- GBP/USD has been rocked by inflation data on both sides of the pond.

- Rate decisions from both the Fed and the BOE promise a supercharged week.

- Mid-September's daily chart paints a mixed picture.

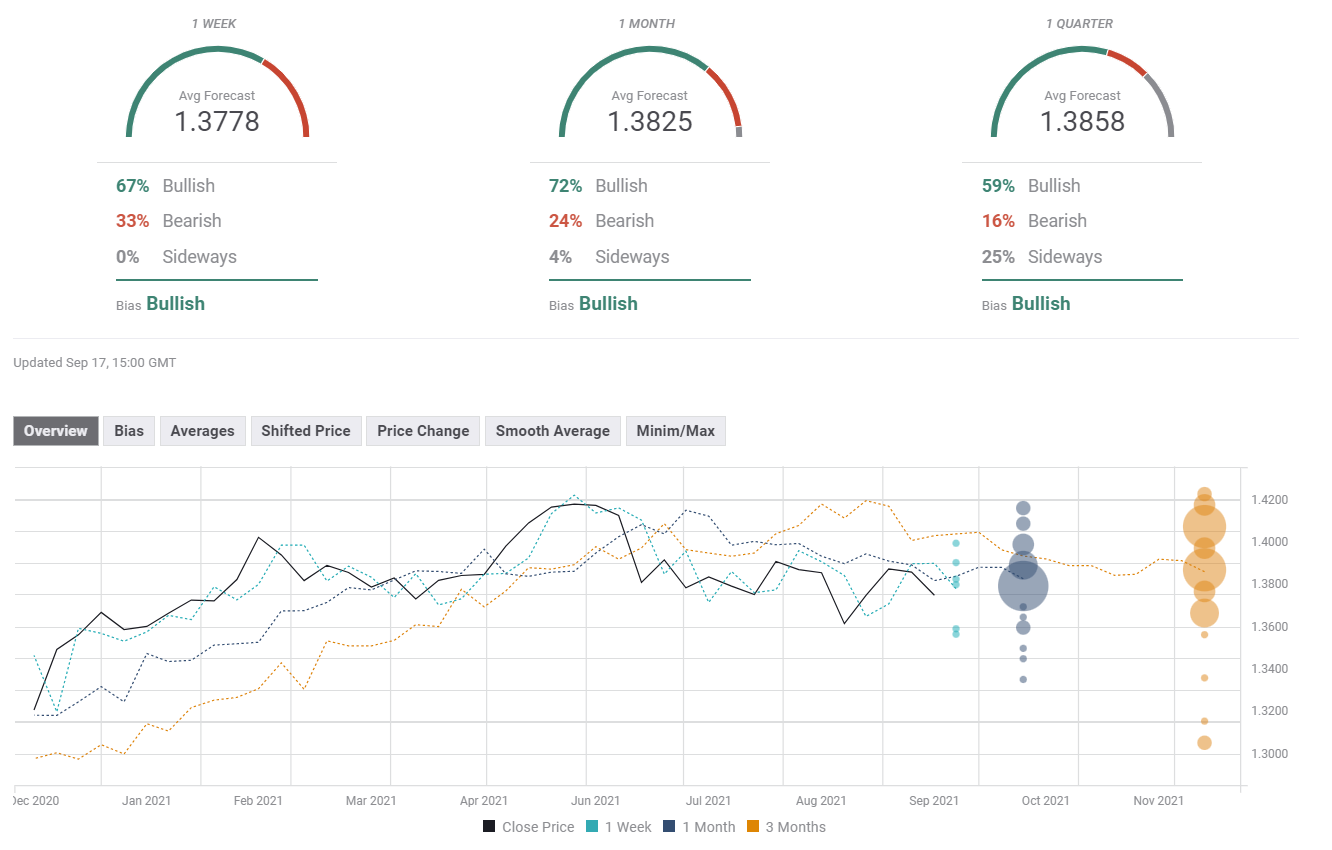

- The FX Poll is projecting a substantial recovery.

Do current inflation trends warrant tightening policy anytime soon? The past week's latest figures have caused jitters, leaving investors confused. Central banks take the stage in the upcoming week, with the Fed's taper timing and the BOE's rate hike prospects critical for GBP/USD.

This week in GBP/USD: Chopped by CPI

The right kind of cooldown? US inflation is easing, as seen in August's Core Consumer Price Index (Core CPI), which decelerated to 4% YoY. Import prices fell by 0.3% outright. Easing inflation vindicates Federal Reserve Chair Jerome Powell's insistence that price rises are transitory and potentially delays the bank's taper decision.

However, some see softer inflation as a result of a "consumer strike" in response to elevated costs earlier. If that demand disappears forever, it could weigh on the US and global economies. That thinking supported the safe-haven dollar.

