As the world population and size of economies increase, energy consumption is also expected to rise. According to a report from ExxonMobil, by 2040, global demand for liquid fuels is projected to increase to the equivalent of around 110 million barrels of oil per day, up by about 9 percent from 2018.

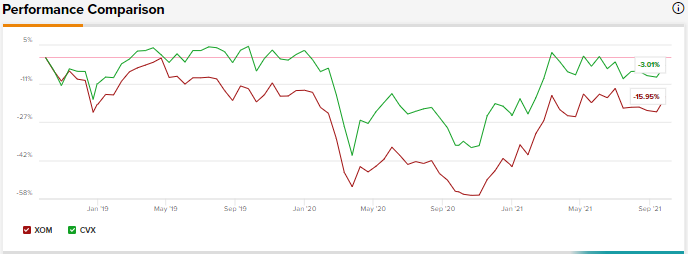

Using the TipRanks stock comparison tool, let’s compare two energy companies, ExxonMobil, and Chevron Corp., mainly based on the risk factors for the stocks.

I am bullish about Exxon Mobil, considering the company is exploring renewable energy solutions while still keeping its financial leverage and operating costs low. In contrast, I am neutral about Chevron Corp.

ExxonMobil (XOM)

ExxonMobil is involved in the exploration and production of crude oil and natural gas. The company also manufactures, trades, transports, and sells crude oil, natural gas, petrochemicals, and petroleum products.

The company’s business segments include Upstream, Downstream, and Chemicals. ExxonMobil’s Upstream business includes selectively developing oil and natural gas resources, and pursuing productivity and efficiency gains.

Its downstream business is involved with the logistics, trading, and refining of oil, while the Chemicals business manufactures and markets petrochemical products.

In Q2, the company turned profitable, with a profit of $4.7 billion or $1.10 per share, after a loss of $1.1 billion in the same period of last year. Analysts were expecting earnings of $1.01 per share. ExxonMobil posted revenues of $67.7 billion, a jump of 107.8% year-over-year, and surpassing consensus estimates of $64.6 billion.

It is important to note that ExxonMobil’s business is basically a commodity business, which means the company is susceptible to changing oil, gas, and petrochemical prices. Last year, the balance of supply and demand was significantly disrupted, as the spread of the COVID-19 pandemic lead to reduced business and consumer activity and significantly reduced demand for crude oil, natural gas, and petroleum products.

However, going by the Q2 results of XOM, this demand seems to be recovering, as the company benefitted from stronger oil prices.

Indeed, according to the TipRanks Risk Factors tool, ExxonMobil seems to be at a high Macro and Political risk of 25%, compared to the sector average of 11.3%. (See Exxon Mobil stock chart on TipRanks)

Interestingly, while ExxonMobil has listed the shift of many countries to alternative energy as a risk, the company is mitigating this risk by pursuing renewable energy solutions.

This is indicated by the fact that XOM has signed a memorandum of understanding (MOU) to “participate in a major carbon capture and storage (CCS) project in Scotland and to explore the development of CO2 [carbon dioxide] infrastructure in France.”

In Q2, XOM also expanded its earlier agreement with Global Clean Energy to purchase up to 5 million barrels of renewable diesel, and expects to begin commercial production in 2022. ExxonMobil is targeting the production of more than 40,000 barrels per day of biofuels by 2025.

Yesterday, J.P. Morgan analyst Phil Gresh reiterated a Buy rating and a price target of $65 (8.5% upside) on the stock. The analyst is bullish on the stock, as he believes that XOM has “traditionally differentiated itself with its defensive characteristics, owing to its well-integrated and diversified portfolio, including solid FCF generation and below-average financial leverage.”

Moreover, Gresh believes that with a “deep pool of assets that the company could sell and currently higher oil prices, we think that significant balance sheet progress can be made in coming years as well.”

