GBP/USD Weekly Forecast: Buyers Protecting 1.36, Led By Greenback

The GBP/USD weekly forecast remains neutral to bullish as the price remains well above the 1.3600 support but below Thursday’s highs. US dollar is seasonally strong in September, that may lose some momentum in the coming weeks (FXB, UUP).

Weekly Fundamental Forecast: BoE And FOMC Remain The Key Events

Following the Bank of England meeting on Thursday, the GBP/USD exchange rate jumped sharply to 1.3721 after falling from 1.3741 on Monday to 1.3607 on Wednesday.

From Wednesday to Thursday, the 10-year bond yield in the UK rose 12 basis points to 0.916% but then barely touched Friday’s closing price of 0.918%.

Interest rates in the central bank policy summary are the same for the Bank of England and the Federal Reserve. Still, the American institution seems several steps ahead in the hawkish mode.

During the Monetary Policy Committee (MPC) meeting on Thursday, two additional votes were given in support of reducing the £875 billion asset facility after 8-1 voting to keep the main rate at 0.1%.

Specifically, the bank warned that inflation could surpass 4% this year due to energy price increases and lowered its third-quarter GDP forecast to 2.1% from 2.9%. Prices of natural gas have skyrocketed in Europe due to shortages and restrictions.

The Federal Reserve Board meeting on Wednesday had few repercussions on currency and credit markets. However, Chairman Powell noted that he and most members believed that tapering asset purchase criteria had been met. Moreover, despite the long-term threat of a pandemic, the bank’s own forecast indicates that fund interest rates will increase in next year’s calendar year. On Wednesday, the 10-year government bond yield rose just one point to 1.333%.

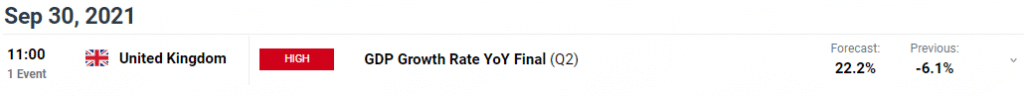

Key Dates/Events In The UK Next Week

A survey of UK house prices begins in September. According to the Bank of England, annual prices rose more than 10% over the past four months. However, economic growth is anticipated to decline in the second quarter as the pandemic’s restrictions again impede recovery.

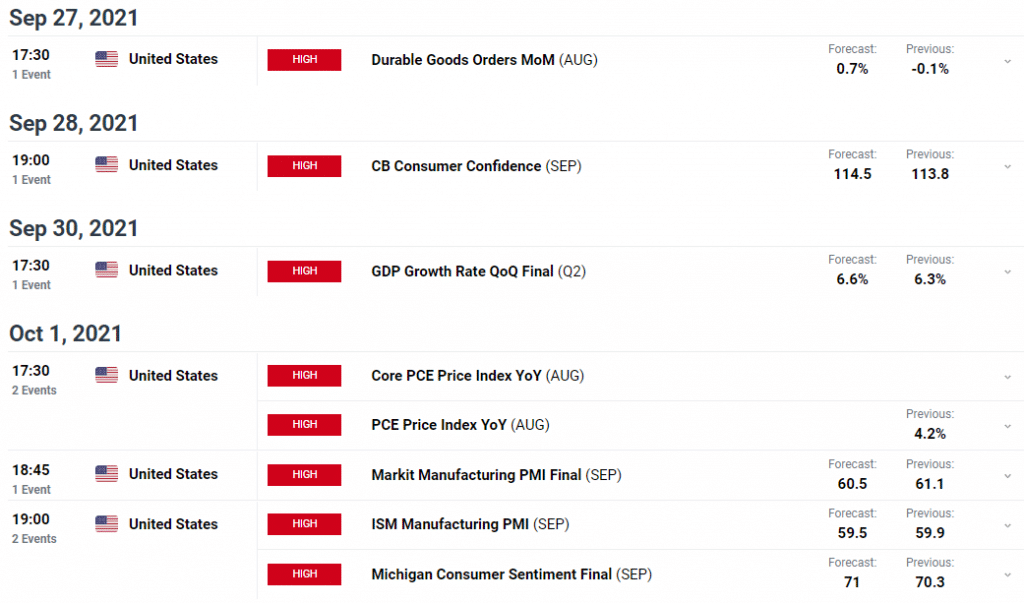

Key Dates/Events In The US Next Week

The week’s economic news begins with US durable goods orders for August, which are essentially recalculated retail sales data. Capital Goods Orders, which belong to the non-defense category, are frequently used for business investments. This measure tells you whether labor shortages and rising prices are affecting manufacturing.

On Monday, the US will publish its economic summary, including durable goods orders for August. The data alone is unlikely to cause a significant market reaction. Data on consumer confidence will be released by the Conference Board on Tuesday.

US Bureau of Economic Analysis will release its final figure for Gross Domestic Product (GDP) growth for the second quarter on Thursday. In addition, the Department of Labor will also publish its weekly jobless claim figures as well.

In addition to the ISM manufacturing purchasing managers’ index and the University of Michigan consumer sentiment data on Friday, the Fed’s preferred measure of inflation, the Core Personal Consumption Expenditures (PCE), will also be scrutinized for new signs of momentum.

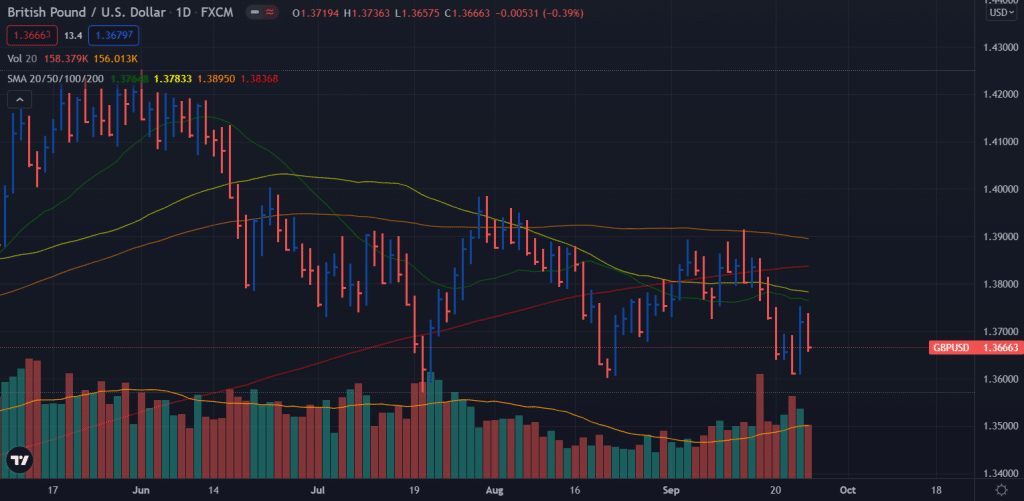

GBP/USD Weekly Technical Forecast: 1.3600 Remains Make Or Break

The GBP/USD price formed a triple bottom around the 1.3600 area. Although the probability of breaking the 1.3600 level exist, Thursday’s daily bar formed a bullish shakeout that may trigger a strong bullish reversal next week. However, the bulls have to take out 1.3754, Thursday’s high, and 20-day SMA to confirm the uptrend.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more