Two Trades To Watch: EUR/USD, WTI Oil - Thursday, Oct. 21

EUR/USD looks to Eurozone consumer confidence & US jobless claims. Crude oil eases, but demand remains strong.

EUR/USD looks to EZ consumer confidence & US jobless claims

EURUSD is paring earlier gains. Whilst inflation rising to a 13 year high is underpinning the common currency, the slight risk off mood in the market favors the US Dollar (UUP, FXE).

Eurozone CPI reached 3.4% YoY in September. However following the release ECB officials have been quick to talk down the prospect of a rate rise (EZU).

Attention now turns to Eurozone consumer confidence. Are rising prices starting to undermine morale in the region? Expectations are for a tick lower to -5 in October.

The US dollar has taken a hit recently amid fears that the Fed could be outpaced by other central banks raising interest rates.

Concerns over the Chinese property sector drive some safe haven flows to the greenback today.

US initial jobless claims are expected to show 300k a slight rise from the previous week’s post pandemic low.

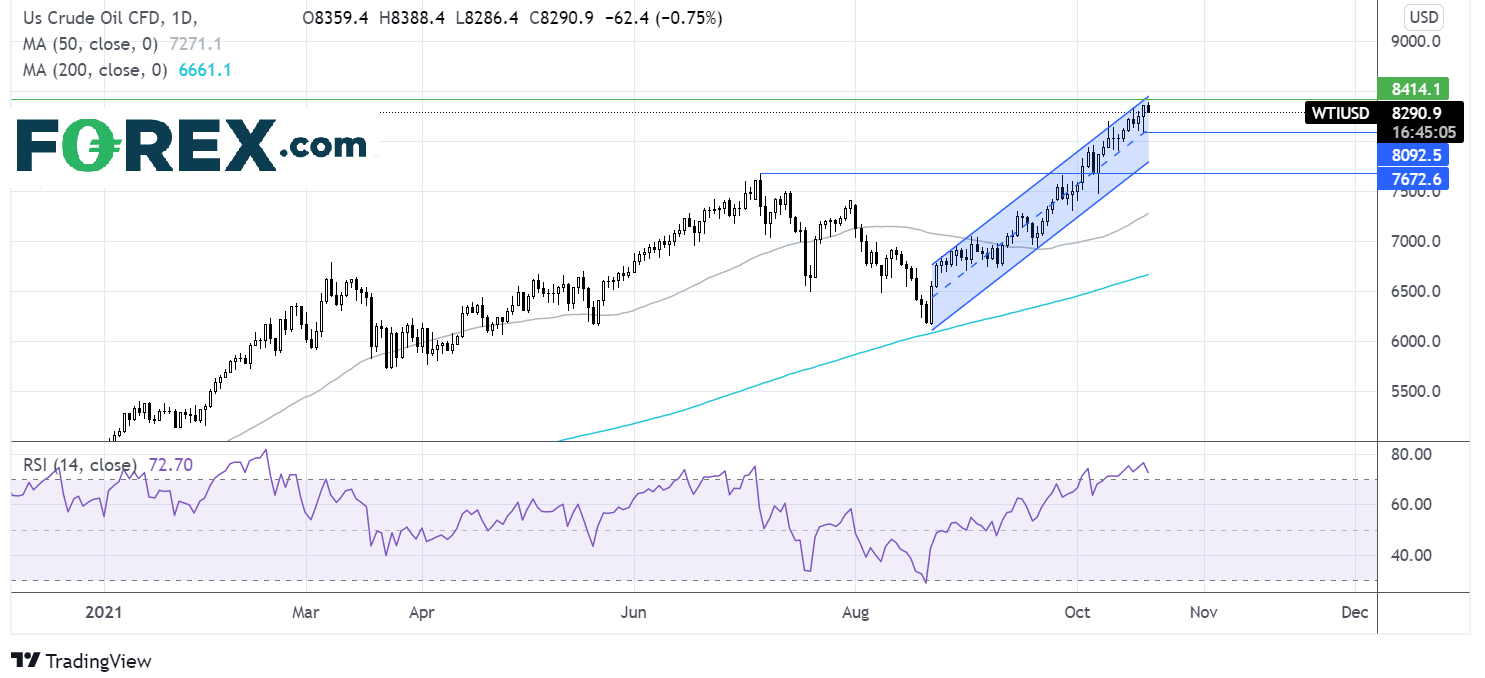

Where next for EUR/USD?

EURUSD is extending its rebound from 1.1530, the year to date low. The break above resistance at 1.1640 the October 4 high, combined with the bullish MACD are keeping buyers optimistic of further gains.

Resistance can be seen at 1.1670 the weekly high, with a breakthrough here exposing the 50 sma at 1.1710 and the descending trendline resistance at 1.1730. A move above here could see the bulls gain traction.

