- AUD/USD bears are lurking in the throes of a downside extension below 0.7220.

- Bulls to target 0.7280 resistance for a shot at 4-hour 200-EMA and bullish territory above 0.7300.

- 1:2 R/R day-trade set up below 0.7250 on the bear's watchlist.

AUD/USD ended Friday under pressure as the US dollar strengthened on both the Evergrande risks and as markets contemplate Federal Reserve tightening. AUD/USD closed the New York session at 0.7256 and had travelled from a high of 0.7316 to a low of 0.7236.

The DXY index, a measure of the US dollar vs a basket of currencies, was poised for its third straight week of gains as the uncertainty over beleaguered Chinese property developer Evergrande helped the greenback bounce back from a sharp decline in the prior session.

Evergrande debacle a major risk to AUD

China Evergrande Group owes $305 billion and has run short on cash, missing a Thursday deadline for paying $83.5 million. However, the company has a 30-day grace period but the question is whether it will make the payments before the deadline. A collapse of the company could create systemic risks to China's financial system which has negative ramifications for global markets.

The safe-haven dollar had its biggest one-day percentage drop in about a month on Thursday after Beijing injected new cash into the financial system and Evergrande announced it would make interest payments on an onshore bond, boosting risk sentiment.

While Wall Street's bellwether, the S&P 500, posted a slim gain on Friday, major European markets slumped as investors weighed a potential fallout from debt-laden China Evergrande. Additionally, MSCI's gauge of stocks across the globe shed 0.15% after three days of gains, leaving the index little changed for the week.

The Evergrande debt resolution is far from clear which is an overhang of immense risk for Australia's iron-ore market and ultimately, the Australian dollar. Positioning in the currency is already very negative, but a short squeeze is not insight given both domestic and downside risks continue to pile up.

Australia is the most China-dependent country in G10 and has already lost about $6.6 billion in revenue to the Chinese market between July 2020 and February 2021. This came as a direct consequence of Beijing targeting its exports with heavy tariffs, claiming they were part of ‘anti-dumping measures. Another hit to the iron ore market could be the straw that broke the camel's back with respect to the Aussie.

Incidentally, the Reserve Bank of Australia has officially “frozen” its policy until February 2022. Therefore, data in the next few weeks may have a somewhat more limited impact on the currency and the focus will remain off-shore for the week ahead. August Retail Sales will be eyed, however.

