Procter & Gamble (PG), the company behind numerous consumer brands of home cleaning and personal care supplies, posted its earnings report recently.

The company turned in beats for both earnings and revenue. However, the company also pointed out some potential issues afoot that put a damper on the news.

I’m bullish on Procter & Gamble overall. (See today’s best-performing stocks on TipRanks)

After a rough start to the year, Procter & Gamble has been heading mostly upward ever since. January featured a slow descent that saw the company lose over 10% of its share price in the time between January 5, and March 3.

It would take until July to surpass the closing price seen on January 5. After that point, though, the company continued a mainly upward trend. That trend is still going on today.

It’s still going on with good reason, too. The company recently posted its earnings report, and revealed that it had turned in beats for both earnings and revenue.

Refinitiv analysts were looking for the company to post $1.59 per share in earnings. The company posted $1.61 instead. Refinitiv also looked for $19.9 billion in revenue for the quarter. Procter & Gamble pulled out a win there as well, with $20.3 billion.

However, it’s clear that issues were emerging. Last year at this time, Procter & Gamble posted $1.63 per share in earnings. Additionally, Procter & Gamble put out some price increases on its product line this quarter.

Pampers diapers notched up in price, to the point where the company saw an extra 1% in organic sales.

The higher prices were designed to help fend off growing transportation costs, but couldn’t also do the job of offsetting growing commodity costs. This cut into profits, and resulted in a lower per-share figure over last year at this time.

The Vital and the Missing

Procter & Gamble was once known for sponsoring soap operas. Those midday dramas perked up a lot of stay-at-home types, often using the sponsor’s products while listening or watching the dramas in question.

Today, Procter & Gamble might well be involved in its own soap opera: “The Vital and the Missing.”

We know that costs are going up at Procter & Gamble. So much so, in fact, that price hikes are already showing up. Worse yet, we’re even starting to see shortages on Procter & Gamble products. The shortages, however, are far from universal. Today.com recently reported that one in three families were “facing a diaper shortage.”

Fox Business quickly countered with reports from Procter & Gamble itself that there were “isolated cases” where “a certain size or version (was) unavailable.”

A report from the Wall Street Journal itself, meanwhile, failed to tip the scales either way. It noted that diaper prices were up about 12% in the last year with more price hikes likely. The cause: the cost of wood pulp filler commonly used in diaper making was on the rise.

The good news for investors is that, so far, Procter & Gamble hasn’t adjusted its full-year 2022 forecast yet. The new fiscal year has just started for the company, so that’s a fairly good sign.

However, if it has to maintain its earnings and revenue figures on the back of price hikes, that’s a very tenuous position. The more prices go up, the greater the likelihood that customers will seek out alternatives. The more likely customers are to seek out alternatives, the more likely Procter & Gamble is to lose ground.

Wall Street’s Take

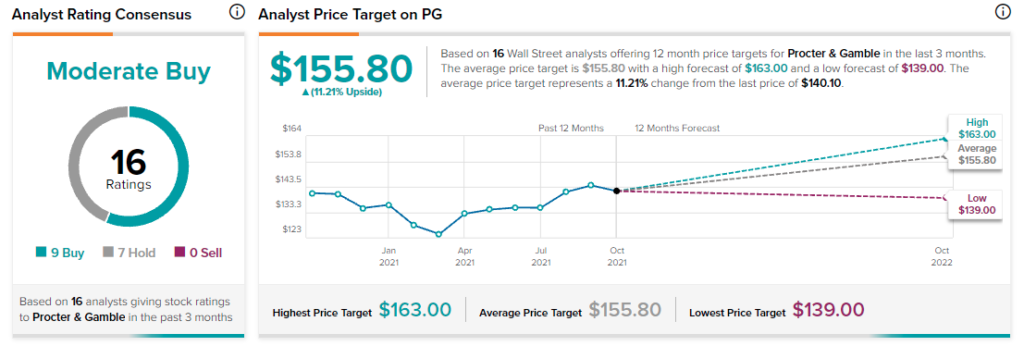

Wall Street’s consensus rating calls Procter & Gamble a Moderate Buy. Based on the projections of 16 analysts that have 12-month price targets on the company issued in the last three months, nine consider it a Buy. The remaining seven call it a Sell. Procter & Gamble’s status as a Moderate Buy extends all the way back to last October.

The average Procter & Gamble price target is in a pretty narrow range. It currently sits at $155.80, with a high of $163 and a low of $139. The average price target implies 11.2% upside potential.

Concluding Views

Procter & Gamble is doing well.

Notwithstanding its big slump earlier this year, which was likely a result of a shift away from pandemic-related stocking up, the company is still a go-to for everyday household operations.

That kind of usefulness has value. Don’t forget that Procter & Gamble is a dividend aristocrat and has been for years. People are basing their retirements around Procter & Gamble’s ability to peddle everything; from diapers to laundry detergent.

It’s incredibly diversified, it holds absolute sway over name recognition, and it has decades of history behind it.

Yes, there will be rough patches from time to time. That’s particularly true these days. However, for a company with a long history of dividends and a history of rising — the share price has more than doubled in the last five years — it looks like a safe investment that will produce value for its shareholders.

Disclosure: At the time of publication, Steve Anderson did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.