Shares of the beverage giant PepsiCo (PEP) have lost fizz and underperformed the broader markets this year. This comes despite the company performing well and delivering strong financial numbers.

To provide a little background, PepsiCo delivered organic sales growth of 8.4% in the first nine months of FY21. Meanwhile, its core earnings increased by 15% to $4.73 a share during the same period.

Thanks to the strong year-to-date performance and sustained momentum in the business, PepsiCo raised its full-year organic sales and EPS outlook. (Read more: PepsiCo Q3 Revenue & Earnings Beat Estimates)

Despite its strong year-to-date financials and upbeat outlook, PepsiCo stock is up only about 10% this year, underperforming the benchmark index by a significant margin (S&P 500 Index is up about 18% this year).

The stock’s underperformance reflects concerns related to supply-chain and inflation. In addition, the continued uncertainty related to the pandemic is limiting its upside.

Stephen Powers of Deutsche Bank expects supply-chain and higher costs to limit the benefits of higher sales on its bottom line. Powers has a Hold rating on PepsiCo stock.

Nevertheless, PepsiCo’s CFO, Hugh F. Johnston, expects to counter commodity inflation and higher expenses through increased pricing. During the Q3 conference call, he stated, “We expect to be able to price through the inflation that we’re facing, whether it be commodities inflation or other types of operating expense inflation.”

Meanwhile, PepsiCo expects the momentum in its business to sustain in FY22, thus adding increased visibility over future revenues and earnings. I maintain a bullish outlook on PepsiCo stock.

Johnston said that PepsiCo’s FY22 organic revenue and core constant currency EPS growth rate are expected to be in line with its long-term targets. PepsiCo’s long-term targets include 4-6% organic sales growth and high-single-digit percentage growth in its core constant currency EPS.

Lauren Lieberman of Barclays acknowledged PepsiCo’s increased visibility in its FY22 outlook, and reiterated her Buy rating. Lieberman increased PepsiCo’s price target to $168 (7.7% upside potential) from $165.

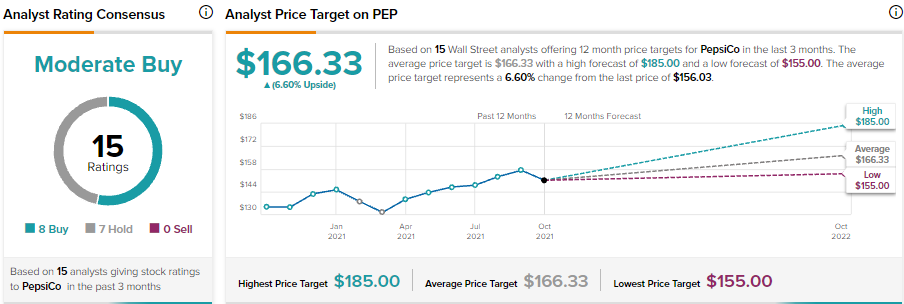

Overall, Wall Street is cautiously optimistic on PEP stock. Its analyst rating consensus of Moderate Buy is based on 8 Buys and 7 Holds.

Furthermore, PepsiCo scores a Perfect 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

The average PepsiCo price target of $166.33 implies 6.6% upside potential to current levels.

Disclosure: On the date of publication, Amit Singh had no position in any of the companies discussed in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.