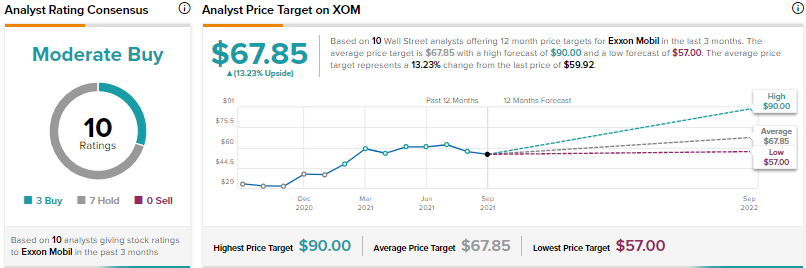

Turning to the rest of the Street, Wall Street analysts are cautiously optimistic about Exxon Mobil, with a Moderate Buy consensus rating, based on 3 Buys and 7 Holds.

The average Exxon Mobil price target of $67.85 implies 13.2% upside potential from current levels.

Chevron Corp. (CVX)

Chevron Corp. is an integrated chemicals and energy company that engages in the manufacture, development, and transport of crude oil and natural gas. The company’s business segments include upstream, downstream, and chemical operations.

In the second quarter, the company posted impressive results, driven by improved market conditions, transformation benefits, and merger synergies. Chevron’s total revenues more than doubled on a year-over-year basis to $37.6 billion, outpacing consensus estimates of $34.32 billion.

Adjusted earnings came in at $1.71 per share, versus the adjusted loss of $1.56 per share reported in the same quarter last year. That also beat analysts’ expectations of earnings of $1.50 per share.

Similarly to ExxonMobil, Chevron is also vulnerable to fluctuations in crude oil prices. Another potential risk factor for the stock is that as governments around the world focus on reducing greenhouse gas emissions, any regulatory changes could result in “curtailing profitability in the oil and gas sector or rendering the extraction of the company’s oil and gas resources economically infeasible.”

Indeed, according to the TipRanks Risk Factors tool, CVX is at a high Legal and Regulatory risk of 29%, compared to the sector average of 19.8%.

However, Chevron is looking at mitigating this risk by investing more capital to grow lower carbon energy businesses. Earlier this month, the company unveiled an energy transition plan to triple its capital investment from $3 billion to $10 billion through 2028, and set new growth targets for hydrogen, renewable fuels, and carbon capture through 2030. (See Chevron stock chart on TipRanks)

Yesterday, J.P. Morgan analyst Phil Gresh remained sidelined, with a Hold rating and a price target of $111 (7.4% upside) on the stock. Gresh is of the view that the “company’s dividend coverage breakeven [is] creeping closer to $55/bbl [barrel of crude oil] Brent, which is a bit above the group average.”

Following the Q2 results, Chevron declared a quarterly dividend of $1.34 per share, payable on September 10 to shareholders of record as on August 19.

The analyst added, “When combined with buybacks, we have the company’s total return of capital yield looking at/below the group average through 2025. While the company could flex its balance sheet to return more capital to shareholders, we have leverage essentially in line with the group already, so we think that our assumed allocation looks fair.”

Return of capital is defined as the principal payments paid to owners of capital, that is, shareholders, unitholders, or partners.

While Gresh approves of Chevron’s higher spending when it comes to the energy transition, he also believes that “the ability to measure the returns on incremental spending will be long dated.”

Turning to the rest of the Street, Wall Street analysts are cautiously optimistic about Chevron Corp., with Moderate Buy consensus rating, based on 9 Buys and 6 Holds.

The average Chevron Corp. price target of $123.36 implies 19.4% upside potential from current levels.

Bottom Line

When it comes to risk factors, it seems Chevron is more vulnerable to Legal and Regulatory risk compared to XOM, which is at Legal and Regulatory risk of 17%, below the sector average of 19.8%.

While analysts are cautiously optimistic about both stocks, it remains to be seen how Chevron’s energy transition move works out.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.