On the other side of the pond, prices rose more than expected – UK headline CPI hit 3.2% YoY, above expectations and the Bank of England's 1-3% range. Sterling shined on the news.

However, there is also a darker side to the rise in UK prices – potential blackouts in the winter. Natural gas prices in Europe and the UK have come despite a mild September so far and ahead of winter. Even without the extreme scenario of power cuts, high energy bills could leave holes in consumers' pockets. That threatens the recovery.

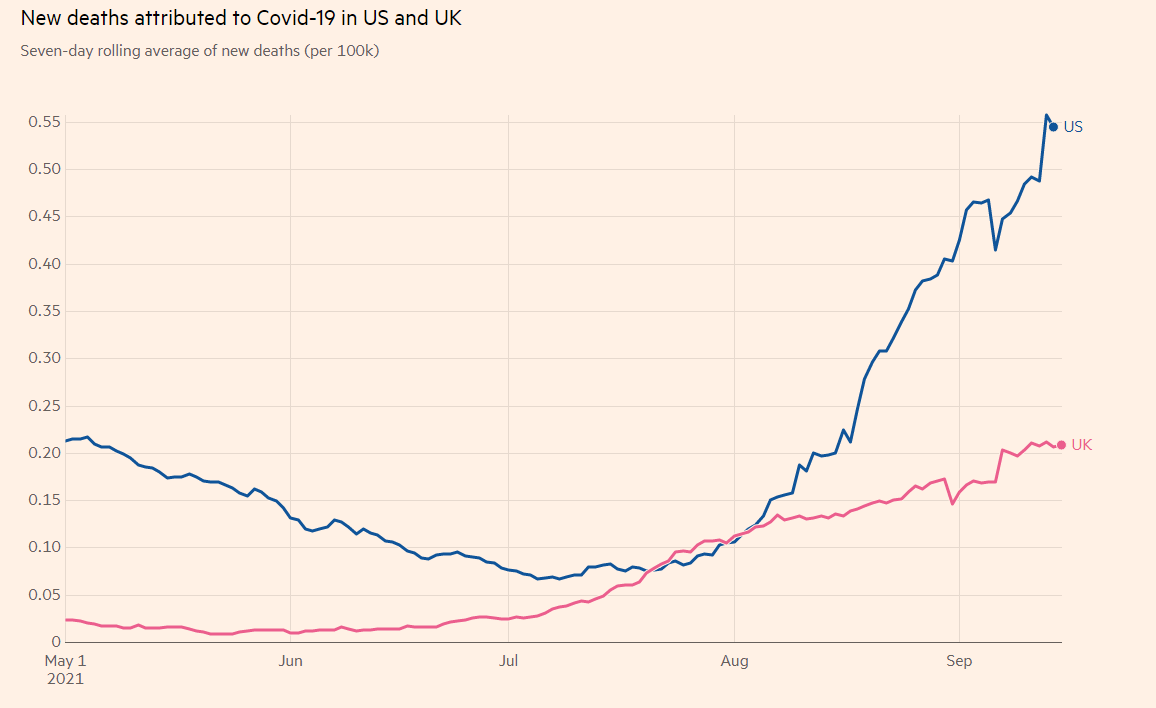

UK Prime Minister Boris Johnson reshuffled his government, but left Rishi Sunak as Chancellor of the Exchequer, calming markets. The PM also decided to expand vaccine coverage ahead of the colder season as UK cases remain elevated, but hospitals are not suffering significant pressure. Britain's vaccination rate is higher than that in the US, which impacts the number of severe cases.

COVID-19 deaths in the US and UK are also off their lows

Source: FT

US Politics: Talks about infrastructure spending remain stuck in Congress, as conservative and progressive Democrats tussle over the details. The EU and the UK remain at odds over the Northern Irish protocol, but it had little impact on the pound.

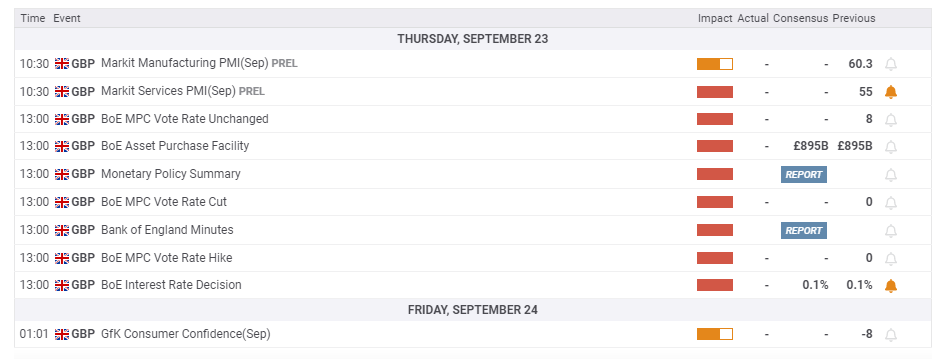

UK events: BOE in focus

How many BOE members support withdrawing stimulus? In August, two members voted in favor of tapering down bond buys, and their number could grow. Bank of England Governor Andrew Bailey told MPs that the Monetary Policy Committee was split 4:4 on whether conditions were met to raise rates.