AUD/USD technical analysis

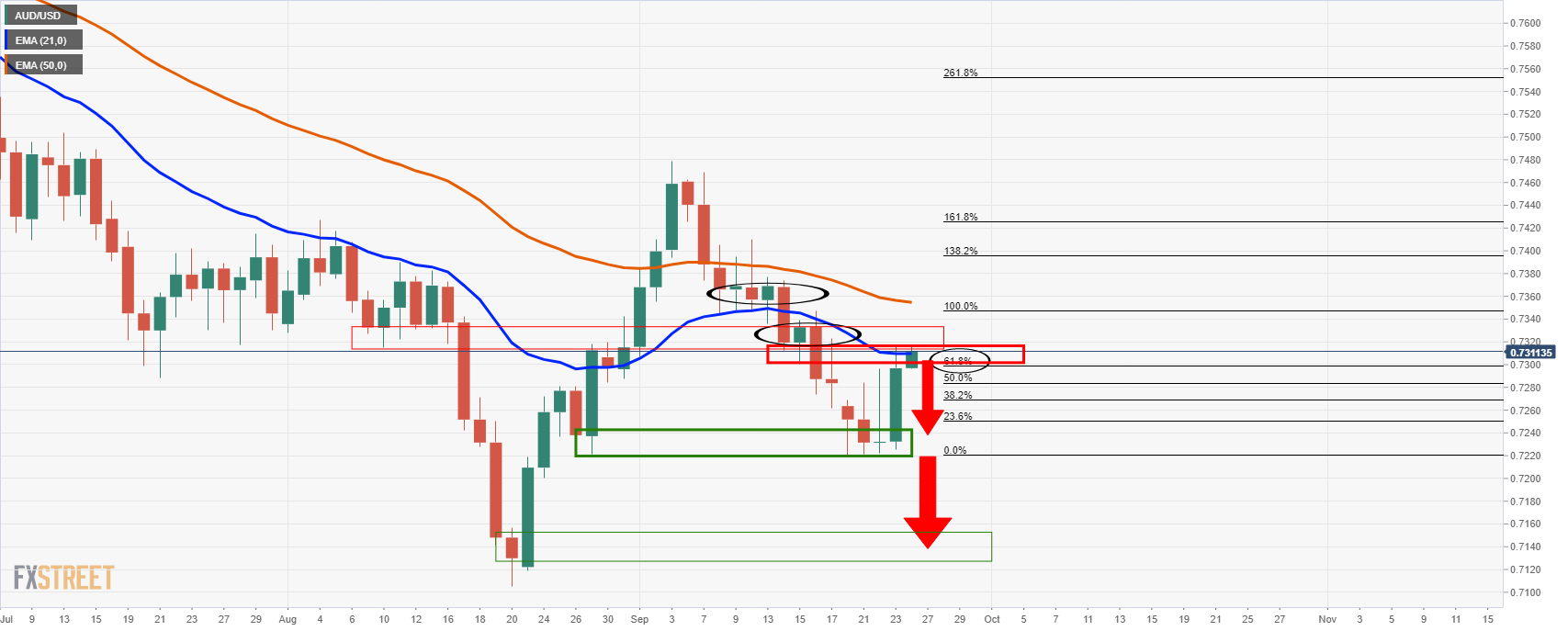

As per the prior analysis, AUD/USD Price Analysis: Daily golden 61.8% ratio under pressure, where the ratio was flagged as potential resistance, the price has indeed stalled and reversed, en-route to prior lows.

