- Canadian dollar finishes at its best level since July 5, up 3.6% in a month.

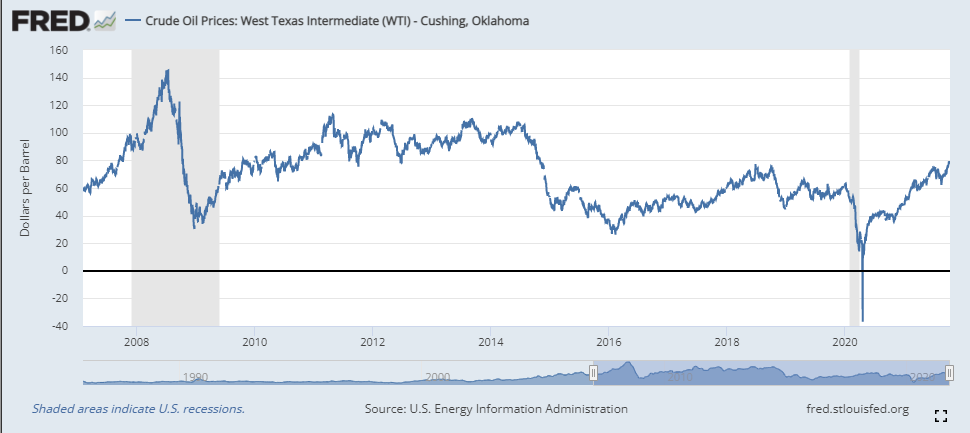

- Crude oil adds 3.6% to $81.93, sets new seven-year highs on four of five days.

- WTI price increases prevail over interest rates for the Canadian dollar.

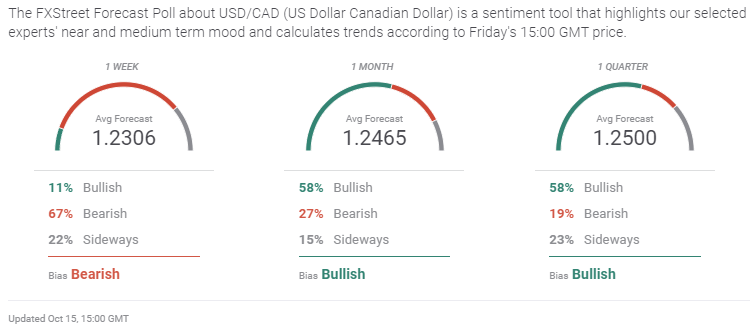

- FXStreet Forecast Poll sees a rebound from support at 1.2300.

