- Gold's technical outlook turned bearish following Thursday's sharp decline.

- Next target on the downside for XAU/USD is located at $1,730.

- FOMC will announce policy decisions and release updated Summary of Economic Projection.

Gold started the week in a relatively calm manner and continued to fluctuate in the previous week’s horizontal channel on Monday. Although the precious metal managed to rise above $1,800 on Tuesday, it came under strong bearish pressure in the second half of the week and fell to its lowest level in a month at $1,745 on Thursday. The XAU/USD pair struggled to stage a convincing rebound ahead of the weekend and closed the second straight week in the negative territory, losing nearly 2%.

What happened last week

On Tuesday, the data published by the US Bureau of Labor Statistics revealed that inflation in the US, as measured by the Consumer Price Index (CPI), edged lower to 5.3% on a yearly basis in August from 5.4% in July as expected. Further details of the report showed that the Core CPI, which excludes volatile food and energy prices, fell to 4%, compared to analysts’ estimate of 4.2%, from 4.3%.

With this print suggesting that the Federal Reserve could opt out to delay the reduction in asset purchases, the greenback started to weaken against its rivals. However, the risk-averse market environment helped the US Dollar Index (DXY) limit its downside and made it difficult for gold to preserve its bullish momentum.

The Fed reported on Wednesday that Industrial Production in August expanded by 0.4%, falling short of the market expectation of 0.5%. On a positive note, the Federal Reserve Bank of New York’s Empire State Manufacturing Index improved sharply to 34.3 in September from 18.3 in August. Although these prints failed to trigger a significant market reaction, rising US Treasury bond yields provided a boost to the USD mid-week.

On Thursday, the US Census Bureau announced that Retail Sales in the US increased by 0.7% in August, beating the market forecast for a contraction of 0.8% by a wide margin. The robust data revived optimism about the US economic recovery regaining traction and allowed the USD to continue to outperform its rivals. Furthermore, the 3% upsurge witnessed in the 10-year US Treasury bond yield put additional weight on XAU/USD’s shoulders, causing the pair to lose than 2% on a daily basis.

Finally, the University of Michigan (UoM) Michigan's Consumer Sentiment Index edged higher to 71 in September's advanced estimate from 70.3 in August. Market participants paid little to no attention to this data and the DXY extended its rally ahead of the weekend. Meanwhile, gold found some demand amid the steep decline seen in the US stocks and closed virtually unchanged on Friday.

Next week

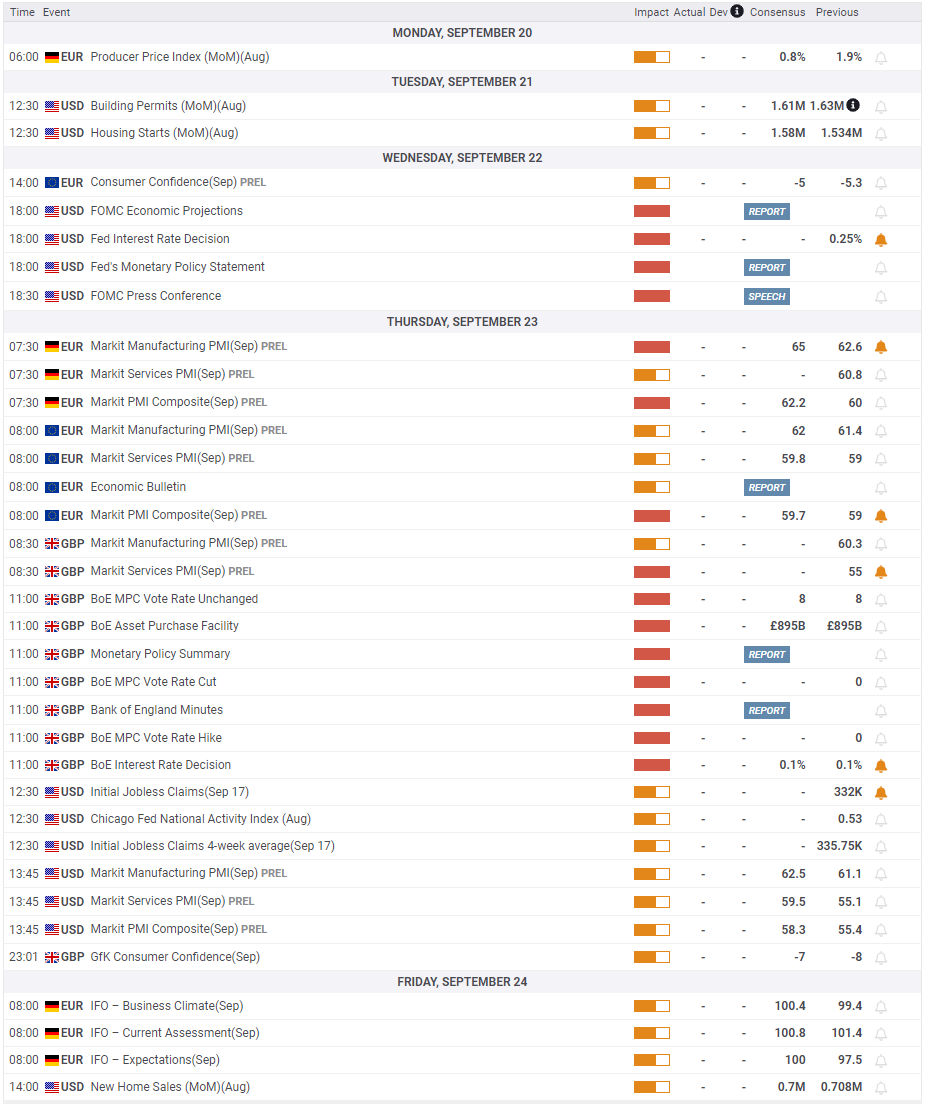

The economic docket will not be offering any high-impact data releases on Monday and Tuesday and gold is likely to fluctuate between key technical levels.

