- Gold price attempts a bounce as the US dollar retreats with Treasury yields.

- Evergrande jitters keep investors on the edge amid Fed’s hawkish surprise.

- Fed tilts towards a taper, Bank of England up next.

Update: Gold attracted some dip-buying near the $1,760 region on Thursday and for now, seems to have stalled the post-FOMC retracement slide from the $1,787 area, or weekly tops. The US dollar witnessed aggressive selling and erased the previous day's hawkish Fed-inspired gains to one-month tops. The US central bank indicated that it will likely begin reducing its monthly bond purchases toward the end of this year. This, however, disappointed some investors expecting an immediate start to the withdrawal of the massive pandemic-era stimulus and prompted some profit-taking around the greenback. This, in turn, was seen as a key factor that extended some support to the dollar-denominated commodity.

The uptick, however, lacked bullish conviction and runs the risk of fizzling out rather quickly amid the prevalent risk-on mood, which tends to undermine demand for the safe-haven gold. The global risk sentiment got a strong boost after the People’s Bank of China injected more money into the banking system, which eased concerns about the fallout from China Evergrande's debt crisis. This, along with a growing inclination among the Fed officials to raise interest rates in 2022, should act as a headwind for the non-yielding yellow metal. Hence, it will be prudent to wait for a sustained strength beyond the $1,780 area before positioning for the resumption of this week's rebound from over one-month lows.

Previous update: Gold price is attempting a tepid bounce but remains in the red for the second straight session ahead of the BOE monetary policy decision. The BOE could likely follow the Fed’s signal at tapering, in light of rising inflation expectations in the UK. However, the central bank decisions’ likely play a second fiddle to the persisting concerns over a potential default story of China Evergrande’s group. The updates on the US $3.5 trillion spending bill will be followed as well amid a bust docket this Thursday.

Read: Gold to remain volatile within range amid hawkish Fed, Evergrande crisis

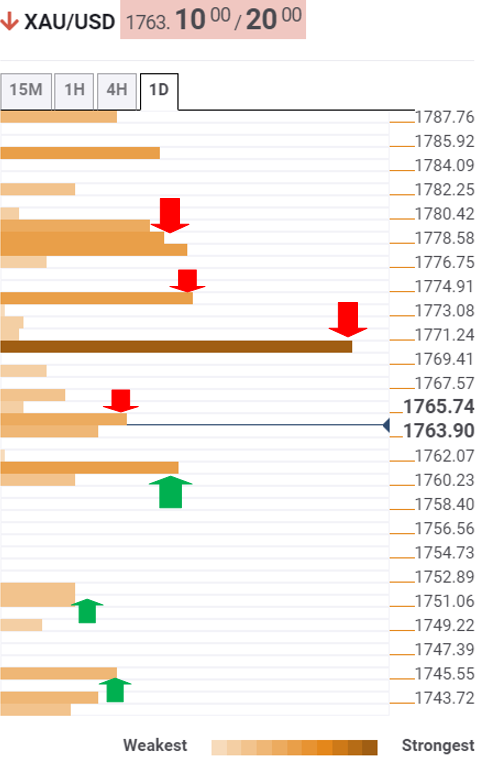

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold is struggling below immediate resistance at $1765, which is the convergence of the previous day’s low and SMA5 one-day.

On a firm break above the latter, gold bulls could test the powerful $1771 hurdle, where the Fibonacci 38.2% one-week, Fibonacci 23.6% one-day and SMA5 four-hour merge.

The next relevant upside barrier is seen at $1774, the confluence of the SMA10 four-hour and Fibonacci 38.2% one-day.

Gold price could face a wall of resistance around $1777 if the recovery momentum extends. That level is the convergence of the Fibonacci 61.8% one-day, one-month and SMA10 one-day.

To the downside, immediate support awaits at $1761, where the previous low four-hour meets with the pivot point one-day S1 and the Fibonacci 23.6% one-week.

A steep drop below the latter cannot be ruled, exposing the next support at $1752, which is the pivot point one-day S2.

The last line of defense for gold bulls is seen at the previous week’s low of $1745.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.