Tilray (TSX:TLRY)(NASDAQ:TLRY) stock investors had a better bullish day when shares surged by 15.79% on Tuesday this week. Most pot names gained that day, and Canopy Growth (TSX:WEED)(NYSE:CGC) stock price increased by 8.4%. Tilray stock had a better day, so could it have better recovery prospects than Canopy Growth when valuations recover for marijuana stocks?

TLRY vs. WEED: Which marijuana stock has better upside potential?

There seems to be no straightforward answer to the above question. Looking at the respective attributes for each of the two Canadian marijuana giants, each has some unique attributes that make it appear better in one aspect yet weaker in another.

Both companies are making headway and placing their best feet forward in the United States market, a huge, highly competitive, and yet fragmented market that could open up for Canadian giants upon U.S. federal legalization.

However, exactly when that could happen is anybody’s guess. For now, investors may be better off assessing the respective companies’ current fundamental positions.

Financial strength: Canopy Growth’s fortress

Balance sheet liquidity and financial strength is one important factor to assess when selecting long-term investments. Adequate liquidity ensures smoother operations, a low propensity for dilutive new equity raises, and a low probability for debt-related stresses and sacrifices that may cause market jitters and shake investor confidence. This is a category where Canopy Growth reigns.

Thanks to a historic $5 billion cash injection by Constellation Brands in 2018, Canopy Growth still had over $2 billion cash on its balance sheet by mid-year this year. The company has more cash than it has debt. WEED’s cash and short-term assets comprise nearly 30% of its total assets.

In comparison, Tilray had just US$376 million (C$465 million) in cash and short-term investments on its books by August. The company has a net debt position, and the company’s cash and short-term investments composed just 6.3% of total assets.

Canopy is significantly more liquid than Tilray.

Should both companies be tangled in a negative cash flow cycle for longer, then Canopy Growth could have a better fighting chance to protect its stock investors from dilutive equity raises

Tilray: High ambitions and higher dilution potential

Under the leadership of a hopeful, resolute, and positively minded CEO Irwin D. Simon, Tilray announced a target to reach a US$4 billion revenue run rate by the fiscal year 2024. That’s huge, especially for a company that recently reported US$168 million in quarterly revenue.

To reach the target, Tilray has to grow its sales run rate to US$1 billion per quarter over the next three years. It’s hard to imagine the company achieving an 80% to 90% compound annual growth rate (CAGR) in sales over the next few years, without going on an acquisitions spree.

Ambitions and hunger for growth look higher at TLRY than at Canopy Growth.

The truth is, TLRY might just achieve its lofty goal. But shareholder dilution is almost guaranteed. The company has since increased its capacity to issue new common shares in a recent shareholder vote.

Dilution can significantly reduce the company’s share price. If in doubt, check with HEXO.

Profitability

A company’s ability to generate profits from its current operations speaks volumes about its capacity to generate positive returns for shareholders. In this regard, Tilray stock fares a bit better than WEED stock. TLRY has reported positive adjusted earnings before interest, taxes, depreciation, and amortization expenses (EBITDA) for several quarters now.

While TLRY’s adjusted EBITDA is still too paltry for the company’s size, it’s still better than Canopy’s persistently negative numbers.

Most noteworthy, adjusted EBITDA measures a business’s capacity to generate positive earnings, without any influences from how management decided to finance or organize its asset base.

Tilray wins here, and I believe this is a result of its low-cost cannabis production assets and a lean operating structure.

Valuation: The tricky part

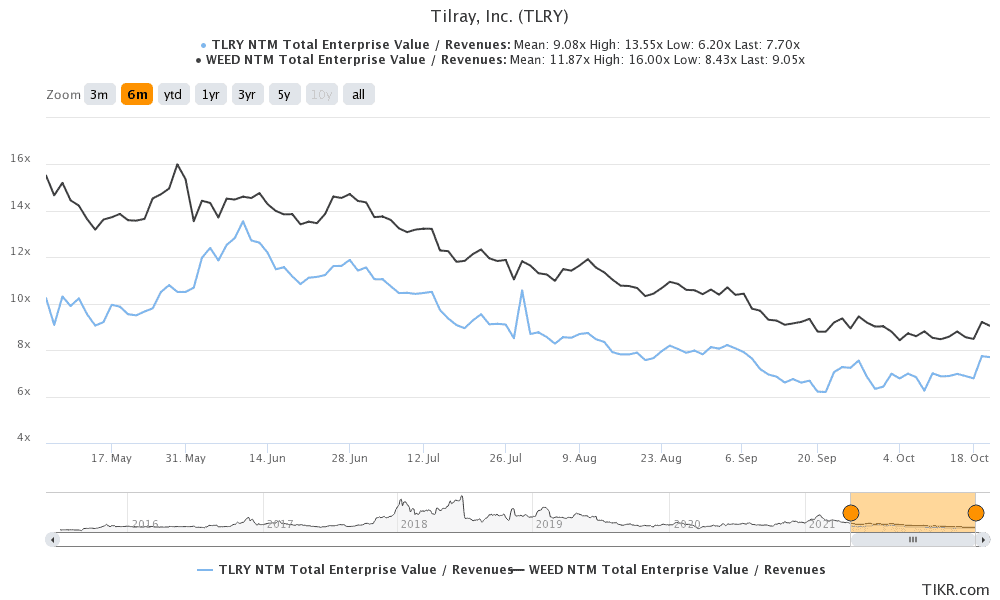

To adjust for differences in cash resources, and profitability, enterprise value to sales multiples could offer better comparisons for valuations between the two pot giants.

Given its low enterprise value to sales multiple, Tilray looks significantly cheaper than CGC stock, although the gap has narrowed somewhat during the past few trading sessions.

However, investors should take note that nearly half of Tilray’s current revenue is from slow growth and narrow margin pharmaceuticals distribution business in Europe. That segment should definitely attract lower revenue multiples. Perhaps the premium on CGC is purely fair after all.

Foolish bottom line

Both companies have a fair chance for inclusion in a long-term focused cannabis portfolio.