- Precious metals benefit from US dollar weakness to rival currencies.

- The stagflation themes feed through into the precious metals' hedge.

- Gold price remains bound by daily dynamic support.

Update: Gold prices trade in a range-bound manner for the second straight session near $1,770. The prices retreat from the previous session’s high of $1,785 amid higher US T-bonds yields. The US 10-year benchmark yields jumped to 1.66%, the highest level since May, with more than 1% gains amid soaring energy prices and inflationary pressures. The scenario brews a perfect stage for Fed’s tapering timeline as soon as November.

Gold is often considered a hedge against higher inflation but a Fed interest rate hike would increase the opportunity cost of holding gold, which pays no interest. Nevertheless, the greenback failed to capitalize on the firm US yields and trades below 94.00, which helps gold find some traction near lower levels. In addition to that, a Reuter poll of forty of 67 economists suggested that the Fed could wait until 2023 to raise rates but warned of an early rate hike on persistent inflation risk.

Gold is subdued and rests in familiar territory awaiting the next major catalyst to kick start it into gear within bullish territory towards the psychological $1,800 level. At the time of writing, XAU/USD is trading at 41,769 and flat in Asia, so far.

Precious metals are finding support from the stagflation theme that has been brewing in recent weeks as well as weakness in the US dollar. The greenback had struggled against its rivals on Tuesday in a bout of profit-taking as rival currencies of central banks that are on the verge of lift-off play catch-up. The moves in forex are denting the US dollar's appeal that had otherwise benefitted by expectations of sooner-than-previously expected interest rate hikes.

''Market pricing for Fed hikes is far too hawkish,'' analysts at TD Securities argued. ''This suggests gold is an ideal hedge against rising stagflationary winds, and reasons to own the yellow metal are growing more compelling as Fed pricing is likely to unwind.''

US Oil (WTI) extends higher

The analysts added that a ''cold winter could send energy prices astronomically higher, potentially pricing-out industries and fueling price asymmetries in markets — which translates into a fat right tail for gold prices. Chinese brokers have also increased their net length in SHFE gold, pointing to increased appetite for the yellow metal amid a growing wall of worry.''

Gold technical analysis

For an in-depth technical analysis of gold, see here: Gold Chart of the Week: XAU hit the $1,800 target, now what?

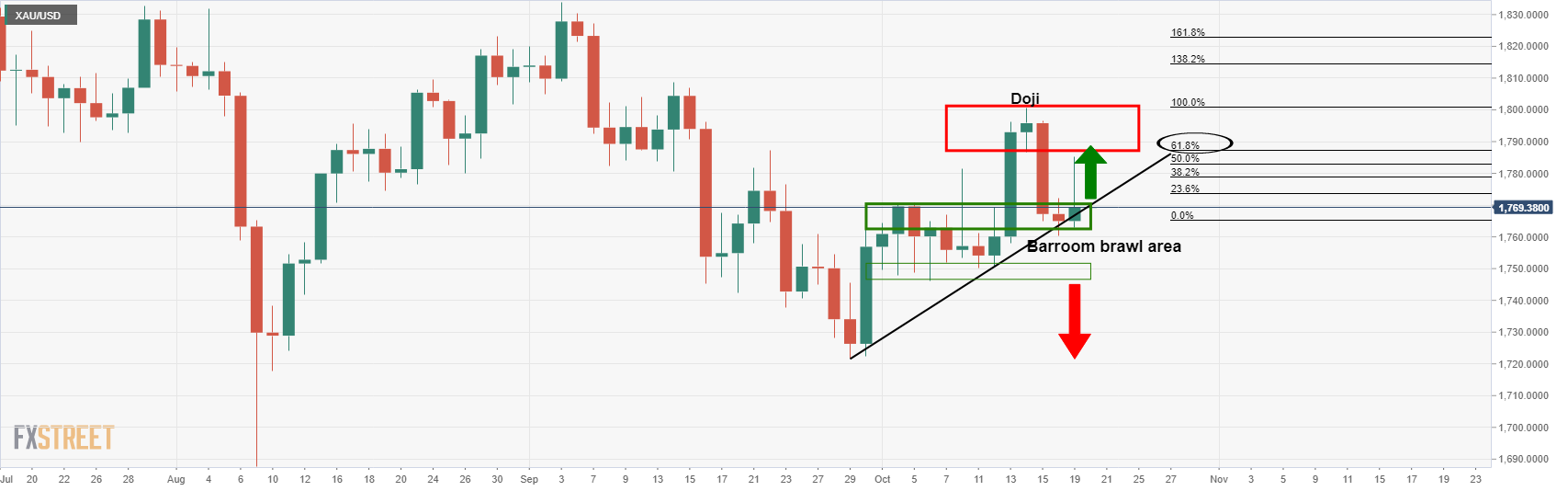

However, at a snapshot, we are likely to see some consolidation to continue to play out:

The price is consolidated unfamiliar territory mid-week and resting by the dynamic trendline support. A move beyond $1,800 is required if the bulls are going to take charge again, or otherwise, a break below the barroom brawl area and $1,750 will open the risk of a downside continuation.

This can be illustrated better from a weekly perspective, as follows:

The price has met a 61.8% Fibonacci retracement of the prior bearish impulse. This is significant and could lead to a break below the dynamic support. A fresh bearish impulse to the downside in the coming weeks would, however, be in contrast to the fundamental stagflation theme.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.