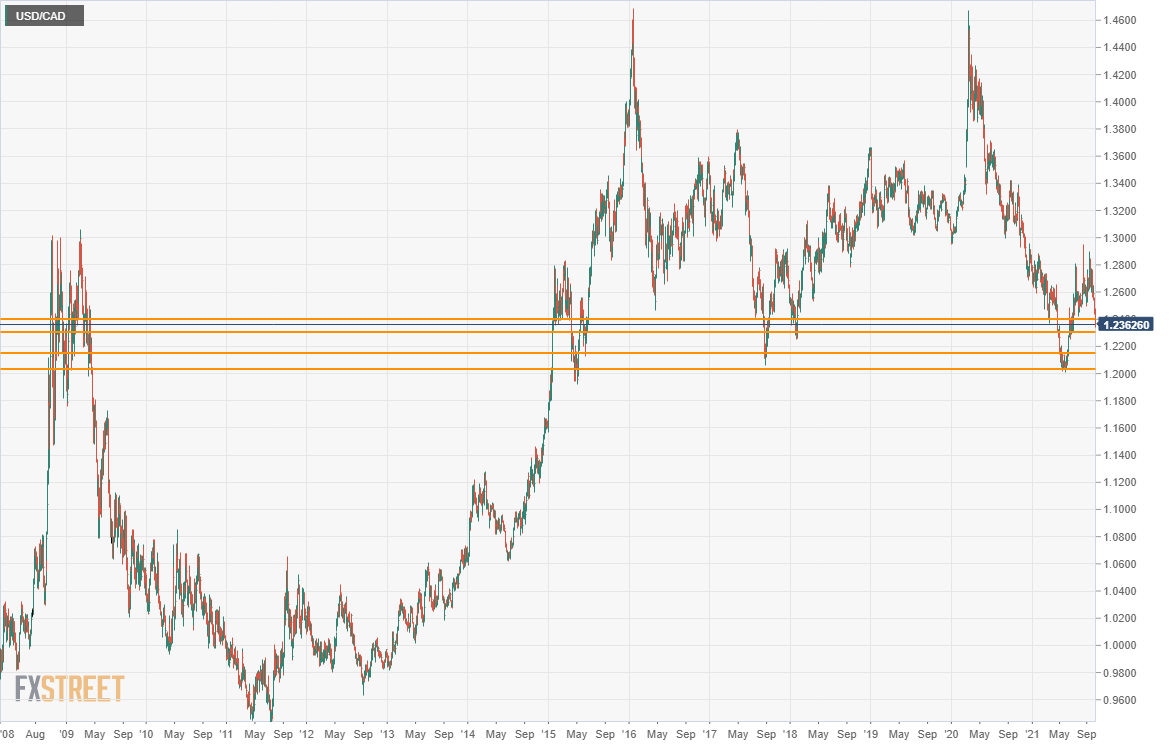

The Canadian dollar followed surging crude oil this week, finishing higher in four of five sessions and closing at its strongest level since July 5. The USD/CAD opened at 1.2473 on Monday, gained 11 points in that day’s trading and then closed lower in each successive finish.

West Texas Intermediate (WTI), the North American pricing standard, continued its rampage, adding 3.6% this week and 32.6% since August 23.

Friday’s close at $81.93 was the highest for this basic industrial commodity since November 2014. The energy sector contributes about 11% to the Canadian economic activity.

Treasury rates on either side of the border retreated, with the US 10-year Treasury and the Canadian bond losing 4 basis points to 1.574% and 1.584%, respectively.

The US dollar lost ground against all the majors except the Japanese yen, but the amounts were small and trading adjustments rather than new initiatives. The greenback’s 2% gain versus the yen was due to the widening Japanese Government Bond (JGB) to US Treasury yield spread. Japan’s national election on October 31 is expected to produce another round of Bank of Japan liquidity and fiscal stimulus from the predicted victory of Liberal Democratic Party (LDP) candidate Fumio Kishida.

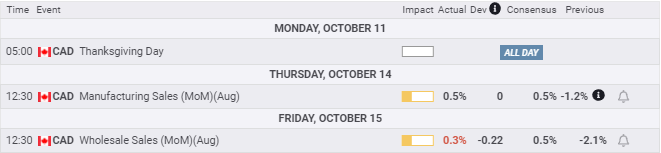

Canadian economic data was scarce this week. Manufacturing Sales in August were as forecast, and Wholesale Sales were slightly weaker than estimates for the same month.

