GBP/USD Price Gains Amid Risk-On, Brexit To Cap Gains By 1.37

The GBP/USD price rose to 1.3680, down 0.08% for the day before the London opening on Monday. As the US dollar declines amid broad risk sentiment, cable pair sellers have hope due to pessimism over Brexit worries related to recent UK gasoline shipments.

US Dollar Index (DXY) lost 0.05% for the day, recently fell to 93.20 on market optimism, and is also tracking the retreat of 10-year US Treasury yields from a three-month high.

Photo by Colin Watts on Unsplash

A closer look at the catalysts for market optimism can help identify US stimulus prospects and welcome developments in Japan and Australia. Moreover, a recent prisoner swap between China and Canada eased Sino-US tensions by enabling Huawei’s CFO’s daughter to return home. Finally, in addition to Evergrande’s lack of news, the Fed’s concerns about tapering asset purchases also add to risk appetite.

The pound is under pressure due to a rise in virus deaths and labor shortages due to Brexit at home. Germany’s elections, however, signal a power vacuum in the bloc after Angela Merkel’s 16-year rule, which Britain can take advantage of unless someone else, like France, takes charge of Brexit.

Sky News reported that Kwasi Quarteng, the business secretary, discussed possible solutions to resolve the supply chain pressures that prompted panic buying fuel on Sunday. Boris Johnson and his team are considering enlisting military support to combat the energy crisis. The Guardian reports that Britain’s ministers will discuss BP’s Operation Escaline contingency plan after it discovered a third of its space is scarce.

The GBP/USD decline is limited by risk appetite; however, Brexit-based concerns will double prices. In addition, the US durable goods orders for August, which are due today, may also have an impact.

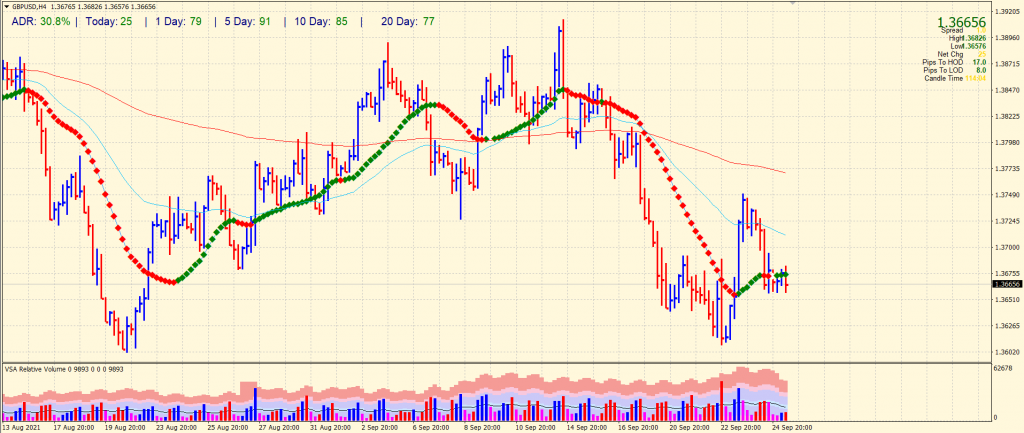

GBP/USD Price Technical Analysis: Looking To Test 1.3600

(Click on image to enlarge)

The GBP/USD price remains under pressure below the key 1.3700 mark. The average daily range is so far 30%, indicating a low activity day. The price is well below the 20-period SMA on the 4-hour chart. Friday’s widespread down bar and an upthrust indicate a bearish pressure that may lead to 1.3600 ahead of 1.3570. On the upside, 1.3700 will be the key hurdle ahead of 1.3740.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more