Recently, San Francisco-based startup Pacaso announced that it is now possible to pay with crypto — including Dogecoin ($DOGE) — for shares in single-family homes in some of the top second home destinations in the U.S.

As Bloomberg reported back on March 21, Pacaso, which was founded in October 2020 by Zillow Group Inc. co-founder Spencer Rascoff and Dotloop founder Austin Allison, managed to achieve “unicorn” status (i.e. achieve a valuation of over $1 billion) “faster than any other U.S. company.”

Pacaso CEO Austin Allison told Bloomberg in an interview:

“Second-home ownership was already a dream for families pre-pandemic, but that interest has only amplified with Covid-19 shifting the way people work and live.“

The Bloomberg report went on to say that that Pacaso buys single-family houses in the U.S. and then sells ownership shares in these properties (the minimum investment is “a one-eighth slice of the residence”). Owners of a home can book stays throughout the year (the number of weeks they can occupy the home depends on “the size of their ownership”) and interestingly Pacaso makes sure that the owners’ belongings “are switched out upon arrival and departure.”

In a funding round in March, Pacaso raised $75 million from Greycroft Partners, Global Founders Capital, Acrew Diversify Capital Fund, First American Financial Corp. and Shea Ventures. Angel investors that took part included Amy Weaver, president and CFO of Salesforce.com Inc.; Jeff Wilke, former CEO of Amazon Worldwide Consumer; Elie Seidman, former Tinder CEO; and Dollar Shave Club founder Michael Dubin.

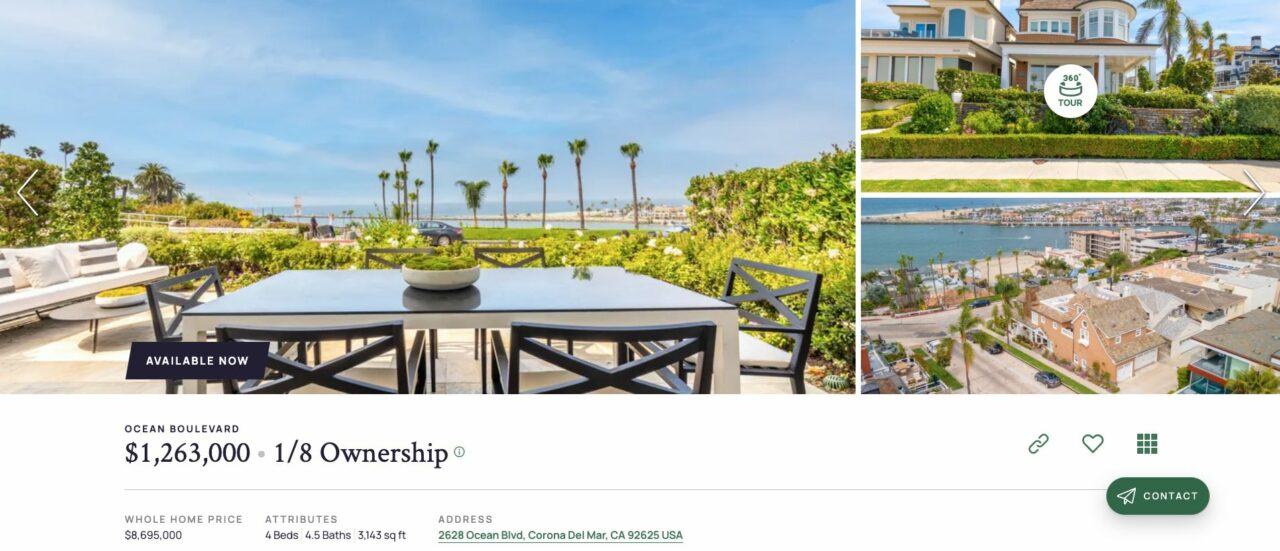

Here is an example of a property currently listed for sale on Pacaso:

As you can see, to buy one share in this four-bedroom Californian home costs $1,263,000.

Here is what Pacaso does to help buyers own a home:

“We create a property LLC for each home, find and vet co-owners, and handle all the sales details. At closing, the co-owners enjoy 100% ownership of the home – Pacaso does not retain any shares.“

And this is how it helps them to enjoy their second homes:

“We take care of furnishings, repairs, utilities and property management – you just show up and relax. Scheduling is easy and equitable with our app and SmartStay™ technology.“

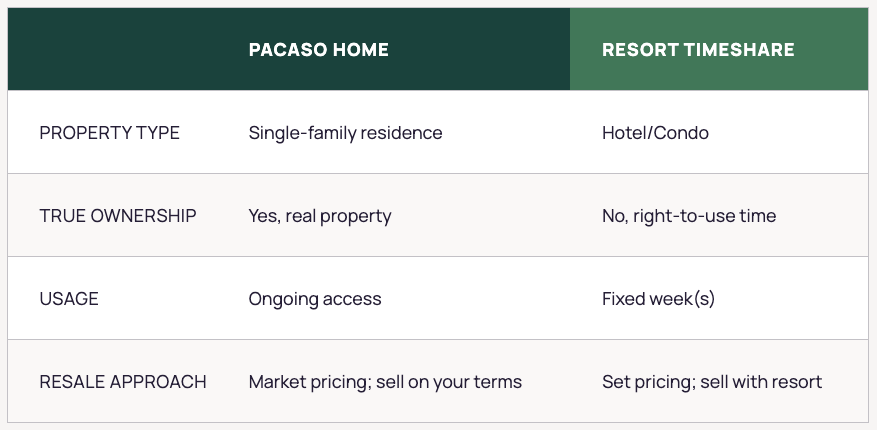

The following table from Pacaso shows how its business model differs from the timeshare model for owning vacation real estate:

In a press release issued on October 20, Pacaso announced that it will “begin accepting cryptocurrency as a payment option for ownership shares in second homes offered through its platform. In an industry first, aspiring co-owners will now be able to pay for their second homes with Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Dogecoin (DOGE), Wrapped Bitcoin (WBTC), and a number of other cryptocurrencies, including five USD-pegged stablecoins.”

The press release went on to say crypto payments would be handled by crypto payment processor BitPay.

The Pacaso CEO had this to say:

“Digital currencies and the blockchains that power them are seeing increased adoption across the real estate industry, and a crypto payment option is a recurring topic in our conversations with prospective buyers of second homes. As we expand internationally and put second-home co-ownership within reach for more people across the globe, we’re thrilled to be able to respond to that demand and extend as many payment options as we can to our customers.“

He later added:

“With mass adoption of digital currencies well underway, increasing numbers of second-home buyers will demand a full range of payment options. Whether you’re HODLing Bitcoin, diversifying out of a DOGE-heavy portfolio, or somewhere in between, Pacaso is here to help you realize your second-home dreams.“

And BitPay CEO Stephen Pair said:

“We are seeing more transactions being made for large purchases like real estate as more crypto holders want to spend and live their life on crypto. Pacaso makes a second home a reality. The market potential for crypto is huge, with $55 Billion as the estimated value of purchases consumers will make using cryptocurrency in the next 12 months.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.