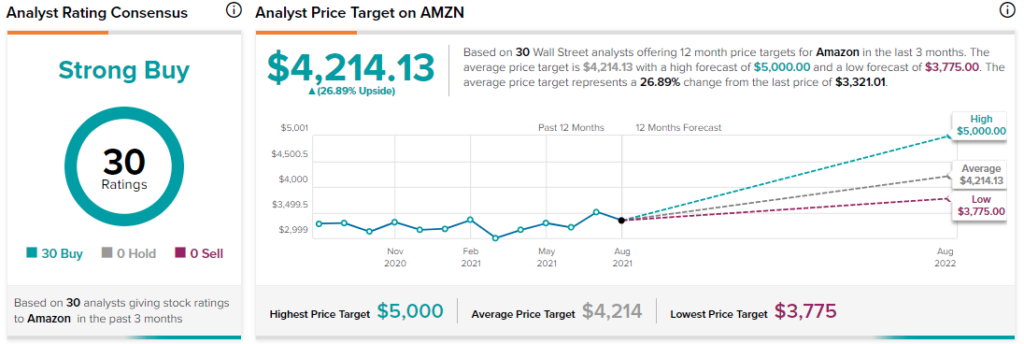

As per TipsRanks’ analyst rating consensus, Amazon comes with a Strong Buy rating. Out of 30 analysts ratings, 30 have provided Buy recommendations.

The average AMZN price target is $4,214.13. The price targets range from $3,775 to $5,000 per share.

Bottom line

Amazon clocked a net income of $29.4 billion in the 12-months period ending in June 2021.

Given the company’s strong top- and bottom-line growth, impressive financials, and massive growth potential in cloud computing, Amazon is a difficult company to bet against.

Disclosure: At the time of publication, Chris MacDonald did not have a position in any of the securities mentioned in this article

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.