Multilevel marketing firm Nu Skin Enterprises (NUS) expects its third-quarter revenue to range from $637 million to $642 million. Following the announcement, shares of the company lost 4.1%, at the time of writing, in early trade on Monday.

Headquartered in Utah, Nu Skin offers consumer products, product manufacturing and controlled environment agriculture technology.

The President and CEO of Nu Skin, Ryan Napierski, said, “Our third-quarter revenue was softer than anticipated as the delta variant created unexpected disruptions in many of our markets. Unanticipated government restrictions impacted our ability to sell and distribute products, with the largest impact in Mainland China and Southeast Asia, and also disrupted promotional activities such as incentive trips and the performance of local expos in several markets.”

“We are optimistic about our upcoming product launches and the rollout of additional social commerce tools in late 2021 and into next year. We remain confident in our strategy and anticipate annual 2021 revenue to be up modestly year-over-year,” Napierski added.

The company plans to release its financial results for the third quarter on November 3. (See Nu Skin stock chart on TipRanks)

Two months ago, Jefferies (JEF) analyst Stephanie Wissink maintained a Buy rating on the stock with a price target of $70 (68.8% upside potential). The analyst expects the company to report earnings per share (EPS) of $1.18 in the third quarter.

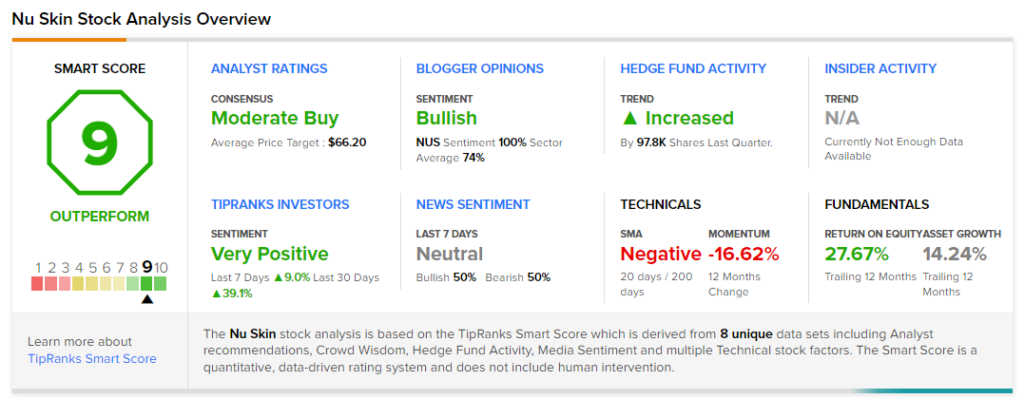

Overall, the stock has a Moderate Buy consensus rating based on 3 Buys and 2 Holds. The average Nu Skin Enterprises price target of $66.20 implies 59.6% upside potential. Shares have lost 25.1% year-to-date.

According to TipRanks’ Smart Score rating system, Nu Skin scores a 9 out of 10, suggesting that the stock is likely to outperform market averages.

Related News:

Deere Reaches Tentative Agreement with UAW; Shares Rise 2.1%

KDP Unveils $4B Share Buyback Program; Reiterates FY2021 Outlook

Understanding Isoray Inc’s Risk Factors