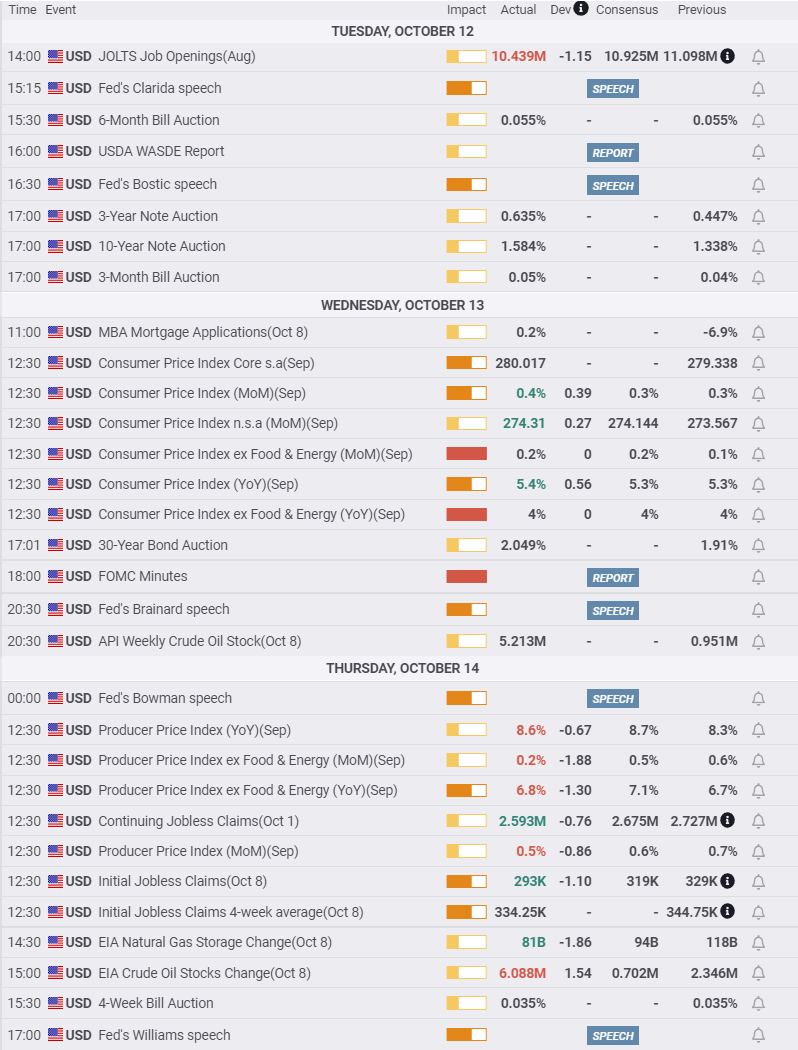

In the United States, annual CPI rose to 5.4% in September, the highest it has been in 13 years, and core inflation stayed at 4%.

Producer Prices in September climbed as well, promising further consumer hikes in the months ahead. The PPI (YoY) rose to 8.6% from 8.3% in August, and core climbed to 6.8% from 6.7%. That both indexes missed their forecasts, 8.7% for headline and 7.1% for core, was not an indication that price increases may be waning.

Retail Sales for September at 0.7% were much stronger than the -0.2% prediction. August sales had gained 0.9%, also surpassing their -0.8% forecast.

Michigan Consumer Sentiment through October has registered three of its lowest scores for the past decade. With Retail Sales for two of those months much stronger than forecast, perhaps Americans are unhappy about something other than the economy. What is upsetting the US consumer?

USD/CAD outlook

Thursday’s breach of 1.2400 brings the USD/CAD to the lowest portion of the pair’s range over the past six years. The practical limit of 1.2000 was reached three times during those years, April and May 2015, September 2017 and May and June this year.

For the prior six-and-a-half years, from May 2009 until January 2015, the USD/CAD was below 1.2000. For about half the period it was below 1.0500 and for most of 2011 and 2012 it was below 1.000. To put it bluntly, there is a great deal of room for the USD/CAD to fall.

Two forces are contesting for the direction of the USD/CAD, energy prices and interest rates. Unlike the rest of the majors, which have seen the US dollar climb as US rates have moved higher since the early part of August, the greenback has fallen against the loonie. The difference is crude oil.

The contest is not decided. If the Federal Reserve begins its bond taper as promised this year and if the schedule and amount is sufficient and not cursory, US Treasury yields will rise above 2%.

Crude prices, like Treasury rates and the USD/CAD itself, have a great deal of historical range on either side. Much will depend on policy choices made in the various chanceries and central banks as the world economy moves out of the pandemic and into recovery. For example, if the US again promoted energy independence and production, crude prices would collapse in short order.

For the moment, energy prices are in ascendance and with them the Canadian dollar. Until that changes or the US Treasury rates resume their push toward 2%, the USD/CAD bias is slowly lower.

Canadian CPI for September and Retail Sales for August are the main data points in the week ahead. Neither will supplant WTI in market impact.

American data on Industrial Production and the housing market for September will not change views on the dollar. The Fed's Beige Book collection of anecdotal economic information prepared for the November 3 FOMC meeting will gather much attention, even though it is rarely predictive of bank policy.