AUD/USD prior analysis, daily chart

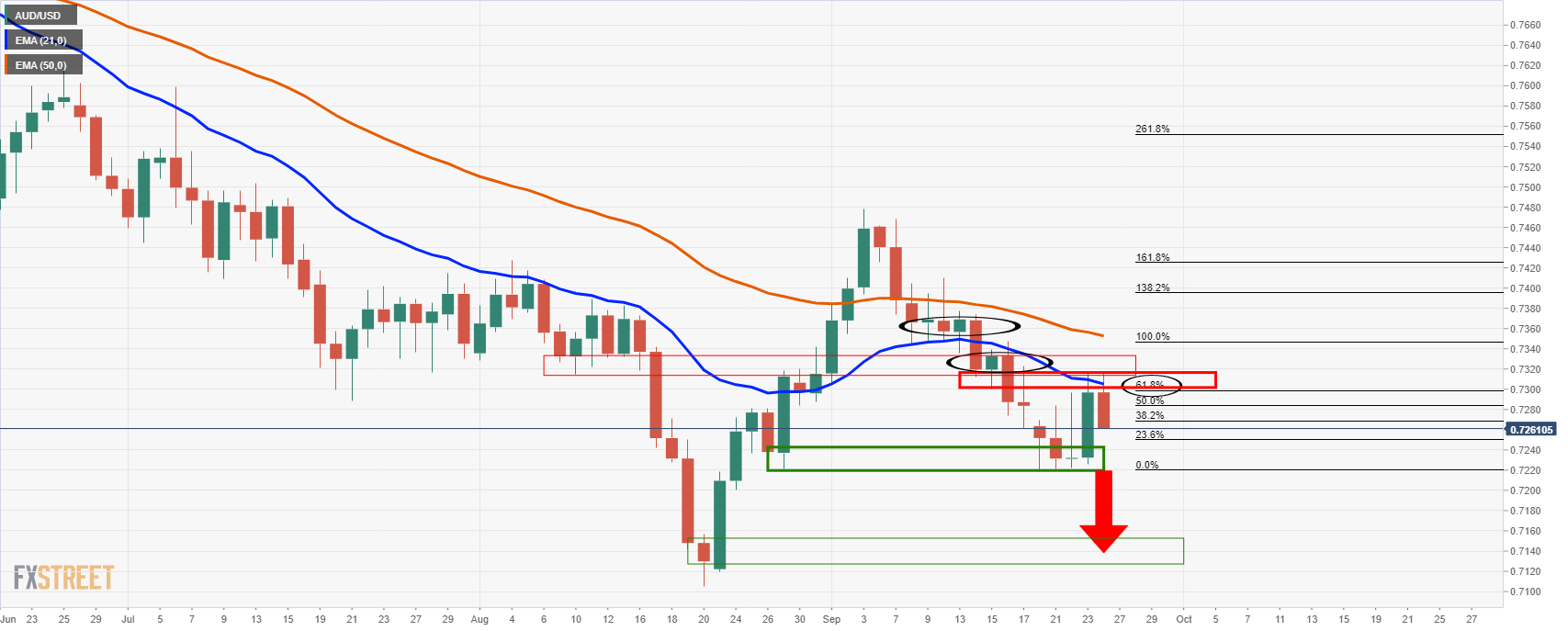

Live pre-market open update

As illustrated, the price has dropped and is currently en route for a downside extension. Failures below 0.7220 open risk of a retest of the mid-Aug lows and 0.71 the figure.

On the other hand, the bulls will be in control on a break of the 4-hour 20 and 50 EMAs that guard a run to the 200-EMA near 0.73 the figure.

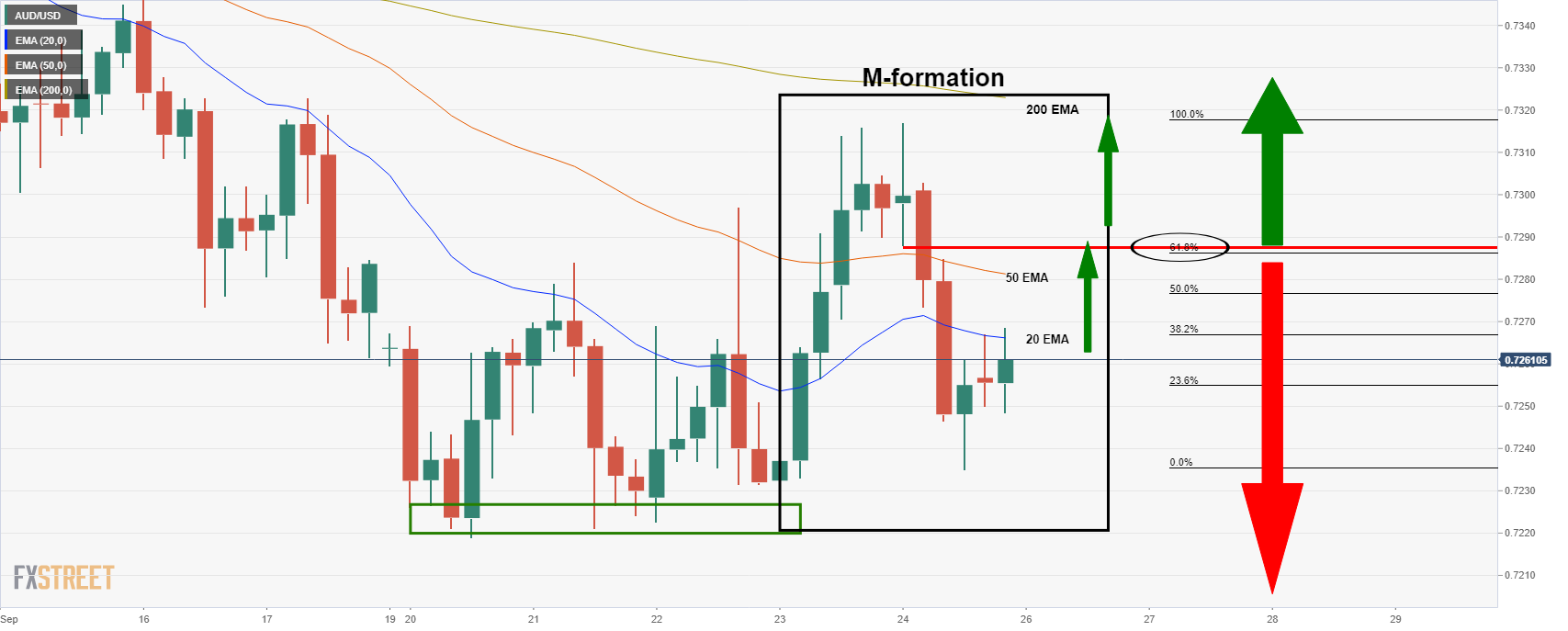

Additionally, the M-formation is a bullish reversion pattern which could see a test of the neckline that has a confluence with the golden 61.8% Fibonacci retracement ratio, (bullish above, bearish below).

