Bitcoin

Bitcoin peaked at $52,803 in early September and set a lower high from the July intra monthly low of $29,337 on 20th July. Price retraced 50% to around $41,000 and would set a higher low if the September high is exceeded.

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler, made positive comments on bitcoin exchange traded funds (ETFs) based on futures during a speech at The Future of Asset Management North America Conference. Gensler is seeking to ensure investor protections are in place as digital assets have become of a size that warrants regulatory oversight to reduce the likelihood of investors getting hurt when participating in these new markets.

Morgan Stanley had increased their bitcoin exposure in their investment funds when price fell below $40,000 through the Grayscale Bitcoin Trust in the first half of the year. Morgan Stanley allows its high net worth clients to access these investment funds that include the Galaxy Institutional Bitcoin Fund and the FS NYDIG Select Fund.

DAILY TREND: UP

Source: ICE Connect

Bitcoin reached $52,803 in early September ending a strong August move in price to set a lower high and had since retraced 50% of that move to hold above $40,000.

Upcoming high impact events

- No major events listed

US dollar

The U.S. Dollar Index (USDX) closed +1.7% in September at 94.23, after a slightly shaky start to the month. During the last week of September the U.S. Dollar Index (USDX) broke through a previous resistance area created during November 2020 with conviction before pulling back slightly leaving a fresh ten-month high at 94.52.

Nonfarm Payrolls data published by the U.S. Bureau of Labor Statistics on 3rd September showed August numbers at 235,000, significantly below expectations and a big drop compared to July’s revised data. The U.S. Dollar Index (USDX) reflected this worrying news by falling throughout the day closing with a 0.21% loss.

Retail Sales data released on 16th September by the US Census Bureau, which measures the total receipts of retail stores, showed August (Month on Month) data outperforming July’s with a headline rate 0.7%. This positive news saw the U.S. Dollar Index (USDX) rally to close up for the day +0.38%.

22nd September 2021 was a busy day for the Federal Reserve; highlights included interest rates remaining unchanged at 0.25%. Details came out from the Fed that it will possibly begin tapering as early as November and gave an indication that possible rate rises could be earlier than expected in 2022 although some Federal Open Market Committee (FOMC) members believe patience is required. This positive news created a surge in the U.S. Dollar Index (USDX), which eventually led to a new September high.

DAILY TREND: UP

Source: ICE Connect

After a slightly nervous start to the month exacerbated by worse than expected Nonfarm payrolls data the DXY fell to test an area of support at 91.78 – 92.15, which held, sending the market rallying.

The rally continued throughout the month helped by positive data. The DXY broke through a resistance area at 93.50 – 93.75 from August 2021, this was formed based on a reaction to an area of resistance shown on a monthly chart between 93.75 – 94.80.

The DXY ended the month positive leaving a new ten-month high at 94.52 as it pulled back slightly on the last trading day for September.

The DXY closed at 94.24 with a +1.7% change.

Upcoming high impact events

-

Wed 6 Oct ADP Employment Change (Sep).

-

Fri 8 Oct Nonfarm Payrolls (Sep).

-

Tue 12 Oct CPI (Sep).

-

Wed 13 Oct FOMC Statement.

-

Fri 15 Oct Retail Sales (Sep).

-

Wed 27 Oct GDP (Q3).

Singapore dollar

The Singapore Dollar closed the month at $1.3570 against the U.S. Dollar driven mainly by the strengthening of the U.S. Dollar throughout the majority of September.

Industrial production data released on 24th September 2021 by the Singapore Department for Statistics showed an increase in production of +11.2 % (August Year on Year) with little impact on the market albeit the data falling below expectations.

DAILY TREND: NEUTRAL

Source: ICE Connect

USDSGD early September continued the downward momentum before finding a support area at 1.3397 – 1.3428 where it took a bounce, retested and broke slightly lower (1.3380) before reversing.

The turning point on the USDSGD occurred on 10th September 2021. This was mainly due to the strengthening of the DXY (U.S. Dollar against a basket of currencies). As the U.S. Dollar is the Base in the pair this meant the Singapore Dollar began to lose value against the U.S. Dollar as the pair rallied.

USDSGD continued to rally eventually breaking above the downward channel the pair had been trading in for the past two-months (evident on the daily chart), cancelling out the short-term downtrend.

The USDSGD reached a resistance area on a daily chart at 1.3615 – 1.3656 (from August) and the pair began to pull back on the final trading day of the month.

The USDSGD closed at 1.3570 with a +0.9% change.

Upcoming high impact events

- No major events listed.

