Bitcoin, Ethereum, Dogecoin Set Up Trades For Bulls, Bears: How To Play The Cryptos

Bitcoin (BITCOMP), Ethereum (ETH-X), and Dogecoin (DOGE-X) are all trading higher in strong uptrends. An uptrend occurs when a stock or crypto consistently makes a series of higher highs and higher lows on the chart.

The higher highs indicate the bulls are in control, while the intermittent higher lows indicate consolidation periods. Traders can use moving averages to help identify an uptrend, with rising lower frame moving averages (such as the eight-day or 21-day exponential moving averages) indicating the stock is in a steep shorter-term uptrend and rising longer-term moving averages (such as the 200-day simple moving average) indicating a long-term uptrend.

A stock or crypto often signals when the higher high is in by printing a reversal candlestick such as a doji, bearish engulfing, or hanging man candlestick. Likewise, the higher low could be signaled when a doji, morning star, or hammer candlestick is printed. Moreover, the higher highs and higher lows often take place at resistance and support levels.

In an uptrend, the "trend is your friend" until it’s not. In an uptrend, there are ways for both bullish and bearish traders to participate in the trade:

Bullish traders who are already holding a position in a stock or crypto can feel confident the uptrend will continue unless the stock makes a lower low. Traders looking to take a position in a stock or crypto while trading in an uptrend can usually find the safest entry on the higher low.

Bearish traders can enter the trade on the higher high and exit on the pullback. These traders can also enter when the uptrend breaks and the stock or crypto makes a lower low, indicating a reversal into a downtrend may be in the cards.

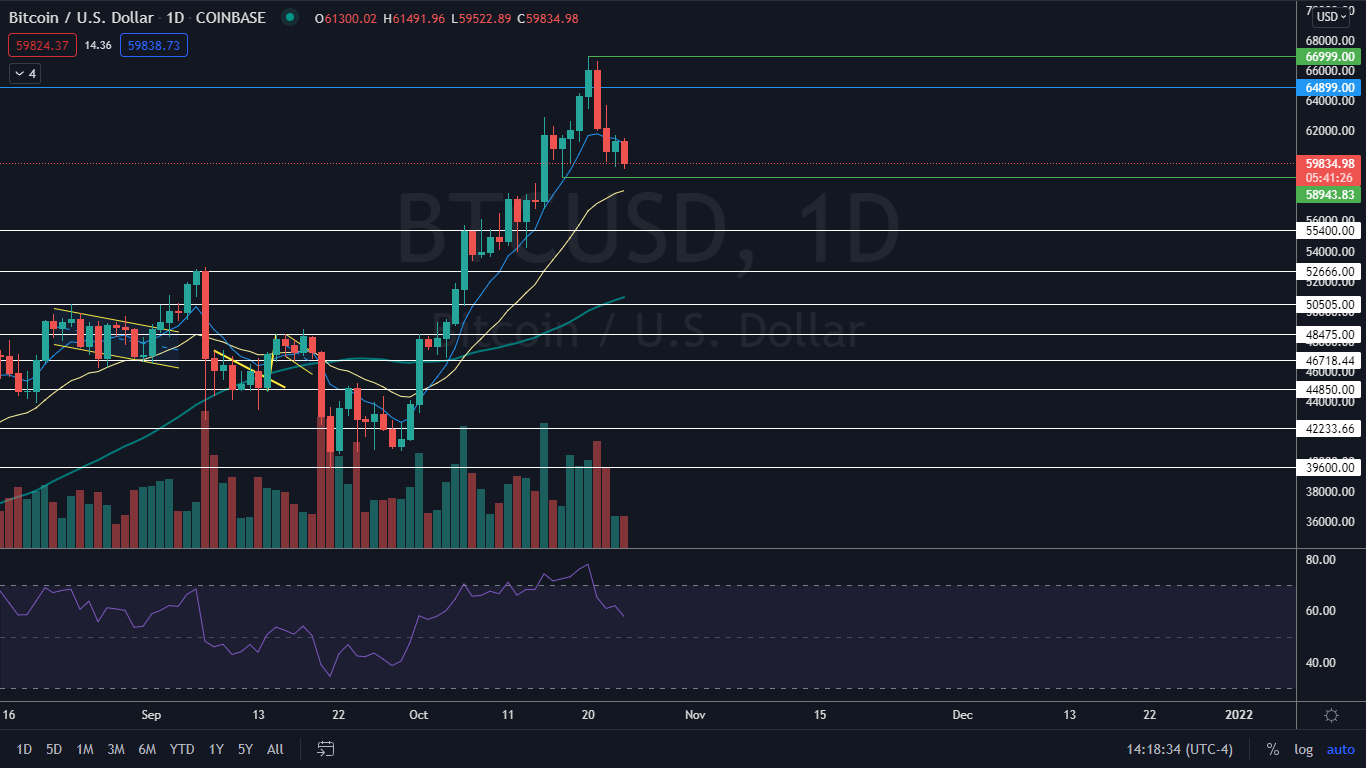

The Bitcoin Chart

Bitcoin printed its last higher low on Oct. 17 at the $58,943 mark, bounced, and made an Oct. 20 all-time high of $66,999. Since that date, Bitcoin has consolidated lower on the daily chart but has not made a lower low.

The lower wicks on Saturday and Sunday's candle may indicate the higher low is in at the $59,522 level and if so, bullish traders will want to watch for Bitcoin to shoot up and make a new all-time high. If Bitcoin falls below the Oct. 17 low-of-day it will invalidate the uptrend. Bitcoin has been recently trading at around $61,327.

The Ethereum Chart

Ethereum has been trading in a strong uptrend since breaking up bullishly from a pennant pattern on Sept. 30. The crypto has made a consistent series of higher lows and higher highs, with the last higher low printed on Oct. 22 at $3,885, and the most previous higher high at Ethereum's all-time high of $4,384.

On Sunday, Ethereum was trading lower but holding above an important support level at $4,000. The sideways consolidation has helped to cool down the crypto's relative strength index (RSI), which like Bitcoin's, was running uncomfortably high when each crypto made new all-time highs. Ethereum has been recently trading at around $4,094.

The Dogecoin Chart

On Sunday, Dogecoin was attempting to make another higher high above the Oct. 18 high of $0.272. The crypto printed its last higher low on Friday at the $0.234 mark.

If Dogecoin is unable to make another higher high, it may settle into a tightening range and begin making a series of lower highs and higher lows. On Sunday, Dogecoin's volume was much higher than average, which indicates a high level of investor interest and in this case favors a bullish move. Dogecoin has been recently trading at around $0.262.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.