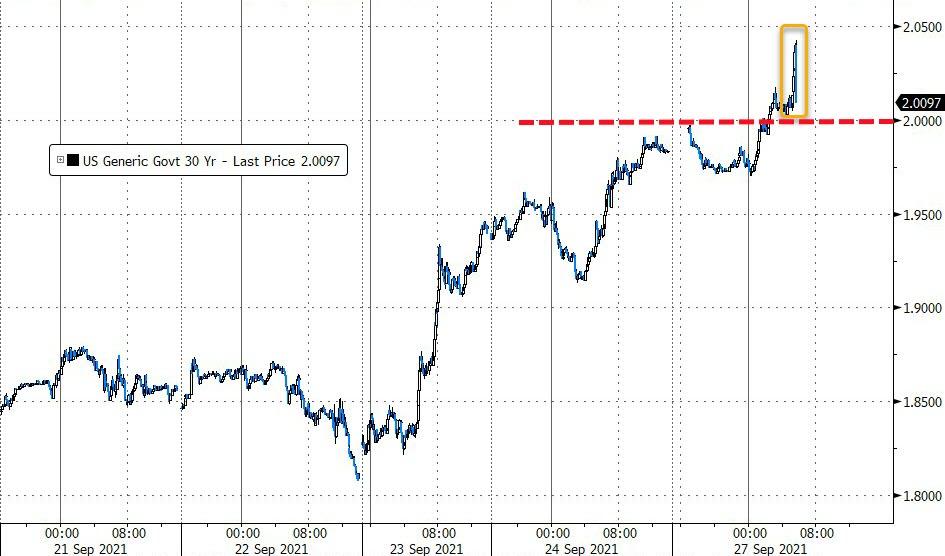

Bond Bloodbath Continues: 30Y Yield Tops 2.00%, 2Y Yield Highest Since March 2020

Following the hotter than expected durable goods headline data, 30Y Yields briefly spiked up to almost 2.05% but fell back on the core data - although they are still holding above 2.00%.

Source: Bloomberg

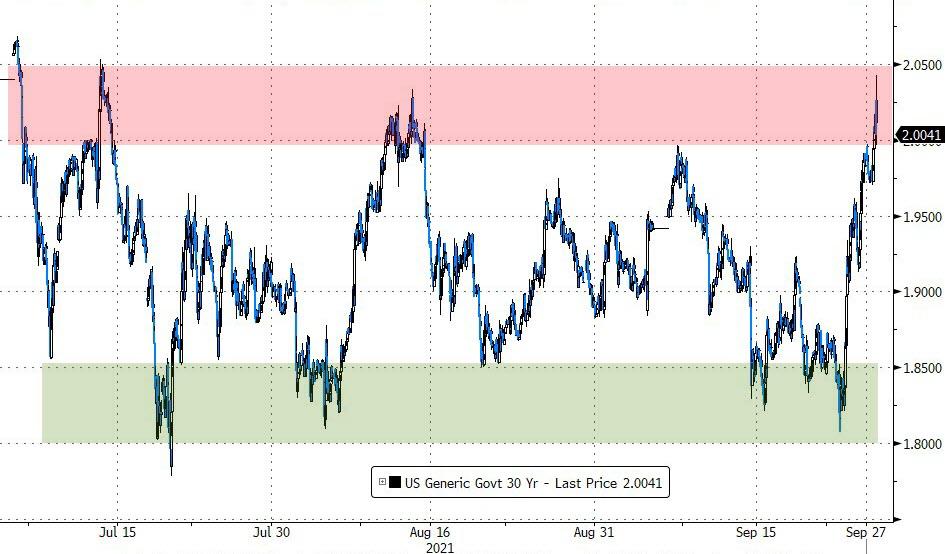

This has been a key level to watch in recent months...

Source: Bloomberg

The short-end of the curve is really suffering with 2Y back above Fed Funds and at its highest level since March 2020 (and 10Y back above 1.50%)...

Source: Bloomberg

Notably, tech stocks are unhappy at this sudden surge in rates (growth) while value stocks are outperforming...

And have further to go if real yields are to be believed here...

So are rising rates a 'good' thing? Can the broad market hold up in the face of growth's collapse? We are sure Eric Rosengren has the answers.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more