Canada statistics October 11–October 15

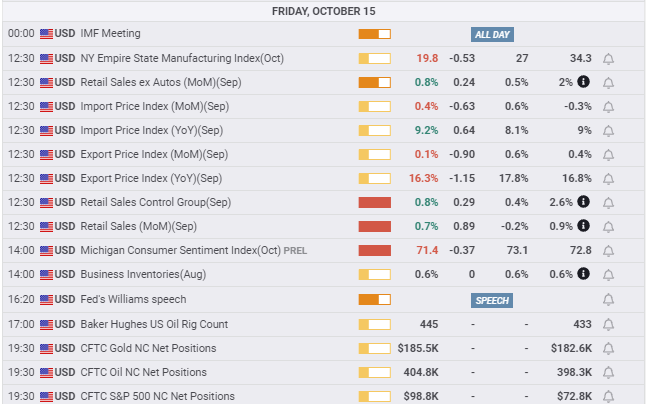

US statistics October 11–October 15

FXStreet

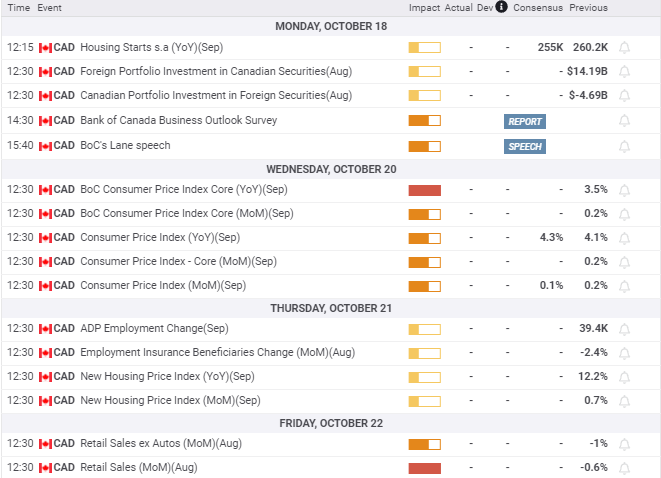

Canada statistics October 18–October 22

FXStreet

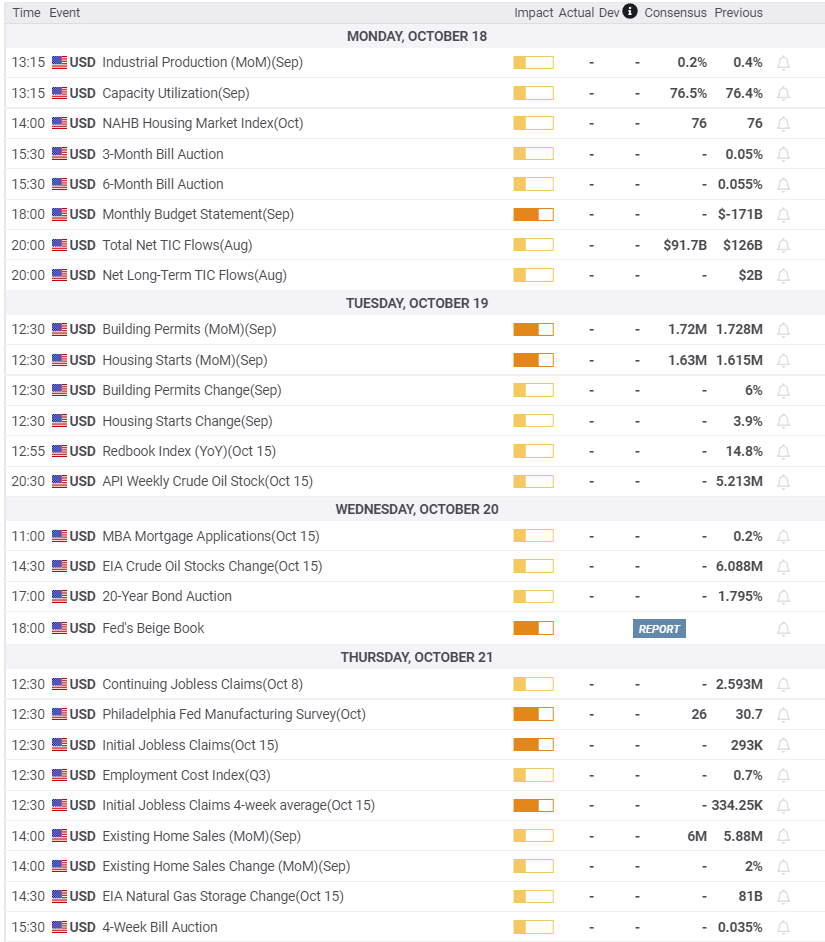

US statistics October 18–October 22

FXStreet

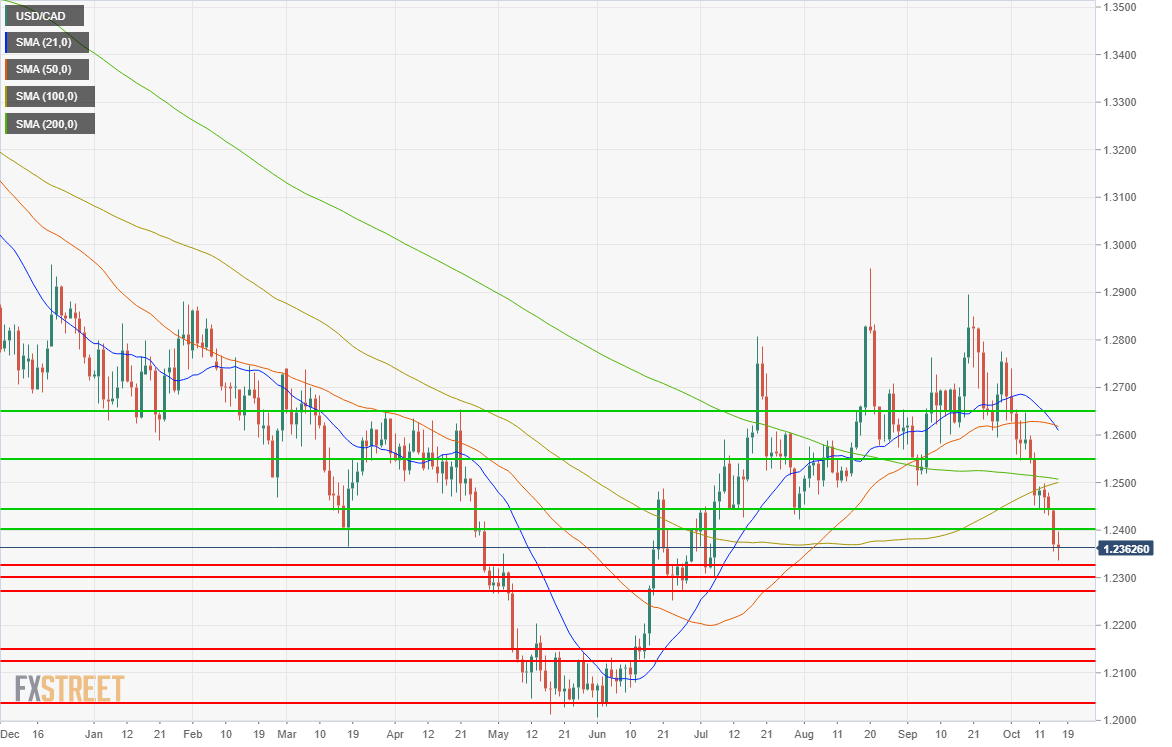

USD/CAD technical outlook

The MACD (Moving Average Convergence Divergence) and the Relative Strength Index (RSI) have posted strong sell signals after the determined sell-off of the last two weeks. The RSI entered oversold territory on Friday. True Range momentum was diminished after Friday's small loss, but the trading direction at the moment is more important than the size of the thrust lower.

The steepness of the reversal in the USD/CAD since September 30 gave the 21-day moving average (MA) at 1.2610 a cross of the 50-day MA at 1.2618 on Friday, a sign of downward momentum. Together they are a substantial line of resistance at 1.2615. The 100-day MA at 1.2500 and the 200-day MA at 1.2507 join in resistance at 1.2500. If the 200-day MA crosses the 100-day MA in the week ahead, it will be another sell signal.

Resistance: 1.2400, 1.2440, 1.2505 (100, 200 MA), 1.2550, 1.2615 (21, 50 MA), 1.2650

Support: 1.2325, 1.2300, 1.2270, 1.2150, 1.2125, 1.2035

FXStreet Forecast Poll

The FXStreet Forecast Poll sees technical weakness down to 1.2300 with a rebound thereafter.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

-637700838537859278.png)