Bearish trade setup

Meanwhile, however, on the lower time frames, there is a compelling prospect as follows which offers a 1:2 risk to reward high probability day-trade set up for the open:

AUD/USD 1-hour chart

The 1-hour chart is bearish while below the 200 EMA and as the price corrects to the 61.8% ratio and meets a confluence of resistance, including the 20 EMA. This could be last that we see from the bulls in the meantime.

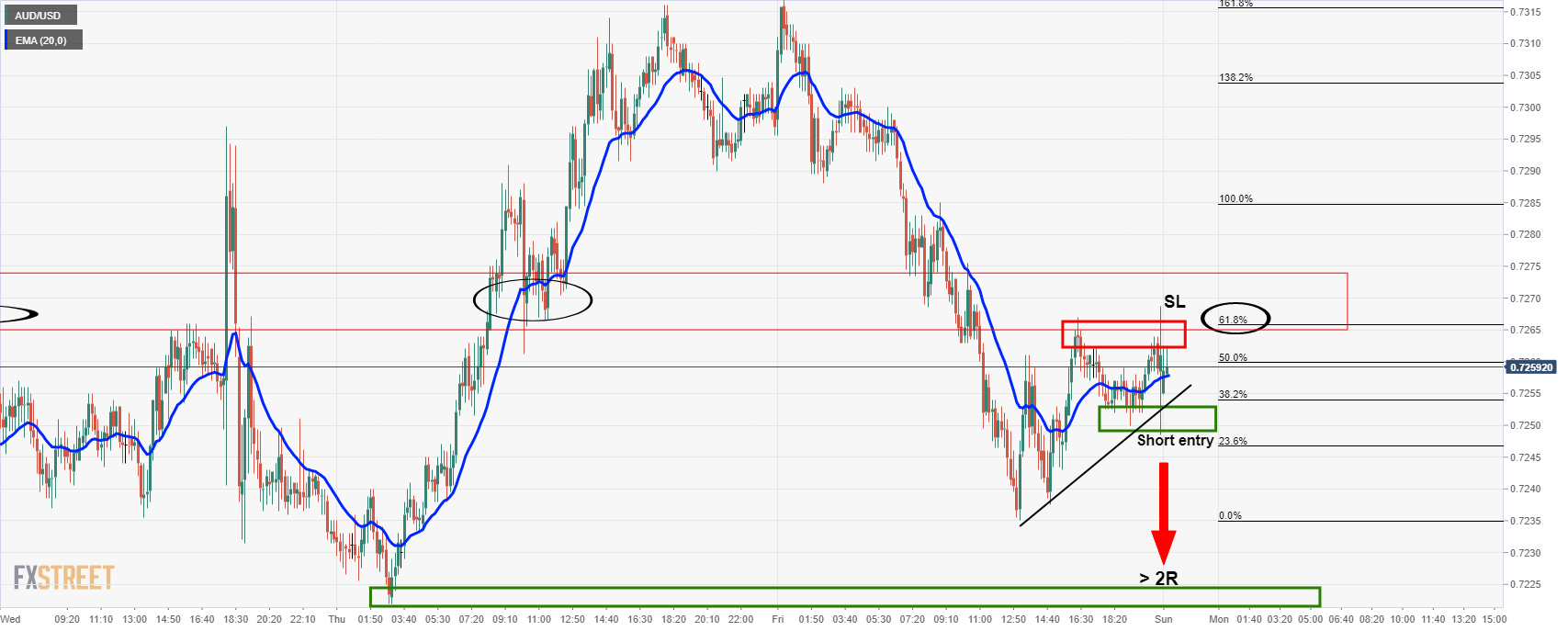

AUD/USD 10-min chart

Therefore, bears will be marketing up their entries on lower time frames (e.g. the 10-min chart is appropriate) to target the prior 0.7220 supporting area. A sell order around the break of 0.7250 with a stop loss placed above the recent highs of 0.7268 to target the 0.7220's offers > 1:2 R/R.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'