THG moves to restore confidence in governance after share price plunge

Matthew Moulding is to give up his special voting rights and could seek out a non-executive chairman as investors seek a shake-up of corporate governance.

Monday 18 October 2021 17:49, UK

Online retailer and logistics specialist THG, formerly known at The Hut Group, has confirmed it is to remove its founder's "golden share" and seek a premium listing after a big plunge in the value of its stock.

Sky News revealed on Sunday how Matthew Moulding - the company's chief executive and executive chairman - was to cancel his special share rights in an attempt to help restore confidence around corporate governance.

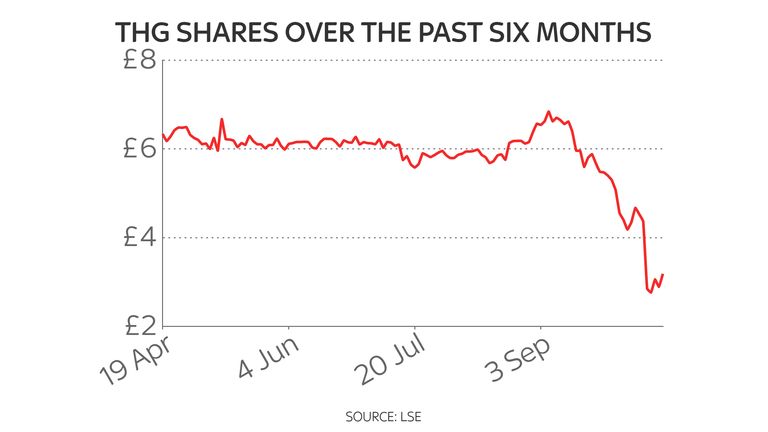

THG, which went public in a bumper initial public offering last September, acted after it was rocked last week by a 35% collapse in its share price following an investor presentation.

The company confirmed on Monday it was also considering a wider governance shake-up amid criticism around Mr Moulding's dual role - rare for a UK-listed firm.

The company could potentially seek to appoint a non-executive chairman.

Mr Moulding's "golden share" status, which granted him greater voting rights for up to 36 months after the flotation, had been a barrier to the firm entering the FTSE 100 because such dual class share structures break its listing rules.

He told investors on Monday: "After the anniversary of our 2020 listing we feel that the time is right to make this next step and apply to the Premium segment in 2022, thereby continuing the development of THG as we endeavour to deliver our strategy for the benefit of our shareholders, key stakeholders and employees."

Shares in THG rose by 20.5%.

Neil Wilson, chief markets analyst at Markets.com, said there was clear appetite for change among investors.

"Clearly governance concerns run much deeper than a quick bit of airbrushing can cope with.

"And following the disastrous capital markets day last week, there are obviously far deeper concerns about the state of the business and a lack of visibility over how different parts fit together," he wrote.