- XAU/USD closed the third straight week in the negative territory.

- Hawkish FOMC policy outlook, rising US T-bond yields weighed on gold.

- XAU/USD seems to have formed technical support at $1,740 ahead of $1,730.

Following the previous week’s decline, gold staged a rebound and closed in the positive territory on Monday and Tuesday. After reaching its strongest level since last Thursday’s sharp decline at $1,787 on Wednesday, however, the XAU/USD pair lost its traction as the greenback gathered strength on the back of the hawkish FOMC policy outlook. Rising US Treasury bond yields caused the bearish pressure to increase in the second half of the week and the pair slumped to a multi-week low of $1,7137 on Thursday before staging a technical rebound and closing near $1,750 on Friday.

What happened last week

At the start of the week, concerns over the Evergrande crisis turning into a global turmoil caused market participants to seek refuge in safe-haven assets. Although the USD outperformed its risk-sensitive rivals, gold didn’t have a difficult time finding demand either. Reflecting the intense flight to safety, the S&P 500 Index opened with a large bearish gap and lost 1.7% on Monday.

In the absence of high-impact data releases, markets remained relatively calm on Tuesday and investors stayed on the sidelines. During the Asian trading hours on Wednesday, the People's Bank of China announced that it left the 1-year and 5-year LPRs at 3.85% and 4.65%, respectively, as expected. However, the PBoC also decided to inject around 110 billion Chinese yuan of short-term cash and helped market mood improve.

With risk flows returning to markets, the USD remained on the back foot on Wednesday and allowed XAU/USD to extend its recovery. Nevertheless, the FOMC’s policy announcements in the second half of the day provided a boost to the greenback and forced gold to turn south.

The FOMC left the benchmark interest rate, the target range for federal funds, unchanged at 0%-0.25% as widely expected following the September policy meeting. In its policy statement, the Fed noted that if progress continues toward employment and inflation goals broadly as expected, a moderation in the pace of asset purchases may soon be warranted. The fact that the publication failed to deliver a tapering timeline caused the USD to weaken with the initial reaction. However, the updated Summary of Projections revealed that the number of policymakers who see a rate hike in 2022 rose to 9 from 7 in June.

More importantly, FOMC Chairman Jerome Powell clarified that the language in the statement meant to flag the bar for taper could be met as soon as the next meeting. Additionally, Powell said that they are planning to conclude the taper around mid-year 2022. While commenting on the disappointing August jobs report, the chairman noted that the weak Nonfarm Payrolls reading was caused by the sudden spike seen in coronavirus Delta cases and added that they do not need a very strong September jobs report to go ahead with the taper.

Supported by the hawkish policy outlook, the US Dollar Index (DXY) climbed to a monthly high on Wednesday and XAU/USD snapped a three-day winning streak.

On Thursday, the impressive upsurge witnessed in US Treasury bond yields weighed heavily on gold and XAU/USD extended its slide to a fresh 5-week low of $1,737.84. In the meantime, the US Department of Labor’s weekly publication showed that the Initial Jobless Claims rose to 351,000 from 335,000. On the last trading day of the week, gold made a technical correction toward $1,750.

Next week

On Monday, August Durable Goods Orders will be featured in the US economic docket but this data by itself is unlikely to trigger a significant market reaction. On Tuesday, the Conference Board will release the Consumer Confidence data for September.

On Thursday, the US Bureau of Economic Analysis will publish the final estimate of the second-quarter Gross Domestic Product (GDP) growth alongside the US Department of Labor's weekly Initial Jobless Claims report.

The Core Personal Consumption Expenditures (PCE) Price Index, the Fed's preferred gauge of inflation, will be looked upon for fresh impetus on Friday ahead of the ISM Manufacturing PMI and the UoM's Consumer Sentiment Index data.

Meanwhile, investors will keep a close eye on the US T-bond yields' movements and the general risk sentiment. 1.5% aligns as key resistance for the benchmark 10-year US T-bond yield and a break above that level could trigger a rally and pave the way for another leg lower in gold prices.

Gold technical outlook

Despite Friday's rebound, the Relative Strength Index (RSI) indicator on the daily chart stays near 40, suggesting that the bearish bias remains intact. On the downside, static support seems to have formed at $1,740 ahead of $1,730 and $1,720.

On the other hand, a daily close above $1,770 (Fibonacci 61.8% retracement of April-June uptrend) could attract buyers and gold could target $1,790 (20-day SMA, 50, day SMA) before $1,800 (psychological level) and $1,805 (200-day SMA).

Gold sentiment poll

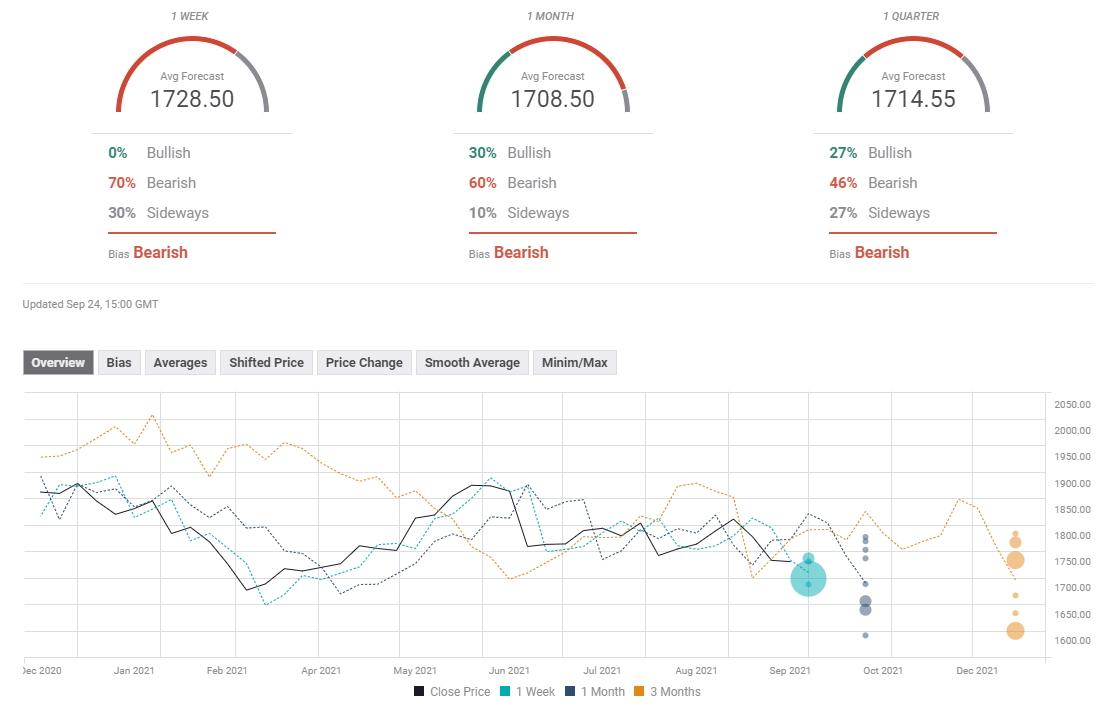

The FXStreet Forecast poll points to a clear bearish shift in gold's outlook. Following this week's action, the average price on the one-week view declined to $1,728 from $1,750 previously. More importantly, 70% of experts expect gold to push lower. Similarly, the average target on the one-month and the one-quarter views stand at $1,708 and $1,714 respectively.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.