On Wednesday, the Federal Reserve will announce monetary policy decisions alongside the updated Summary of Projections following the FOMC’s two-day meeting. Investors will keep a close eye on the dot plot, which reveals policymakers’ rate outlook, and inflation forecasts. More importantly, FOMC Chairman Jerome Powell’s remarks at the press conference will be looked upon for fresh hints regarding the timing of asset tapering.

While speaking at the Jackson Hole Symposium, Powell acknowledged that he thought at the July policy meeting that it would be appropriate to start asset tapering this year. Since then, the disappointing August jobs report, which showed an increase of 235,000 in Nonfarm Payrolls against the market expectation of 750,000, and the dismal consumer sentiment surveys caused investors to reassess the Fed’s tapering prospects. However, this week’s upbeat Retail Sales data makes it hard to guess whether Powell will adopt a cautious tone.

In case Powell unveils that the Fed will start reducing asset purchases before the end of the year, the USD is likely to gather strength and force XAU/USD to turn south. On the other hand, a dovish outlook with the chairman refraining from delivering a tapering timeline could trigger a heavy USD selloff and fuel a gold rally.

On Thursday, the IHS Markit will release the preliminary Manufacturing and Services PMI data for the euro area, the UK and the US.

Gold technical outlook

Following Thursday's sharp drop, the Relative Strength Index (RSI) indicator on the daily chart dropped below 40 and moved sideways on Friday, suggesting that XAU/USD has more room on the downside before it becomes technically oversold. A daily close below $1,750 (static level) could open the door for additional losses toward $1,730 (static level) and $1,720 (static level). However, in case the RSI breaks below 30 with such a move, there could be a technical correction before the next leg down. The last time the RSI dropped into the oversold territory on a Monday on August 9, gold gained nearly 3% in the remainder of the week.

Nonetheless, unless the pair makes a daily close above $1,810, where the critical 200-day SMA is located, buyers are unlikely to dominate gold's action. Ahead of that level, $1,770 (Fibonacci 61.8% retracement of April-June uptrend) and $1,800 (psychological level) align as interim resistances.

Gold sentiment poll

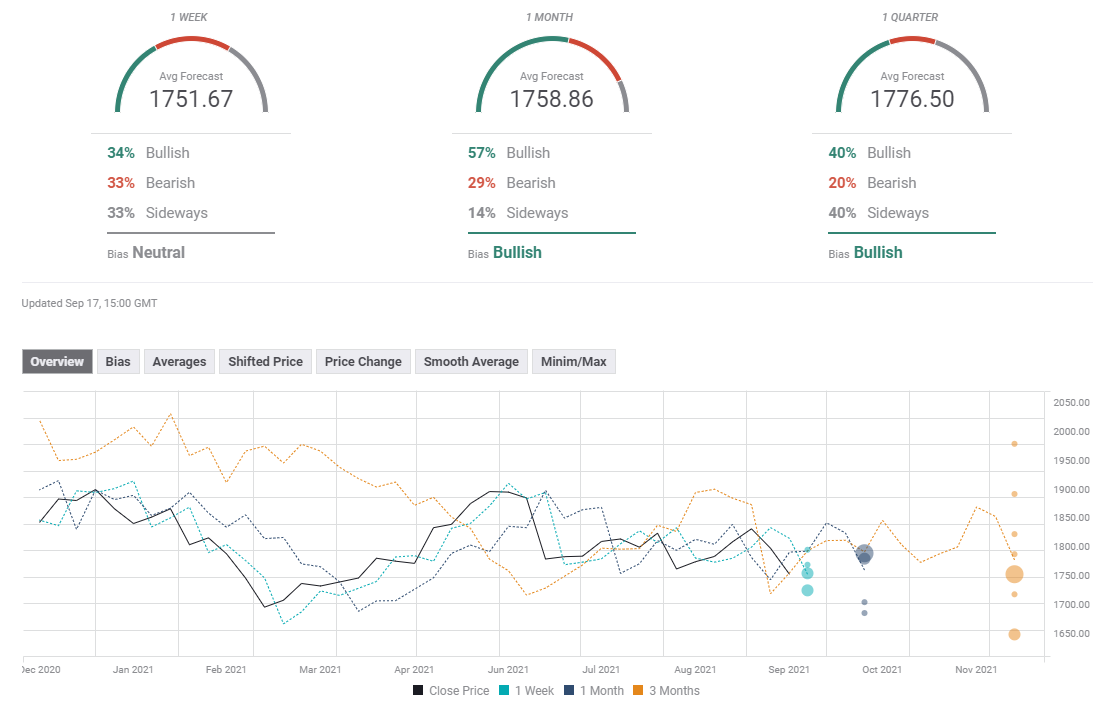

The FXStreet Forecast Poll paints a mixed picture in the near term with experts splitting up evenly between bullish, bearish and neutral forecasts for gold. Reflecting the indecisiveness, the average target on a one-week view sits at $1,751, around Friday's closing level. Although the one-month view points to a bullish shift, the average forecast of $1,758 suggests that a convincing recovery is not expected.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.