Support can be seen at 1.1640 the October 4 high which could open the door to 1.1570 the weekly low.

Crude oil eases, but demand remains strong

Oil prices are paring overnight gains on a bout of profit taking and snapping a 5 day winning run. The price remains around the highest level since October 2014 (BNO).

Oil prices initial rose following a surprise draw in US crude stockpiles. EIA data revealed at 431k barrel decline in inventories, well below the almost 2-million-barrel build forecast.

The unexpected draw comes as concerns remain over rising demand coupled with constrained supply. With the ongoing energy crisis sending coal and gas pricing surging higher, oil is comparatively cheap and increasingly more attractive as an alt5ernative source for power generation.

On the supply side OPEC are maintaining a slow increase in output, insufficient to meet rising demand.

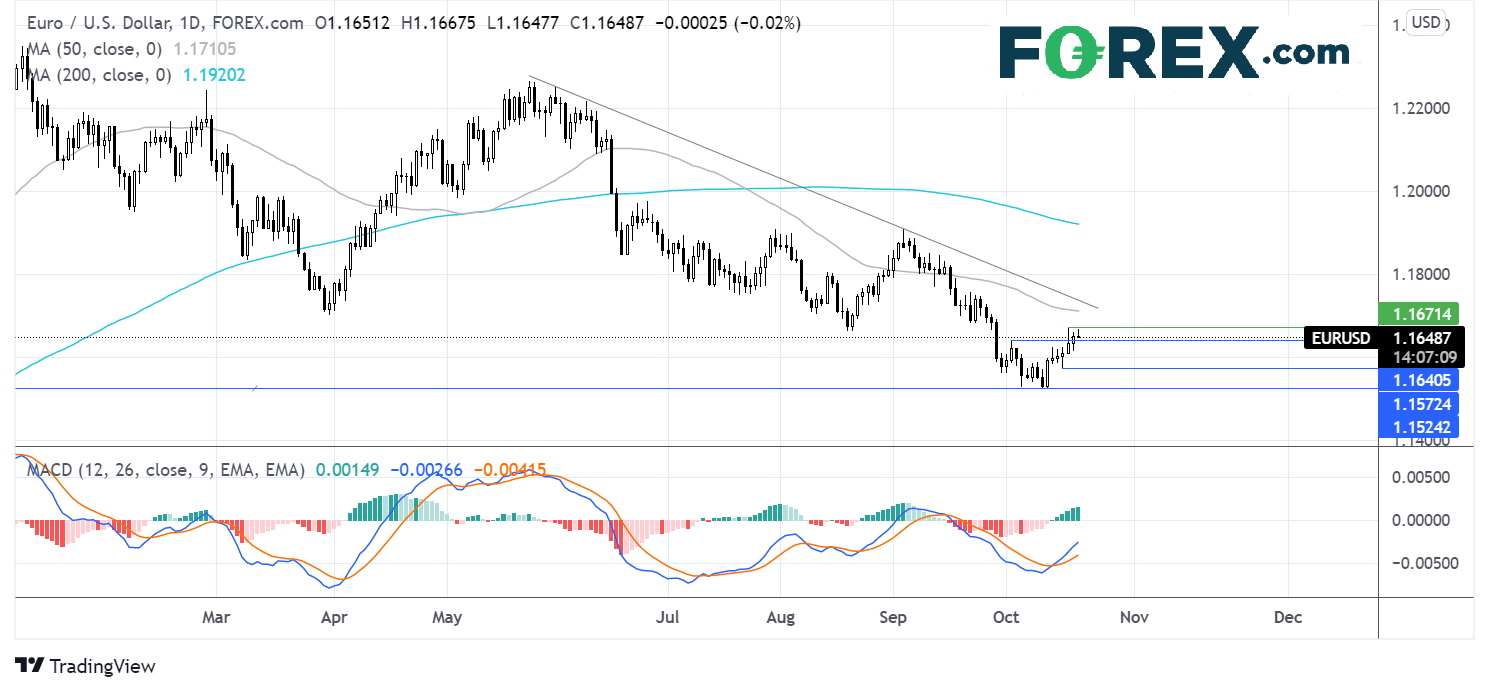

Where next for crude oil prices?

WTI is extending its rebound off the 200 sma in late August. The price trades with the multi-month ascending channel. After hitting a fresh 7 year high overnight, the price is edging lower.

The RSI is in overbought territory so some consolidation or a pull back could be on the cards.

Bulls are eyeing 8410, the November 2012 low followed by 84.50 the upper band of the rising channel.

Support can be seen at 8075 yesterday’s low and the midpoint of the rising channel. A move below 77.50 could take the price out of the rising channel. It would take a move below 76.90 the July 6 high to negate the recent uptrend.