- Gold price eyes a sustained move above $1800 amid USD weakness.

- Market sentiment remains mixed ahead of a critical week.

- Gold bears and bulls fight over $1,800, focus shifts to US GDP.

Gold price is once again testing offers above the $1800 mark, as the bulls look for acceptance above the latter after Friday’s quick retracement from six-week tops of $1814. As risk remains relatively firmer on Monday, courtesy of easing China’s property sector concerns, the US dollar keeps losing additional ground vs. its main competitors, benefiting gold price. Meanwhile, with persistent rising inflation fears amid supply chain crisis and surging energy costs, gold price is likely to keep the upper hand as an inflation hedge.

Read: Gold Price Forecast: A big technical breakout in the offing. Where is XAU/USD headed next?

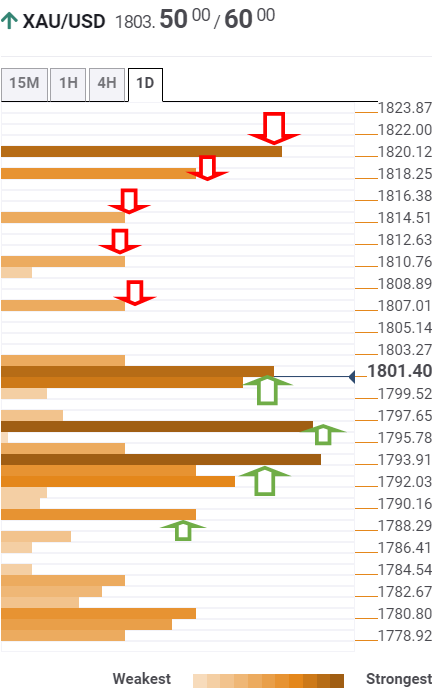

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold has recaptured the $1800 mark, with bulls unstoppable, as they target the Fibonacci 23.6% one-day at $1807.

If the buying interest accelerates, then a test of the pivot point one-day R1 at $1811 will be soon on the cards.

The next stop for gold bulls is seen at the previous day’s high of $1814, above which the pivot point one-week R1 at $1818 will be challenged.

Further up, powerful resistance of the pivot point one-month R1 at $1820 will be a tough nut to crack for gold optimists.

Alternatively, sellers will probe the strong resistance-turned-support around $1800, which is the convergence of the Fibonacci 38.2% one-day, Fibonacci 23.6% one-week and Bollinger Band one-day Upper.

Gold bears will then look out for the $1796 cap, which is the SMA5 four-hour.

Further south, a dense cluster of healthy support levels around $1793 will test the bullish commitments.

That area is the intersection of the Fibonacci 38.2% one-week, Fibonacci 61.8% one-day, SMAs100 and 200 one-day.

The last line of defense for gold buyers is the SMA50 one-hour at $1789.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.