The Meeting Minutes will reveal current trends within the MPC and shake the pound, especially if Bailey seems to be cornered by a growing chorus of hawks.

Rising inflation and a falling unemployment rate – 4.6% as of July – may push the London-based institution to signal rate hikes are coming sooner rather than later, even if the BOE is unlikely to announce any policy change at this juncture. Hints toward November's "Super Thursday" decision will be closely watched.

Here is the list of UK events from the FXStreet calendar:

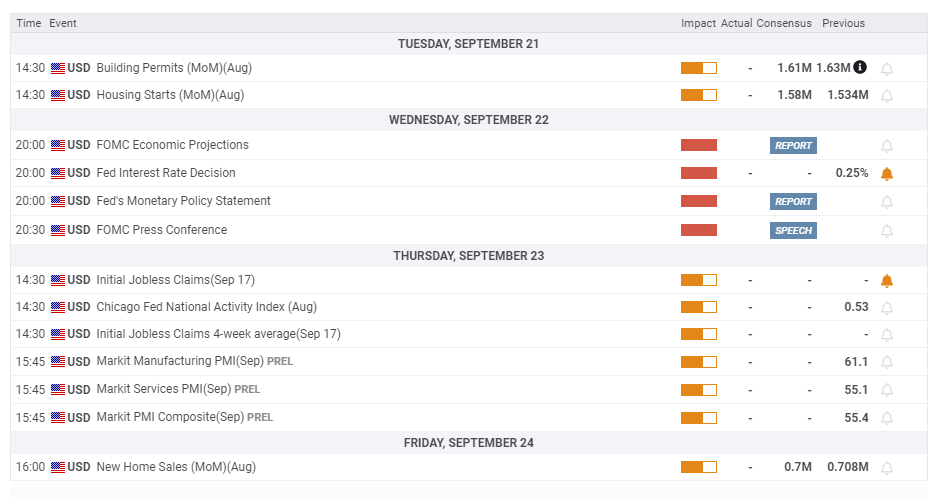

US events: All eyes on the Fed

When will the Federal Reserve taper its $120 billion/month bond-buying scheme? A September taper – aka "Septaper" – is off the cards, but an announcement in the next meeting is undoubtedly in play.

There are other questions. Will it come in November or in December? What would the pace of tapering be? When will the Fed raise interest rates? Fed Chair Jerome Powell will preside over a closely watched decision and will likely err on the side of caution given his dovish tendencies and weaker data of late. Softer inflation seems to vindicate his stance that price rises are transitory.

The bank also publishes new growth, inflation, employment and interest rate forecasts. After surprising markets by projecting two rate hikes in 2023, the Fed is unlikely to rock the boat this time. Powell's words will likely have more impact.

See: Fed Preview: Three ways in which Powell could down the dollar, and none is the dot-plot

Expectations toward the Fed, the decision and the long response to the event overshadow other developments. Nevertheless, housing figures and Markit's Purchasing Managers' Indexes are also of interest.

On the political front, President Joe Biden's infrastructure spending bill is moving along slowly, as Democrats are split on how to move forward. Lawmakers also have to grapple with reaching the debt ceiling. Government shutdowns had little impact on markets in the past, and the US averted missing its debt obligations. Nevertheless, without a resolution, the ceiling could turn from a non-event to a high-stakes one.

US covid cases remain elevated but are already off the highs. Vaccine mandates have yet to increase jabbing, and the US lags behind European countries in immunization.

Here are the upcoming top US events this week:

GBP/USD technical analysis

Pound/dollar has retreated from higher levels, but indicators remain well-balanced. While the currency pair slipped under the 50-day and 200-day Simple Moving Averages (SMAs) on the daily chart, momentum turned to the upside.

Two significant lines characterize cable trading. The upper end is 1.3910, which is where the 100-day SMA and September's peak converge. The lower end is 1.3570, July's low point.

Immediate resistance awaits at 1.3850, which held the currency pair down in mid-September. Beyond 1.3910, the next levels to watch are 1.3980 and 1.4080.

The recent stepping stones for the pair's upside provide support. These include 1.3740, 1.3670 and 1.3600, ahead of 1.3570 mentioned earlier.

GBP/USD sentiment

A defensive Fed and a hawkish tilt from the BOE could trigger a rally.

The FXStreet Forecast Poll is showing investors are undeterred by the recent slide and foresee gains on all timeframes. The bullish trends persist despite minor downgrades to the average targets.

Related reads

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.