Chinese Yuan

The Chinese Yuan Renminbi closed the month at $6.4492 against the U.S. Dollar. The USDCNH finally broke below its prior trading range 6.4500 – 6.5100 it had been in, creating a slightly lower range at 6.4233 – 6.4880.

Data released shows global demand continued to surge in August with China’s exports rising 25.6% compared to the prior year, indicating whilst there are concerns for the economic outlook in the remaining quarter the industrial sector currently is showing some resilience.

China posted a trade surplus of $58.34 billion in August coming out above expectations and July’s data. The United States trade deficit with China continues to widen with China recording a surplus of $37.68 billion (based on Customs data), again up on the previous month.

Industrial production data released 15th September showed August (Year on Year) data was weaker than expected with industrial output at 5.3%, its lowest growth rate since August 2020. Concerns around higher raw material prices, the energy crisis and the recent Covid -19 Delta variant outbreaks deepen.

DAILY TREND: DOWN – NEUTRAL

Source: ICE Connect

Early September the USDCNH broke down below the trading range of 6.4500 – 6.5100 the pair had been trading within since mid-June, signifying the Yuan (Quote currency in the pairing) was gaining strength against the U.S. Dollar (Base). This created a new ten week low for the pair on 3rd September at 6.4234 meaning the strongest the Yuan had been trading at during this time.

Even when CPI and Retail Sales data came in below expectations, it did not seem to have much of an impact on the pair at the time of release.

The pair finally rallied from the lows mainly due to positive news from the U.S. and concerns mounting in China over Evergrande, one of China’s biggest developers before setting a month high of 6.4880. This high on the pairing signified a new one-month low against the dollar for the Yuan. A new range has now been established 6.4233 – 6.4880.

Overall little change for the month with the USDCNH closing at 6.4492 down by -0.1%.

Upcoming high impact events

-

Sat 9 Oct CPI (Sep).

-

Fri 15 Oct Retail Sales (Sep).

-

Wed 20 Oct PBOC Interest Rate Decision.

-

Sun 31 Oct Non–Manufacturing PMI & NBS–Manufacturing PMI (Oct).

Asia tech

Technology stocks in Asia came under renewed pressure in September as the Chinese government regulators indicated increased scrutiny on internet stocks and amidst calls to accelerate national legislation to ensure fair competition and innovation in the digital economy.

China was reported by the Financial Times to seek the breakup of Ant Group’s Alipay to create a separate loans app. Alibaba stock dropped around 4% on the news.

China Evergrande, the property developer owing $300 billion in debt, had faced interest and loan repayment issues, which led to concerns on the implications to China’s markets in the event of bankruptcy. Shares of their EV Unit, China Evergrande New Energy Vehicle Group Ltd., fell strongly after warning of a shortage of cash further adding to the parent company’s woes.

DAILY TREND: DOWN

Source: ICE Connect

Price retraced in September to the Fibonacci 78.6% retracement level erasing a good part of the late August move higher. China’s regulators and state media continued to focus on more regulations on internet related businesses than already announced.

Upcoming high impact events

-

Sat 9 Oct China CPI (Sep).

-

Wed 20 Oct PBOC Interest Rate Decision.

-

Sun 31 Oct China Non-Manufacturing PMI.

Oil

Brent crude oil broke the July to August downtrend and traded higher to a new high at $79.95 to end the month 9.3% higher versus August at $78.31.

Brent crude oil rose to a three-year high in September as demand recovered strongly and producers suffered unplanned outages. Despite the OPEC+ commitment to increase production levels by 400,000 barrels per day starting in August through to December, demand growth is expected at approximately 6 million barrels per day leading to a 1.1 million barrel deficit in 2021.

DAILY TREND: UP

Source: ICE Connect

Brent price reached a new high of $79.95 on 28th September. Brent turned positively correlated to the U.S. Dollar during this period.

Upcoming high impact events

OPEC+ countries maintains its outlook to increase supply of oil in August by 400,000 barrels per day through to December

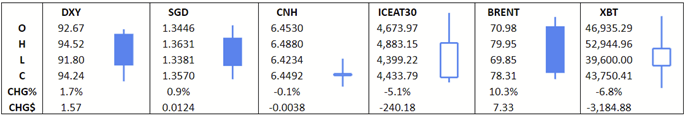

Key figures

Source: ICE Connect, ~30 Days

The following videos/clips/demonstrations are for educational and instructional purposes only. Traddictiv provides these videos purely for the purpose of demonstrating a method of using the product. Users understand that all the content used in the video is purely for demonstration purposes only and is not a guide and does not provide any indication or prediction of actual results. As a User you understand and agree that hypothetical results obtained through the demonstration, do not indicate, in any way, the results you may receive on using our products.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.